Netflix Prepares to Reveal Q3 2024 Results: What to Expect

Netflix (NFLX) is gearing up to announce its third-quarter 2024 results on October 17, following the market’s close. Let’s delve into the key aspects of the largest video-streaming service in the world ahead of this important release.

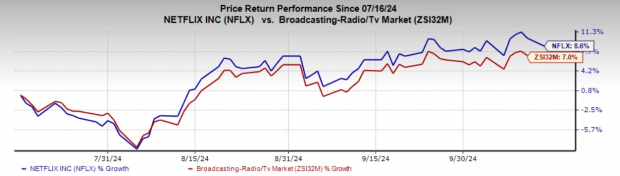

In the last three months, Netflix shares have climbed 8.6%, outperforming the broader industry, which rose by 7% during the same period. This positive momentum is expected to continue, with analysts anticipating that Netflix will exceed earnings expectations this earnings season.

Image Source: Zacks Investment Research

As a result, several ETFs that heavily invest in Netflix, such as MicroSectors FANG+ ETN (FNGS), Invesco Next Gen Media and Gaming ETF (GGME), First Trust Dow Jones Internet Index Fund (FDN), Communication Services Select Sector SPDR Fund (XLC), and First Trust S-Network Streaming & Gaming ETF (BNGE), are attracting attention.

What the Earnings Predictions Reveal

Netflix currently shows an Earnings Surprise Prediction (ESP) of +1.37% and holds a Zacks Rank #2 (Buy). This combination enhances the likelihood of a positive earnings report. Over the past month, there have been no changes in earnings estimates for the upcoming quarter, but experts expect a significant earnings growth of 35.9% and a 14.3% increase in revenue. Historically, Netflix has delivered an average earnings surprise of 6.15% across its past four quarters. It’s worth noting that Netflix is part of a high-ranking Zacks industry, placing it within the top 41% of over 250 industries.

Current Brokerage Recommendations and Projections

Netflix holds an average brokerage recommendation score (ABR) of 1.89 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on recommendations from 40 brokerage firms. This score has slightly improved from an ABR of 1.91 recorded a month ago. Among the current ratings, 23 are Strong Buy and two are Buy, indicating that 57.5% of recent recommendations favor buying, which is up from 53.85% last month.

According to short-term target estimates from 36 analysts, the average price target for Netflix stands at $715.75, ranging from a low of $545.00 to a high of $900.00.

Growth Factors on the Horizon

Netflix is well-positioned for growth through initiatives like the paid-sharing plan and increased revenue from advertising. Many analysts believe its crackdown on password sharing has successfully drawn in new subscribers.

This year, Netflix has ventured into live programming and sports, challenging traditional television. It plans to offer live streaming of NFL games starting this Christmas. Analysts think this strategy could help Netflix lower subscriber churn while attracting new viewers.

For the upcoming quarter, Netflix expects a revenue boost of 13.9% year-over-year, reaching approximately $9.73 billion, with earnings projected at $5.10 per share, although it anticipates fewer new subscribers than in the previous year.

Valuation Insights

Currently, Netflix shares appear pricey, with a price-to-earnings (P/E) ratio of 37.81 compared to the industry average of 10.60. However, its solid Growth Score of B indicates the potential for continued growth, justifying its elevated valuation.

Prominent ETFs to Watch

MicroSectors FANG+ ETN (FNGS)

This ETN tracks the performance of the NYSE FANG+ Index, an equal-dollar-weighted index, aimed at providing exposure to key growth stocks in technology and tech-enabled sectors. Netflix makes up 10% of its holdings. The fund has cumulative assets of $380 million and charges 58 basis points in annual fees while averaging 154,000 shares traded daily. Its Zacks ETF Rank is #3 (Hold).

Invesco Next Gen Media and Gaming ETF (GGME)

This ETF focuses on firms heavily involved in future media technologies or products. It tracks the STOXX World AC NexGen Media Index and holds 89 stocks, with Netflix accounting for 8% of its portfolio. GGME has assets of $41.1 million and annual fees of 60 basis points, with a Zacks ETF Rank of #3.

First Trust Dow Jones Internet Index Fund (FDN)

Tracing the Dow Jones Internet Composite Index, this fund gives exposure to a wide array of the internet industry, including 41 stocks, with Netflix making up 7.8%. As one of the most liquid ETFs in the tech sector, it has $6 billion in assets and trades around 218,000 shares daily. FDN charges 51 basis points annually and has a Zacks ETF Rank of #1 (Strong Buy) with a high-risk outlook.

Communication Services Select Sector SPDR Fund (XLC)

XLC includes companies across telecommunications, media, and interactive services, managing $18.2 billion in assets. Netflix is the fourth-largest holding, representing 6.1% of the fund’s portfolio. Approximately 42% of the fund focuses on interactive media and services, with other segments representing significant portions. This fund charges 9 basis points in fees and trades an average of 3.6 million shares daily, reflected in its Zacks ETF Rank of #2 (Buy).

First Trust S-Network Streaming & Gaming ETF (BNGE)

BNGE follows the S-Network Streaming & Gaming Index and contains 45 stocks, with Netflix accounting for 4.9%. The largest sector in the ETF is entertainment, making up 44.9%. This ETF has $3.9 million in its asset base and trades around 3,000 shares daily, charging 70 basis points annually.

Stay Updated on Key ETF Information

Zacks’ free Fund Newsletter provides insights into significant news and analysis, along with top-performing ETFs each week.

Want the latest recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” to get this report now.

Netflix, Inc. (NFLX): Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

Communication Services Select Sector SPDR ETF (XLC): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

First Trust S-Network Streaming & Gaming ETF (BNGE): ETF Research Reports

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.