Bitcoin Rises Toward $70,000: A Look at Market Signals and Challenges Ahead

Bitcoin has seen a steady rise since surpassing the $60,000 mark. The cryptocurrency is now approaching the $70,000 level, a price it hasn’t attained in several months. As market sentiment heats up, investors are asking whether Bitcoin has the momentum needed to reach new all-time highs or if it will struggle to overcome important resistance levels.

Market Sentiment Shows Promise

The Fear and Greed Index is a helpful tool for gauging market sentiment and understanding trader perspectives on Bitcoin’s direction. At present, the index indicates a “Greed” level of approximately 70. Historically, this level signals a positive outlook but is still a fair distance from the extreme greed zone around 90, which could point to a potential market top. A higher index signifies greed, while lower scores indicate fear. Typically, when the index exceeds 90, the market becomes excessively bullish, raising concerns of possible overextension.

Last year, a similar situation occurred when the Fear and Greed Index reached similar heights, and Bitcoin was valued around $34,000. Following that, the price more than doubled, reaching $73,000 within months.

Monitoring Support Levels

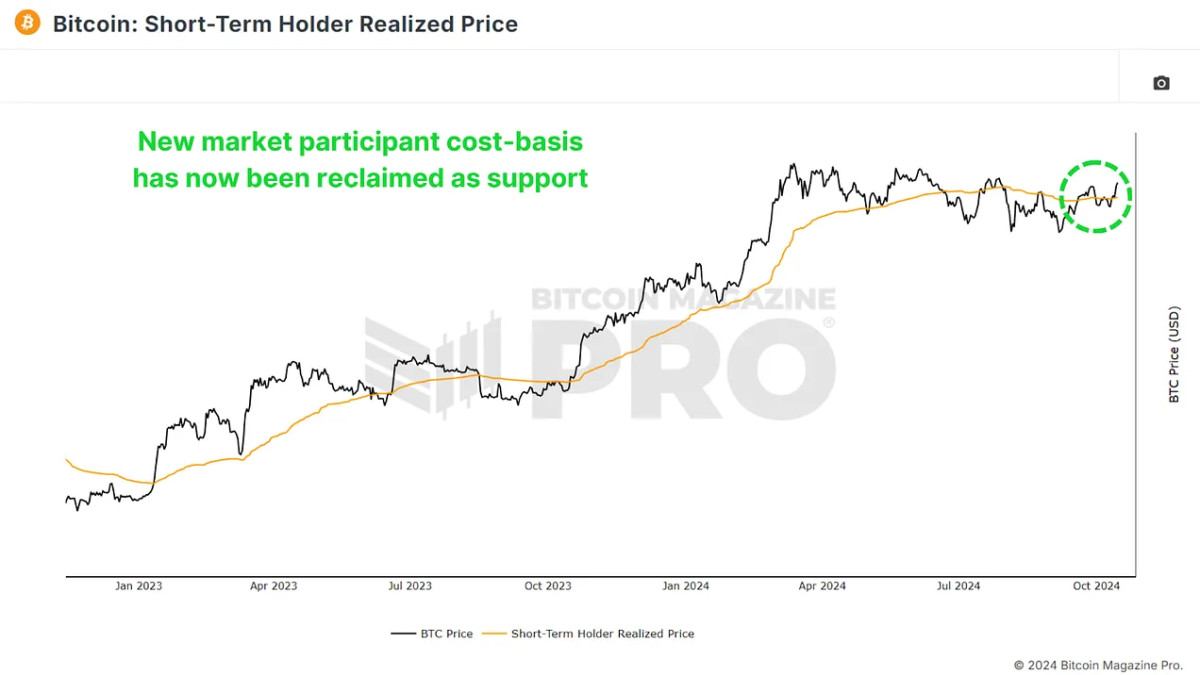

The Short-Term Holder Realized Price represents the average price paid by new Bitcoin investors. This metric is critical, as it often acts as a solid support during bull runs and a resistance point during bear markets. Currently, this price is about $62,000, and Bitcoin has successfully maintained its value above it. This is encouraging, as it indicates that new investors are profitable, and Bitcoin is holding above an essential support zone. Historically, breaching this level tends to lead to market weakness, making the preservation of this support vital for ongoing price increases.

This pattern has emerged in previous cycles, particularly during the 2016-2017 bull market, when Bitcoin frequently retraced to this support level before climbing again. If this trend continues, Bitcoin’s recent advances may lay the groundwork for additional gains.

Market Stabilization Observed

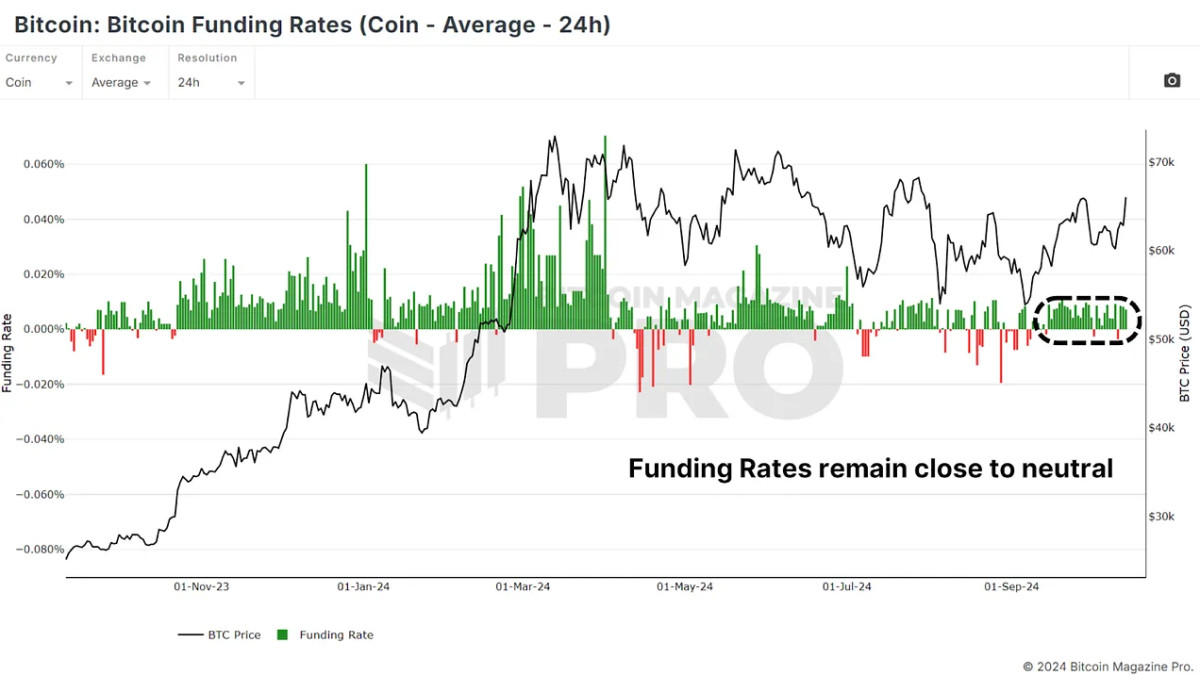

Traders closely monitor Funding Rates, which reflect the cost of holding long or short positions in Bitcoin futures. In recent months, funding rates have been unpredictable, shifting between overly optimistic long positions and overly pessimistic short positions. Fortunately, the market appears to have stabilized, with funding rates now hovering around neutral levels. This stability suggests that traders are not excessively leveraged in either direction.

With funding rates in neutral territory, the risk of a liquidation cascade—where over-leveraged positions are wiped out, leading to sharp market declines—is reduced. As long as these funding rates stay stable, Bitcoin may have the room to rise without major fluctuations.

Resistance Ahead for $70,000 and More

Despite positive sentiment and technical indicators, Bitcoin still faces significant resistance ahead. The current downtrend line is one that has repeatedly tested Bitcoin, causing retracements each time it has been approached.

Moreover, the $70,000 level has previously acted as resistance and represents a psychological milestone for traders. Above that, Bitcoin will again encounter resistance in the $73,000 to $74,000 range, which marks its all-time high. Surpassing this could signal a strong bullish trend, though achieving this may require several attempts.

A positive note arises from the recent reclaiming of the 200 daily moving average, a crucial level that previously served as resistance for BTC.

Macro Context: Institutional and ETF Inflows

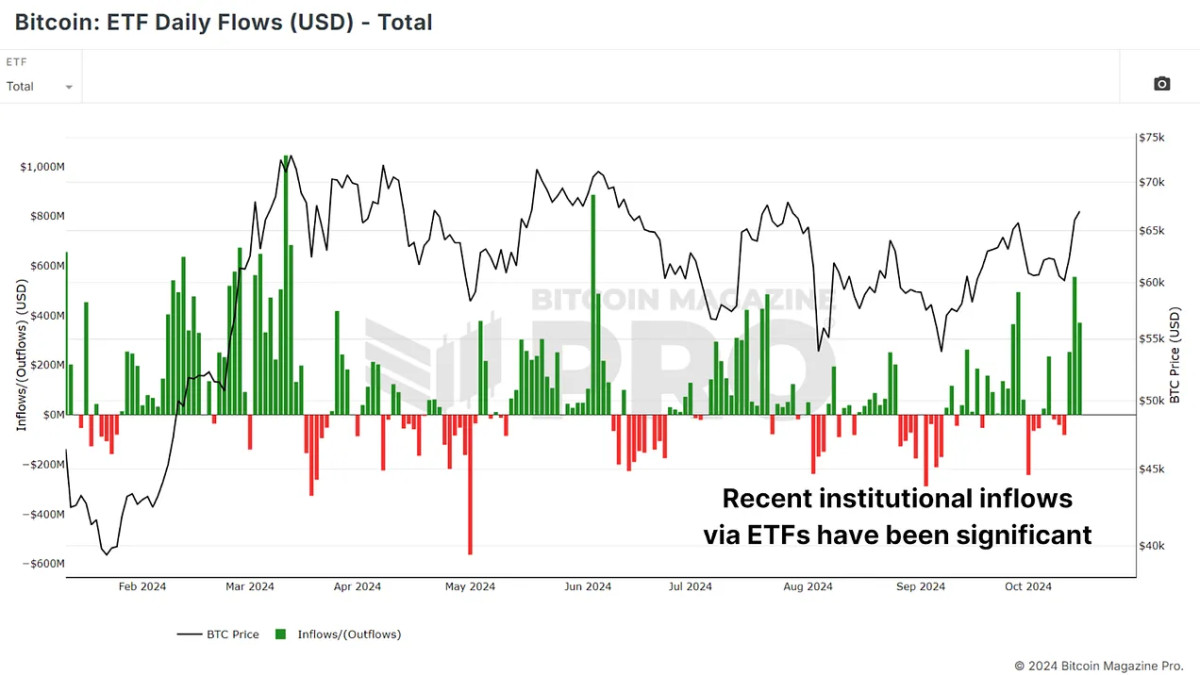

Looking beyond technical indicators, the broader macro environment appears increasingly supportive for Bitcoin. Institutional investment continues to pour into Bitcoin Exchange-Traded Funds (ETFs). Recent updates indicate over $1 billion has flowed into Bitcoin ETFs in the past few days, signifying growing confidence in the asset. In recent weeks, hundreds of millions more have entered ETFs, indicating that institutions remain bullish on Bitcoin’s prospects.

This influx is notable because institutional investors typically adopt a long-term outlook, providing a more stable foundation than retail speculation. Additionally, as equities and even gold have performed well recently, Bitcoin’s comparatively slower gains may create an opportunity for it to catch up, especially if investors pivot from traditional assets to the more risk-oriented Bitcoin.

Final Thoughts

Overall, Bitcoin’s price movements, funding rates, and market sentiment indicate a healthier environment than seen in months. The upward trend in institutional inflows into ETFs and favorable macro conditions enhance this optimistic outlook. However, significant resistance remains, and any upward drive may face hurdles before Bitcoin can achieve new heights.

For a deeper exploration of this topic, check out this recent YouTube video:

Can Bitcoin Now Make A New ATH

https://www.youtube.com/watch?v=4_lZaDss_9I[/embed>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.