In the fickle realm of investments, the greatest gems often dawn in obscurity, shrouded in doubt. Yet, history gleams with tales of such underdogs transcending skepticism to script tales of epic wealth for steadfast believers.

Archer Aviation (NYSE: ACHR) is a riveting protagonist in this narrative, poised to mirror the trajectory of groundbreaking and triumphant enterprises. Propelling towards revolutionizing electric air travel, this company emerges as a beacon of risk in the sea of conventional blue-chip stocks. But, as the age-old adage goes, no venture reaps without the sow of chances. Can Archer Aviation metamorphose into a millionaire-maker for savvy investors?

Here’s a dive into the potential riches that this stock may churn.

Archer Aviation and the grand design

If you’ve flaunted electric drones, those buzzing toys fueled by electric vigor, the premise of electric air transport isn’t alien. Think of those miniature miracles, but magnified to an expansive scale.

Archer Aviation is on course to unleash a compact aircraft primed to ferry four passengers on brief journeys. The vision? A 100-mile autonomy on a single burst, tailored for bustling metropolises shackled by terrestrial gridlocks. With a slated commercial debut set for 2025, Archer Aviation aims to ace the market ahead of rivals like Joby Aviation.

Per Morgan Stanley, the electric vertical take-off and landing (eVTOL) sector might burgeon exponentially upon liftoff. Forecasts hint at a potential $1.5 trillion market size by 2040. Blink at Archer Aviation’s current $1.5 billion market cap, and you spot the enchanting allure of a multi-bagger gain should the company successfully navigate the launchpad to prosperity.

Does Archer Aviation hold the purse for its flight?

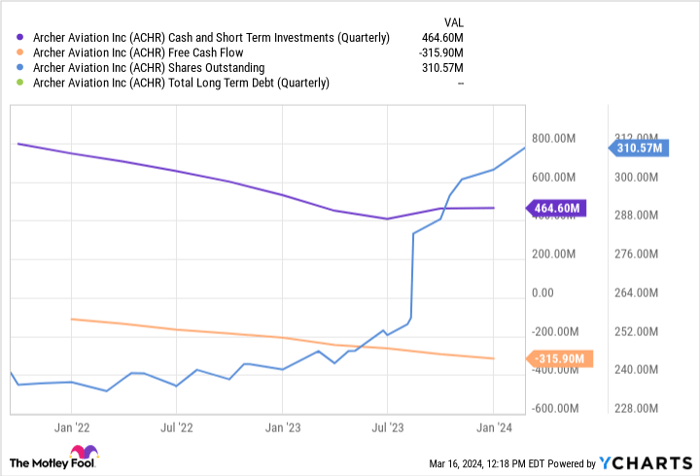

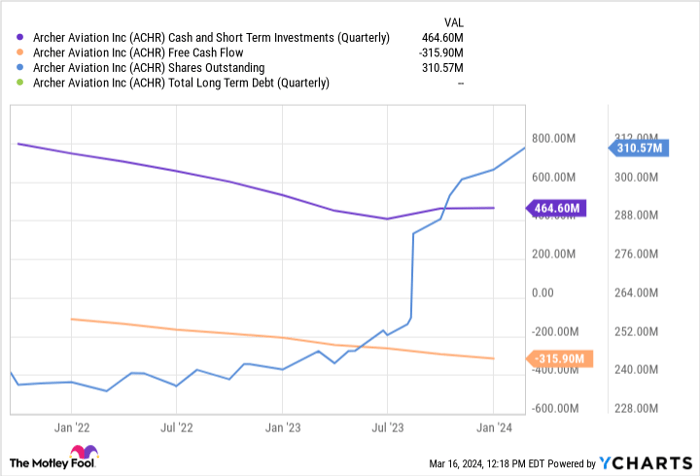

Archer Aviation’s product isn’t up for commercial grabs yet, unfurling a $316 million trailing twelve-month cash incineration on developmental rites like research, testing, and factory constructions earmarked for completion this year.

Fortunately, the ledger bears no debt burden, paving a runway for plowing back every cent into the enterprise:

ACHR Cash and Short Term Investments (Quarterly) data by YCharts

On the flip side, Archer Aviation keeps tapping the equity markets to quench its funding thirst. Over the past year, outstanding shares have burgeoned by a stellar 70 million. As new shares cascade into the pool, existing ones dilute their equity slice, engineering a complex tango where anticipating profits is an unpredictable odyssey. Brace yourself, for the horizon teases with more dilutions, painting a mosaic of uncertainty on Archer Aviation’s profitability canvas.

Breathing life into an idea

Investors often dissect a stock, weighing its worth through an earnings prism. But Archer Aviation transcends this physical realm, incarnating an idea more than a flourishing business. In this embryonic state of affairs, revenue and earnings whimper in insignificance.

So, where does this enigmatic juncture leave potential investors? Scrutinize Archer Aviation’s technology and products fervently. Should your faith pulsate that electric air travel will burgeon into a quintessential urban transit solution, a dalliance with a $1.5 billion enigma like Archer Aviation spells a risky rendezvous, yet dangling the carrots of magnificent potential upsides to justify the dalliance.

If you plunge into this abyss, contemplate the wisdom of dollar-cost averaging. The more untested a company is, the wilder the stock’s rollercoaster dances. Brace for erratic price swings in this carnival ride of opportunities spanning years.

Would you bet $1,000 on Archer Aviation today?

Before entrusting your fortune to Archer Aviation, ruminate over this:

The gurus of Motley Fool Stock Advisor have unfurled their top ten picks for burgeoning investors to sow in. Surprisingly, Archer Aviation fails to grace this elite list. These ten musketeers loom as potential giants set to pirouette wealth in the days ahead.

Stock Advisor‘s treasure trove unveils a roadmap to financial triumph, floating insights on portfolio crafting, analyst articulations, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor chronicles a triumphant voyage, tripling the S&P 500’s tides.*

Peek at the ten contenders

*Stock Advisor returns as of March 18, 2024

Justin Pope keeps his pockets devoid of any shares in the spotlight. The Motley Fool joins him in maintaining a neutral stance on these equities. And remember, the Fool always spares a thought for full disclosure.

The insights swirling here reflect the author’s kaleidoscopic viewpoints and do not necessarily mimic Nasdaq, Inc.’s stance.