Philip Morris International’s Strong Growth Signals Bright Future

The tobacco industry has not been seen as a growth area in years, but Philip Morris International (NYSE: PM) is working to change that perception. With its smoke-free business gaining impressive traction, the stock recently achieved an all-time high and has risen over 40% since the start of the year.

Let’s explore the third-quarter results to understand if this upward trend can continue.

Zyn Drives Growth Momentum

Zyn stands out as the primary growth driver for Philip Morris, with sales increasing 43.6% year over year to reach 164.6 million cans this quarter. Zyn is a nicotine pouch that uses nicotine powder and flavorings instead of traditional tobacco. Philip Morris expanded its portfolio by acquiring this brand alongside Swedish Match at the end of 2022, marking a significant shift for the company.

Additionally, sales of heated tobacco units (HTUs), including the IQOS system, also surged, with volumes up 8.9% to 35.3 billion units in the quarter. Excluding inventory movements, volumes saw an even more impressive increase of 14.8%, largely benefiting from strong performances in Japan and Europe.

Traditional cigarette volumes have also seen a slight rise, up 1.3% to 163.2 billion units, even as the company’s market share dipped slightly to 24.2%.

On a broader scale, organic revenue, which removes the effects of currency fluctuations, acquisitions, and divestitures, grew by 11.6% year over year, totaling $9.9 billion. Adjusted earnings per share (EPS) increased by 18.0%, when accounting for constant currency.

Revenue from combustible tobacco grew by 8.6%, supported by a notable increase in pricing and stable volumes. Meanwhile, smoke-free revenue jumped 16.8% year over year.

The strong performance is backed by higher gross margins from both Zyn and IQOS, contributing to an 80-basis-point rise in organic gross margins. Notably, smoke-free gross margins improved by 200 basis points compared to combustible gross margins, which only saw a 10 basis point increase. Management highlighted that smoke-free margins are over 450 basis points higher than those of combustible products this quarter.

Image source: Getty Images.

Thanks to this momentum, management has once again raised its full-year guidance for 2024.

| Original Guidance | Prior Guidance | New Guidance | |

|---|---|---|---|

| Organic revenue growth | 6.5% to 8.0% | 7.5% to 9.0% | 9.5% |

| Adjusted EPS | $5.90 to $6.02 | $6.33 to $6.45 | $6.45 to $6.51 |

| Adjusted EPS growth excl. currency | 7% to 9% | 11% to 13% | 14% to 15% |

| Volume growth | 0% to 1% | 1% to 2% | 2% to 3% |

Data source: Philip Morris International.

The company forecasts around $11 billion in operating cash flow while allocating $1.4 billion toward capital expenditures, focusing largely on enhancing Zyn production capacity in the U.S.

Philip Morris also announced a 3.8% increase in its quarterly dividend to $1.35, resulting in a forward dividend yield of 4.1%—well-supported by its cash flow.

Should You Consider Investing in Philip Morris Stock?

Even though tobacco companies have spoken about moving away from traditional cigarettes for years, Philip Morris is already reaping the rewards as its smoke-free products generate substantial revenue and earnings. At the same time, cigarette volumes have remained stable, aided by pricing strategies that bolstered earnings growth and increased guidance this year.

As the company boosts its Zyn production in the U.S., it is also looking to broaden its market reach internationally. IQOS has just begun its U.S. launch in Austin, with plans for a new product version looking for FDA approval next year, potentially enhancing growth further in 2026.

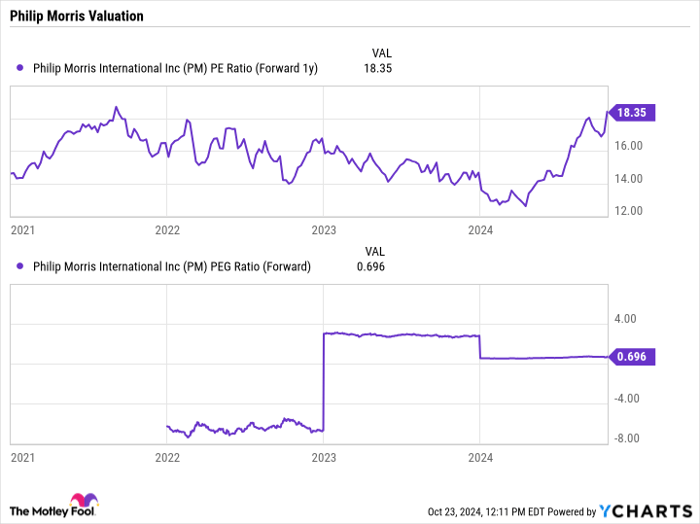

Trading at a forward price-to-earnings (P/E) ratio of 18 based on the 2025 analyst consensus, the stock remains attractive. Its PEG (price/earnings-to-growth) ratio of 0.7 further indicates that it might be undervalued.

Data by YCharts.

Even with recent stock gains, investing in Philip Morris might still be a good opportunity. This company is a rare large-cap growth player in a traditionally defensive industry. The stock’s valuation has risen due to strong performance, but remains appealing, especially considering its solid dividend.

Should You Invest $1,000 in Philip Morris International Now?

Before making a purchase, potential investors should weigh their options:

The Motley Fool Stock Advisor analysts recently pinpointed their top ten stocks to buy, and Philip Morris International was not featured among them. The stocks selected could yield significant returns in the upcoming years.

For context, when Nvidia joined this list on April 15, 2005, a $1,000 investment would now be worth $867,372!

Stock Advisor provides a straightforward path to investment success, including portfolio-building guidance, regular updates, and two new recommendations each month. Since 2002, this service has more than quadrupled the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Geoffrey Seiler has positions in Philip Morris International. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.