TD Bank Faces Major Setbacks: A Look Into Its Future

Investors weigh risks after TD Bank’s stock tumbles following guilty pleas.

Toronto-Dominion Bank (NYSE: TD) has long been a solid investment, boasting over 3,300% growth in the past three decades. In contrast, the S&P 500 has seen a rise of just 1,400% during the same period. Unfortunately, recent news indicates that TD Bank stock has struggled to keep pace. Over the last three years, the stock has remained stagnant, diverging from the soaring broad market indexes. Last week, shocking news caused a drop of more than 6% in share value. For patient investors, this could represent a potential buying opportunity.

What Led to TD Bank’s Troubles?

To begin, TD Bank’s guilty pleas are concerning. It has become the largest U.S. bank to plead guilty under the Bank Secrecy Act and the first to plead guilty to conspiracy to commit money laundering.

The guilty pleas arose from a U.S. government investigation, which indicated that the bank had facilitated the laundering of hundreds of millions of dollars. U.S. Attorney General Merrick Garland remarked, “By making its services convenient for criminals, it became one.” This led to significant consequences for the bank.

TD Bank is facing approximately $3 billion in fines. More importantly, a ruling has imposed an asset cap, limiting the bank’s ability to grow beyond its current size.

The last instance of an asset cap being enforced occurred in 2016 when Wells Fargo (NYSE: WFC) was scrutinized for opening millions of unauthorized accounts to inflate growth figures. Nearly a decade later, Wells Fargo continues to grapple with its asset cap and seeks to lift it. Similar to TD Bank, Wells Fargo also agreed to pay around $3 billion in fines at that time.

After the news broke, TD Bank’s stock dropped about 6.5%, resulting in a loss of nearly $7 billion in market value—significantly exceeding the fine amount. Is this a chance to invest?

What Can We Learn from Wells Fargo?

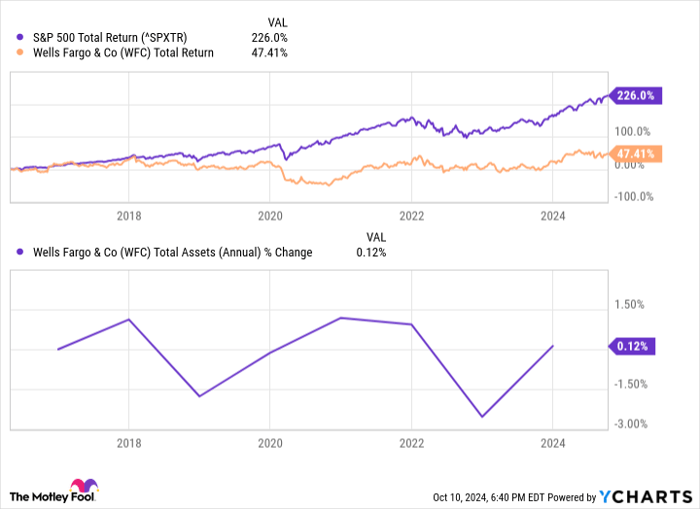

Looking at the Wells Fargo situation clarifies the potential implications for TD Bank. Since 2016, Wells Fargo’s performance has lagged behind the market. While the banking sector, in general, has struggled, Wells Fargo’s damaged reputation and the asset cap have limited its value creation.

^SPXTR data by YCharts.

How long might TD Bank face its asset cap? If Wells Fargo’s experience is any indicator, it could last for a decade or more. This poses a challenge for TD Bank, which has enjoyed a premium valuation due to its historical success. The stock currently trades at 1.4 times its book value following this week’s decline.

In comparison, Wells Fargo’s shares trade at about 1.2 times book value. Pre-scandal in 2016, Wells Fargo shares also hovered around a valuation of 1.4 times book value, similar to TD Bank today.

Historically, TD Bank has outperformed Wells Fargo in return on equity, a key measure of profitability for shareholders. However, the newly imposed asset cap could severely obstruct growth, just as it has for Wells Fargo.

It’s evident that while TD Bank’s stock appears more attractive now than last week, the company faces significant challenges. Management has lost control over its growth prospects, which can be a red flag for potential investors.

Notably, after the Wells Fargo scandal, Warren Buffett gradually divested his shares, even though Berkshire Hathaway had been a long-time investor. This decision proved prudent, and investors in TD Bank may wish to consider a similar approach.

There may be a future price point at which TD Bank becomes an attractive investment again; however, the long-term implications of the asset cap could understandably deter those considering entry at what seems like a discount.

Is This Your Chance for a Lucrative Investment?

Ever feel as if you missed out on acquiring top stocks? If so, pay attention now.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies believed to be on the brink of substantial growth. If you’re worried you missed your chance, now might be an opportune moment to invest before it’s too late. The data supports this perspective:

- Amazon: an investment of $1,000 in 2010 would now be worth $21,266!

- Apple: a $1,000 initial investment in 2008 would have grown to $43,047!

- Netflix: if you invested $1,000 in 2004, it would have skyrocketed to $389,794!

Currently, we are issuing “Double Down” alerts for three companies that present incredible opportunities that could be fleeting.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.