Netflix Set to Shine: Expectations for Upcoming Earnings Report

Netflix NFLX is gearing up to announce its third-quarter 2024 results on Oct. 17, following the market’s close. A glimpse into the company’s fundamentals sheds light on its growing strength before the results hit the market.

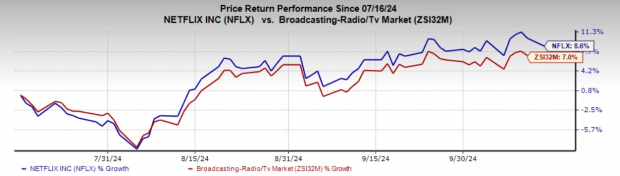

Over the past three months, Netflix shares have surged by 8.6%, surpassing the broader industry’s increase of 7%. This positive trend is expected to persist, as analysts predict Netflix will outperform this earnings season.

Image Source: Zacks Investment Research

Exchange-Traded Funds (ETFs) with significant investments in Netflix, such as MicroSectors FANG+ ETN FNGS, Invesco Next Gen Media and Gaming ETF GGME, First Trust Dow Jones Internet Index Fund FDN, Communication Services Select Sector SPDR Fund XLC, and First Trust S-Network Streaming & Gaming ETF BNGE, are grabbing attention.

Anticipated Earnings Insights

Netflix boasts an Earnings ESP of +1.37% and holds a Zacks Rank #2 (Buy). This combination of a positive Earnings ESP and a Zacks Rank of 1, 2, or 3 suggests a strong likelihood of exceeding earnings expectations. The streaming giant has not seen any estimate revisions in the past month but is projected to achieve a remarkable earnings growth of 35.9% alongside a revenue increase of 14.3% for this upcoming quarter. Historically, Netflix has maintained an impressive average earnings surprise of 6.15% over the last four quarters, highlighting its strong performance within a top-ranked Zacks industry positioned among the top 41% of over 250 sectors.

Access the latest EPS estimates and surprises on Zacks’s Earnings Calendar.

Netflix Price Performance and EPS History

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

The average brokerage recommendation (ABR) for Netflix currently stands at 1.89 on a scale ranging from 1 (Strong Buy) to 5 (Strong Sell). This ABR reflects insights from 40 brokerage firms and has slightly improved from an ABR of 1.91 just a month ago. Out of these recommendations, 23 are labeled as Strong Buy, accounting for 57.5% of the total. In the previous month, 53.85% were classified as Strong Buy, with Buy provisions stable at around 5%.

Short-term projections by 36 analysts set the average price target for Netflix at $715.75, oscillating between a low of $545.00 and a high of $900.00.

Growth Potential

Netflix is on track for substantial growth owing to its paid-sharing initiative and additional revenue through advertising. Many analysts are optimistic that Netflix’s efforts to limit password sharing have led to an increase in new users.

Additionally, the company has ventured into live and sports programming this year, infiltrating the traditional TV space. It plans to stream National Football League (NFL) games this Christmas, which is expected to reduce subscriber churn while attracting new audiences.

For the third quarter, Netflix anticipates a revenue increase of 13.9% year-over-year, reaching $9.73 billion, alongside earnings per share of $5.10. Forecasts indicate a slowdown in subscriber growth compared to the same period last year.

Valuation Metrics

Currently, Netflix shares are considered pricey, holding a P/E ratio of 37.81 compared to the industry average of 10.60. Nonetheless, its strong Growth Score of B suggests the company is positioned for continued expansion, which justifies the elevated valuation.

Focus on Key ETFs

MicroSectors FANG+ ETN (FNGS)

MicroSectors FANG+ ETN reflects the performance of the NYSE FANG+ Index, which consists of growth stocks from next-generation technology. It holds ten stocks in equal portions, with Netflix making up 10% of the fund.

With an asset base of $380 million, this ETF charges 58 basis points annually and trades an average of 154,000 shares each day. It has a Zacks ETF Rank of #3 (Hold).

Invesco Next Gen Media and Gaming ETF (GGME)

This ETF invests in companies focused on future media technologies and tracks the STOXX World AC NexGen Media Index, containing 89 stocks. Netflix represents 8% of GGME’s total assets.

GGME has an asset base of $41.1 million and charges 60 basis points yearly, holding a Zacks ETF Rank of #3.

First Trust Dow Jones Internet Index Fund (FDN)

FDN follows the Dow Jones Internet Composite Index, offering investors extensive exposure to the internet sector. It features 41 stocks, with Netflix as the third-largest at 7.8%.

This fund is one of the most liquid ETFs in technology, managing $6 billion in assets and averaging 218,000 shares traded daily. It charges 51 basis points per year and holds a Zacks ETF Rank of #1 (Strong Buy) with a high-risk outlook.

Communication Services Select Sector SPDR Fund (XLC)

XLC focuses on telecommunications, media, and entertainment companies, with $18.2 billion in assets. It follows the Communication Services Select Sector Index, comprising 22 stocks; Netflix is the fourth-largest at 6.1%. Approximately 42% of the portfolio is in interactive media, while entertainment and media categories follow.

With annual fees of 9 basis points and an average trading volume of 3.6 million shares daily, XLC has a Zacks ETF Rank of #2 (Buy).

First Trust S-Network Streaming & Gaming ETF (BNGE)

This ETF contains 45 stocks, tracking the S-Network Streaming & Gaming Index. Netflix holds the fourth position, accounting for 4.9% of total assets. Entertainment leads the portfolio with a 44.9% share, followed by hospitality, leisure, and other sectors.

BNGE has accumulated $3.9 million in assets with an average trading volume of 3,000 shares and charges 70 basis points in fees per year.

Stay Updated on Key ETF Insights

Receive Zacks’ free Fund Newsletter for weekly updates on critical news and analysis along with performance insights of top ETFs.

Access the latest recommendations from Zacks Investment Research, including a report titled “5 Stocks Set to Double.” Click to obtain this free report.

Netflix, Inc. (NFLX): Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

Communication Services Select Sector SPDR ETF (XLC): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

First Trust S-Network Streaming & Gaming ETF (BNGE): ETF Research Reports

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.