Why Microsoft Stands Out Among the “Magnificent Seven” Tech Giants

The “Magnificent Seven” refers to the world’s biggest and most promising technology companies, consisting of Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ: META), and Tesla (NASDAQ: TSLA). Notably, Tesla is the smallest player with a market capitalization of approximately $700 billion. These companies represent significant forces in the market.

Microsoft’s Versatile Business Model

Investing in the Magnificent Seven presents great opportunities, but Microsoft is particularly appealing right now. If you’re set with an emergency fund and have no high-interest debt, consider investing $1,000 in Microsoft as a cornerstone of your portfolio.

Microsoft shines as we look ahead to 2025 due to its diverse range of products and services. Unlike some of its peers, Microsoft’s success isn’t tied to just one segment. For context, here’s how other companies rely heavily on specific areas:

- Apple: The company’s fortunes oscillate with iPhone sales. Successful iPhone launches boost revenue, while declines directly impact growth.

- Nvidia: Success hinges on sales of graphic processing units essential for artificial intelligence developments.

- Alphabet: Its revenue largely relies on advertising through Google Search. Any disruptions here can significantly affect profits.

- Amazon: While its cloud services generate substantial profit, e-commerce remains vital for overall revenue and financing other ventures.

- Meta: More than 98% of Meta’s revenue comes from advertising. A dip in this area can halt financial progress.

- Tesla: The company’s leadership in electric vehicles is questioned if production can’t scale effectively.

This analysis isn’t to undermine these other firms; they have strong fundamentals too. Instead, it underscores Microsoft’s broad reach across multiple sectors. Notably, its largest business segment, Intelligent Cloud, contributes only about 44% to total revenue.

Impressive Financial Performance

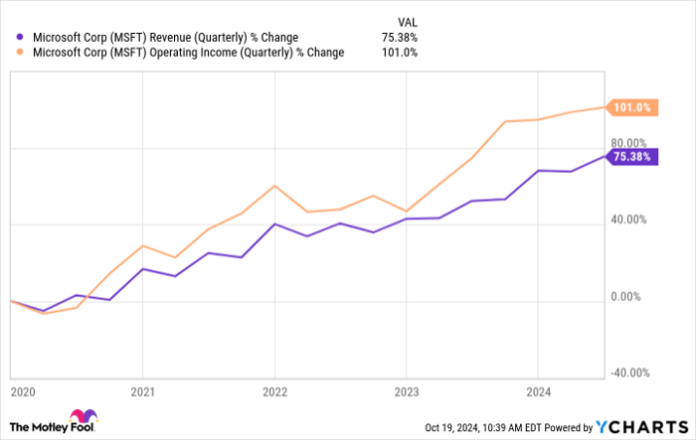

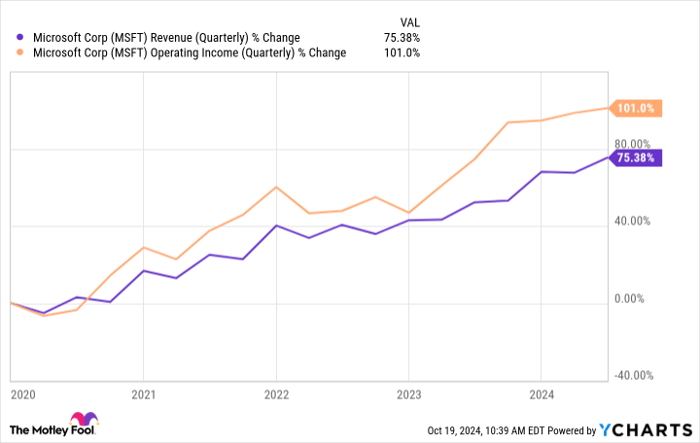

Microsoft’s financial statistics are compelling. In the fourth quarter of fiscal 2024 (ending June 30), the company saw revenue and operating income both rise by 15% year-over-year, reaching $64.7 billion and $27.9 billion, respectively.

MSFT Revenue (Quarterly) data by YCharts.

The company managed to double its operating income over the past five years, showcasing its operational efficiency and the success of its lucrative cloud platform, Azure.

Valuation Challenges for Long-Term Growth

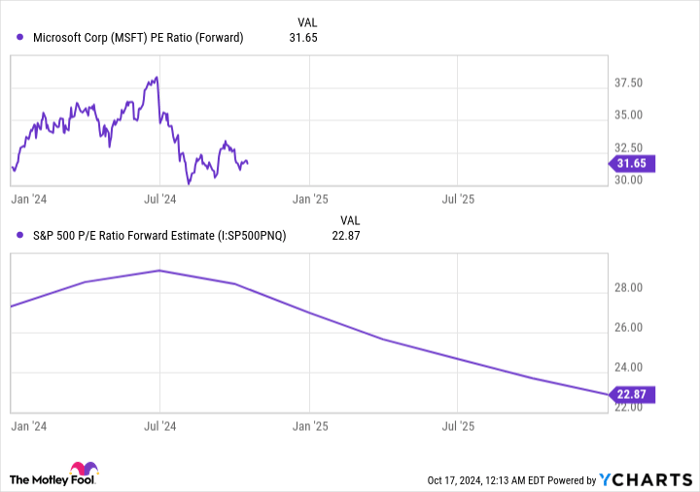

Microsoft is currently priced at a premium, with shares trading around 31.6 times forward earnings compared to the S&P 500’s average of 22.8. While high valuations can limit short-term upsides, investing in established, growth-oriented firms like Microsoft often comes at a cost.

MSFT PE Ratio (Forward) data by YCharts.

Despite the premium price, Microsoft is dedicated to returning value to shareholders through dividends and stock buybacks. The current quarterly dividend of $0.83 yields about 0.8% based on recent prices, and the company has a sustained record of increasing payouts. Additionally, a recently announced $60 billion stock buyback program reinforces its commitment to shareholder value.

While Microsoft may not suit investors seeking undervalued stocks or immediate income, it offers a strong long-term option that can fit well in any portfolio.

Catch This Opportunity Before It’s Gone

Have you ever felt like you missed out on early investment opportunities with successful companies? If so, here’s a chance to get back in.

Every so often, our expert analysts recommend a “Double Down” stock – a company they believe is poised for growth. If you’ve been hesitant, now might be the perfect time to invest. The statistics are telling:

- Amazon: Investing $1,000 at our recommendation in 2010 could have grown to $21,285!

- Apple: A $1,000 investment when we highlighted it in 2008 could now be worth $44,456!

- Netflix: If you placed $1,000 when we suggested it in 2004, it could have soared to $411,959!

Currently, we’re issuing “Double Down” alerts for three exceptional companies. Opportunities like this don’t often surface.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.