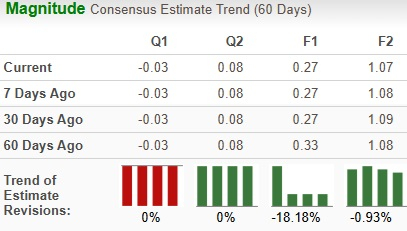

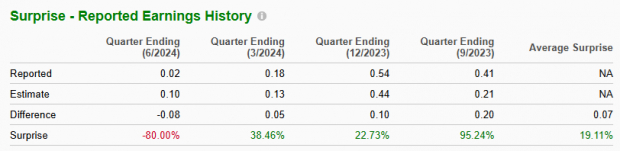

Intel Corporation INTC is scheduled to report third-quarter 2024 earnings on Oct. 31. The Zacks Consensus Estimate for revenues and loss is pegged at $13.01 billion and 3 cents per share, respectively. Earnings estimates for INTC have declined from 33 cents per share to 27 cents for 2024 and from $1.08 per share to $1.07 for 2025 over the past 60 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

INTC Estimate Trend

Image Source: Zacks Investment Research

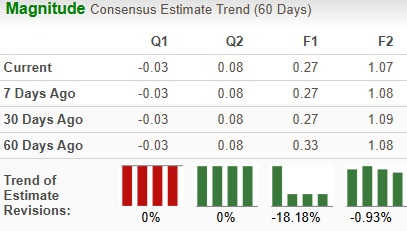

Earnings Surprise History

The leading semiconductor manufacturer delivered a four-quarter earnings surprise of 19.1%, on average, beating estimates thrice. In the last reported quarter, the company’s earnings surprise was negative 80%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model does not predict an earnings beat for Intel for the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Intel currently has an ESP of 0.00% with a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Shaping the Upcoming Results

During the quarter, Intel collaborated with International Business Machines Corporation IBM to deploy its Gaudi 3 AI accelerators as a service in IBM Cloud. With this, IBM became the first cloud service provider to deploy Gaudi 3 across hybrid and on-premise environments. Aimed at offering improved visibility and control over the software stack, simplifying workload and application management, the collaboration intends to help customers cost-effectively scale enterprise artificial intelligence (AI) workloads while prioritizing performance, security and resiliency.

In addition, Intel is scaling its AI footprint to edge devices and PCs with its Core Ultra processors, supporting more than 100 software vendors and 300 AI models. The company introduced Intel Core Ultra 200V series processors that mark an immense advancement in x86 processor technology, setting a new benchmark for graphics performance, improved security and power efficiency with unmatched AI computing capabilities. The state-of-the-art features will expedite the development and adoption of AI PCs, further solidifying its position as a frontrunner in the AI revolution.

During the quarter, Intel also extended its collaboration with Amazon Web Services, Inc. (“AWS”’), a wholly-owned subsidiary of Amazon.com AMZN. The partnership involves co-investment by the companies in custom chip designs under a multi-year, multi-billion-dollar framework. Under this expanded agreement, the semiconductor company will develop an AI fabric chip for AWS, leveraging its most advanced Intel 18A process node. These are likely to have generated incremental revenues in the quarter.

However, China’s purported move to replace U.S.-made chips with domestic alternatives could significantly affect Intel as it derives a significant portion of its revenues from the communist nation. The recent directive to phase out foreign chips from key telecom networks by 2027 underscores Beijing’s accelerating efforts to reduce reliance on Western technology amid escalating U.S.-China tensions.

As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in critical industries. This shift poses a dual challenge for Intel, as it faces potential market restrictions and increased competition from domestic chipmakers. In addition, Intel is witnessing intensifying competition in the server, storage and networking markets from its rivals like Advanced Micro Devices, Inc. AMD and NVIDIA Corporation NVDA. These are likely to have adversely impacted its bottom line in the quarter.

Price Performance

Over the past year, Intel has lost 31.3% against the industry’s growth of 187.6%, lagging its peers.

One-Year Price Performance

Image Source: Zacks Investment Research

Key Valuation Metric

From a valuation standpoint, Intel appears to be relatively cheaper than the industry and below its mean. Going by the price/sales ratio, the company shares currently trade at 1.74 forward sales, lower than 17.52 for the industry and the stock’s mean of 2.72.

Image Source: Zacks Investment Research

Investment Considerations

Intel’s innovative AI solutions are set to benefit the broader semiconductor ecosystem by driving down costs, improving performance and fostering an open, scalable AI environment. The company’s latest Gaudi and Core Ultra platforms are designed to deliver flexible, secure, sustainable and cost-effective solutions for maximizing AI opportunities. These advancements not only position Intel as a leader in AI but also catalyze industries to embrace AI’s transformative potential, paving the way for unprecedented innovation and growth.

However, increasing competition from other established players and emerging China-based firms is likely to adversely impact its bottom line. The communist nation’s stonewalling efforts and push for technological autonomy could reshape the dynamics of the semiconductor industry and affect Intel’s performance to a large extent.

End Note

Intel’s strategy for open, scalable AI systems extends beyond hardware, encompassing software, frameworks and tools. By fostering a broad ecosystem of AI players, including equipment manufacturers, database providers and software developers, Intel aims to offer enterprises a diverse range of solutions that cater to their unique GenAI requirements. This collaborative approach not only promotes innovation but also enhances interoperability and compatibility, empowering enterprises to leverage existing ecosystem partners with confidence.

However, it appears that the recent product launches are “too little too late” for Intel. With declining earnings estimates and abysmal price performance compared with its peers, the stock is witnessing a negative investor perception, although trading relatively cheaply. Consequently, it might not be prudent to bet on the stock at the moment.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.