Berkshire Hathaway: A Closer Look at Its Future Potential

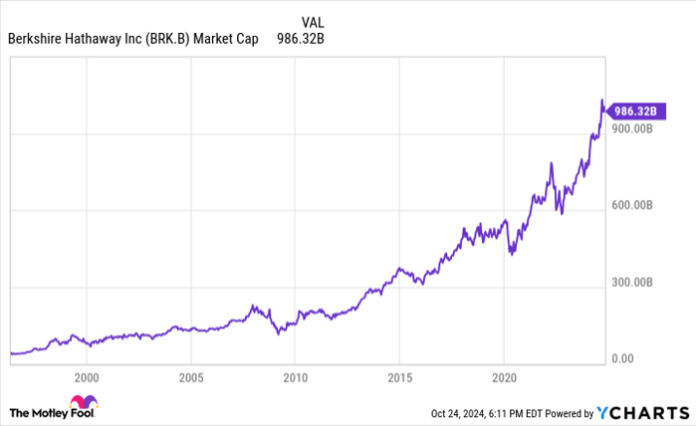

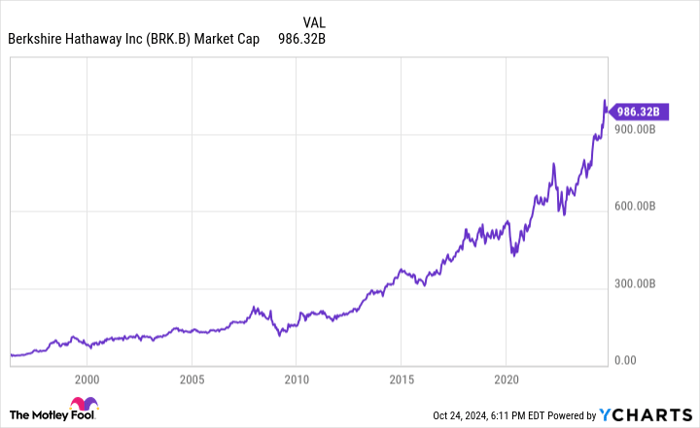

Many investors recognize Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) as a top long-term investment. However, with its valuation nearing $1 trillion, questions arise about whether it can achieve similar success moving forward.

As Berkshire navigates around this market cap, is it still a worthy investment? The response may be unexpected.

Warren Buffett’s Insights for Investors

Warren Buffett himself provides a clear indication of Berkshire’s future performance. In his recent letter to investors, he mentioned that while Berkshire may perform slightly better than the average corporation, “there is now no possibility of eye-popping performance.” This change stems from the company’s impressive growth, which limits the number of impactful investments available. Buffett explained, “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire.” Given its massive size, finding those needle-moving companies has become increasingly difficult.

Historically, Berkshire Hathaway’s aggressive investments could rapidly raise its stock price. Now, however, few opportunities exist to create that kind of significant wealth increase, especially since these opportunities often reside within other large companies that experience their own scaling challenges.

Nevertheless, Buffett reassured investors by stating, “Berkshire is built to last.”

BRK.B Market Cap data by YCharts

The Case for Investing in Berkshire Stock

While Berkshire may not see the same skyrocketing growth rates of 20% per year, this does not eliminate its potential as a good investment today. One of the primary advantages is Berkshire’s reliable access to capital, positioning it uniquely compared to many other companies.

This access largely stems from its insurance businesses, which are less impacted by economic downturns. Insurance policies are often necessary expenditures, leading to consistent cash flow that isn’t tied to market fluctuations. During financial crises, such as in 2008, Berkshire effectively utilized its assets when other investors struggled to raise capital.

Berkshire also diversifies its cash flow by owning various businesses across multiple sectors globally. This allows the company to allocate resources effectively, enhancing its ability to capitalize on attractive investment opportunities, particularly in bear markets.

According to Buffett’s latest investor letter, Berkshire does not distribute dividends and has a robust cash reserve. He emphasized, “During the 2008 panic, Berkshire generated cash from operations and did not rely in any manner on commercial paper, bank lines or debt markets.” This mindset prepares the company to handle economic downturns, earning it a reputation as “built to last.”

While substantial growth in stock value may not be in the cards, these structural advantages suggest that Berkshire can still deliver value to patient investors who believe in its proven investment strategy.

Is Now a Good Time to Invest $1,000 in Berkshire Hathaway?

Before making a purchase in Berkshire Hathaway, keep this in mind:

The Motley Fool Stock Advisor team recently named the 10 best stocks to buy now—and Berkshire Hathaway didn’t make the list. The selected stocks have great potential for significant returns in the coming years.

For instance, consider Nvidia. When it joined the list on April 15, 2005, an investment of $1,000 would now be worth $867,372!

Stock Advisor offers investors a straightforward roadmap for success with portfolio building strategies, analytical updates, and two new stock picks each month. Since 2002, this service has notably outperformed the S&P 500 by over four times.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.