DocuSign’s Stock Soars: Is it Time to Invest?

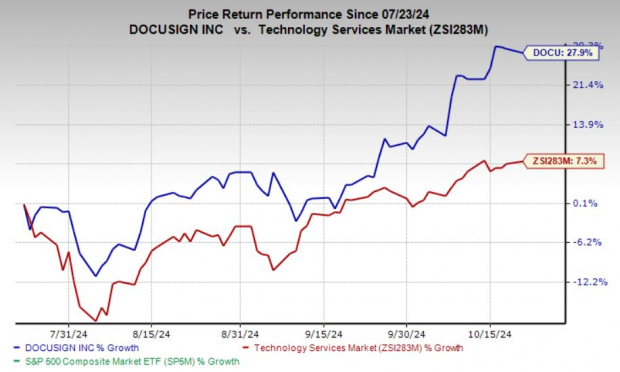

DocuSign, Inc. (DOCU) has experienced a significant increase in its stock price, rising 27.9% over the last three months, compared to the broader industry’s growth of 7.3%.

Recently, DOCU’s stock closed at $71.78, just shy of its 52-week high of $73.8. Trading above its 50-day moving average further indicates positive investor sentiment.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

With strong performance in DOCU shares, investors may consider purchasing the stock. But is it still a good time to invest in DOCU? Let’s explore.

Driving Growth through Demand

DocuSign continues to thrive due to high customer demand for its eSignature solutions in a vast market. The company’s customer base has increased from 1.1 million in fiscal 2022 to 1.5 million in fiscal 2024. This trend is expected to persist, as considerable parts of the eSignature market remain untapped, presenting DocuSign with numerous opportunities to grow revenue worldwide.

Subscription fees represent 97% of DocuSign’s total revenue. These fees cover product usage and customer support, typically ranging from one to three years. This subscription model proves advantageous for software developers, creating stable revenue streams, enhancing cash flow visibility, and making expensive software more accessible to resource-constrained businesses.

DOCU’s strategic initiatives targeting both commercial and enterprise customers have aided subscription revenue growth. In fiscal 2024, subscription revenues saw a 10% increase, attributed mainly to existing and new customer expansions.

International revenues for DocuSign have steadily climbed over the past three years, growing from 23% in 2022 to 26% in 2024. The company launched its international efforts in Canada, the U.K., and Australia, capitalizing on similarities in eSignature processes between these locations and the U.S. This demand is being harnessed through focused sales and marketing initiatives.

DocuSign has also formed strong relationships with leading tech companies like Salesforce (CRM) and Microsoft (MSFT). For example, DocuSign has enhanced its partnership with Salesforce to automate contract creation and improve collaboration tools in Salesforce’s Slack. Moreover, last year, the company integrated eSignature services into Microsoft Teams, becoming an official partner for its Approvals app. Such collaborations allow DocuSign to reach a broader range of customers than it could independently.

Solid Returns on Investments

Return on equity (ROE) is a crucial metric indicating how effectively a company uses shareholder investments to generate profits. DocuSign boasts a trailing 12-month ROE of 53.7%, significantly surpassing the industry average of 9.5%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In terms of return on invested capital (ROIC), DocuSign reports a trailing 12-month ROIC of 12.9%, well above the industry average of 4.4%. This indicates effective investments in profitable opportunities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Positive Earnings Outlook

The Zacks Consensus Estimate for DOCU’s earnings in fiscal 2025 stands at $3.45, reflecting a 15.8% increase from last year. The forecast for fiscal 2026 indicates a further 6% rise in earnings compared to previous figures. Sales expectations for fiscal 2025 and 2026 are projected to grow by 6.5% and 6%, respectively.

In the past 60 days, seven estimates for fiscal 2025 have been revised upward, while none have been lowered, showing analysts’ confidence in DocuSign. The Zacks Consensus Estimate for fiscal 2025 earnings has increased by 6.8% during this period.

Why Invest in DOCU Now

DocuSign stands out as a compelling investment option due to its robust market presence and ongoing growth potential. The company has shown resilience in the rapidly evolving eSignature market, attracting a growing customer base. Its subscription model ensures long-term revenue stability and predictable cash flow.

Strategic partnerships with tech giants like Salesforce and Microsoft enhance DocuSign’s offerings and access to broader clientele. Given the positive market sentiment, strong collaborations, and an ability to penetrate an untapped market, DocuSign poses as an attractive choice for investors seeking growth and opportunities in the digital landscape.

Currently, DOCU has a Zacks Rank #1 (Strong Buy). To view the complete list of Zacks #1 Rank stocks, click here.

Infrastructure Stocks Set for a Boom

A significant effort is underway to rebuild America’s aging infrastructure. This initiative is bipartisan and crucial, with trillions of dollars expected to be invested and fortunes to be made.

The pressing question is, “Are you ready to invest in the right stocks while they have the greatest growth potential?”

Zacks has released a Special Report to help you identify these investment opportunities, and it’s available for free. Discover five companies poised to benefit immensely from construction and repair efforts involving roads, bridges, and buildings, as well as cargo transport and energy transformation on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

DocuSign Inc. (DOCU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.