IQVIA Holdings Anticipates Strong Q3 Earnings Amid Market Expectations

Durham, North Carolina-based IQVIA Holdings Inc. (IQV) specializes in advanced analytics, technology solutions, and clinical research services for the life sciences sector. The company operates through three main segments: Technology & Analytics Solutions (TAS), Research & Development Solutions (RDS), and Contract Sales & Medical Solutions (CSM). With a market cap of $43.1 billion, IQVIA has a global footprint that includes the Americas, Europe, Africa, and the Indo-Pacific. The firm is set to announce its Q3 earnings on Thursday, Oct. 31, before the market opens.

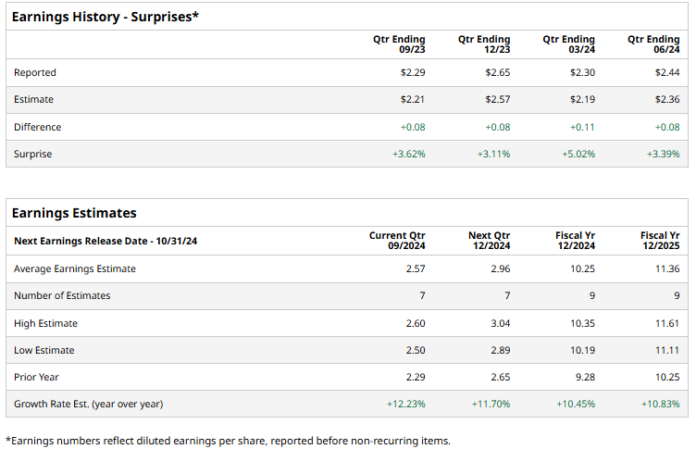

Analysts predict that IQVIA will report earnings of $2.57 per share for the third quarter, a 12.2% increase from the $2.29 per share recorded in the same period the previous year. The company has consistently outperformed Wall Street’s adjusted EPS projections for the last four quarters, with its adjusted EPS in the last reported quarter climbing 9.9% year-over-year to $2.44, surpassing expectations by 3.4%.

Looking ahead, analysts project IQVIA’s adjusted EPS for fiscal 2024 to reach $10.25, marking a 10.5% increase from $9.28 in fiscal 2023. A further increase of 10.8% is forecasted for fiscal 2025, bringing adjusted EPS to $11.36.

To date, IQV is up 2.3% this year, significantly lagging behind the S&P 500 Index’s gains of 23% and the Health Care Select Sector SPDR Fund’s (XLV) 12.3% returns over the same time period.

Shares of IQVIA jumped 9.2% following its strong Q2 earnings announcement on July 22. The company reported a 2.3% year-over-year increase in revenues, reaching $3.8 billion and exceeding Wall Street’s revenue expectations. While the CSM segment faced some challenges, both the TAS and RDS segments showcased strong performance. Specifically, the TAS segment reported revenue growth of 2.7% to $1.5 billion, while RDS revenues saw a 2.4% increase to $2.1 billion compared to the prior year.

Moreover, IQVIA’s net income surged by 22.2% year-over-year to $363 million, surpassing analyst expectations. In light of this strong profitability in the first half of the year, the company updated its full-year adjusted EPS guidance, raising it from $10.95-$11.25 to $11.10-$11.30.

The outlook for IQV stock remains positive, with an overall “Strong Buy” consensus rating. Among the 21 analysts covering the stock, 16 recommend “Strong Buy,” two suggest “Moderate Buy,” and three advise a “Hold” rating. With a mean price target of $274.85, this presents a potential upside of 16.1% from the current price levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.