Tesla Prepares for Q3 Earnings: What to Expect

Third-Quarter Results Awaited As Estimates Edge Up

Tesla TSLA is set to announce its third-quarter 2024 results this Wednesday, shortly after the market closes. The Zacks Consensus Estimate anticipates earnings of 58 cents per share, with revenues projected at $25.6 billion for the quarter.

Keep track of quarterly results: Check the Zacks Earnings Calendar.

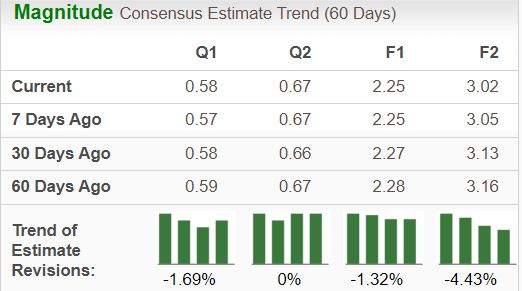

In the past week, earnings estimates for the upcoming quarter have increased by a penny. However, this forecast represents a 12.12% decline compared to last year’s figures. On the revenue side, there is an expectation of a 9.5% increase year over year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For the full year, the Zacks Consensus Estimate sets Tesla’s revenues at $98.7 billion, a modest rise of 2% from last year. The estimate for earnings per share (EPS) in 2024 stands at $2.25, indicating a significant drop of around 28% year over year.

Over the last four quarters, Tesla has fallen short of EPS estimates each time, recording an average earnings surprise of negative 8%.

Tesla’s Price and EPS Surprise

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

Q3 Earnings Insights for Investors

Current projections do not strongly indicate an earnings beat for Tesla. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold), could suggest better odds for an earnings surprise. Unfortunately, that is not the case here. TSLA currently has an Earnings ESP of -1.28% and a Zacks Rank of #2. You can find more details by using our Earnings ESP Filter.

Key Factors Influencing TSLA’s Q3 Performance

During the third quarter, Tesla produced 469,796 vehicles, with 443,668 being Model 3 and Y units. The company delivered 462,890 vehicles globally, which slightly missed the Zacks Consensus Estimate of 471,599 vehicles. Nevertheless, this marked the first year-over-year increase in deliveries for 2024, up 4.3% from the previous quarter.

Tesla’s automotive revenues for the upcoming quarter are projected to reach $22.2 billion, reflecting a year-over-year increase of 13%. The company has employed price reductions and incentives to enhance demand, which likely boosted these sales figures but might have pressured profit margins. The Zacks Consensus Estimate for their automotive gross margin stands at 18.3%, a decrease from 18.7% in the same quarter last year.

Despite this expected margin squeeze, Tesla’s energy generation and storage sector is thriving. Demand for Megapack and Powerwall products is strong, leading to an estimated 39% increase in revenues from this segment, projected at $2.16 billion, with gross profit anticipated to climb over 45%.

Moreover, Tesla’s Services and Other segment is expected to generate $2.3 billion in revenue, up from $2.16 billion a year earlier, primarily due to the growth of its supercharging network. Notably, major car manufacturers like General Motors GM, Ford F, and Stellantis STLA are starting to adopt Tesla’s NACS charging standard, which enhances the outlook for this segment.

Tesla’s Stock Performance and Valuation

Year to date, Tesla’s shares have dropped about 11%. This decline has outperformed the overall industry and sector but lagged behind the S&P 500’s growth.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Looking at Tesla’s valuation, it appears somewhat overvalued. The company is currently trading at a forward sales multiple of 6.38, significantly higher than the industry’s average of 1.57 but lower than its own five-year average.

Image Source: Zacks Investment Research

Investment Considerations Ahead of Q3 Earnings

Tesla is currently grappling with reduced automotive margins, and the recent Robotaxi event raised investor concerns due to a lack of clear information regarding the ridesharing platform. Key details such as timelines for scaling robotaxi production and addressing regulatory challenges went unaddressed, possibly hindering competitive positioning against others like Alphabet’s Waymo.

Despite these challenges, Tesla is making noteworthy technological advancements. The company introduced its humanoid robot project, Optimus, and rolled out the Full Self-Driving (FSD) Beta software (V12.5). Furthermore, Tesla aims to step up production of new, budget-friendly EV models that could drive future growth. The energy generation and storage segment remains the company’s most profitable, with the highest margins, while the expanding NACS charging network presents substantial revenue potential. Tesla’s high liquidity and low debt levels provide the flexibility to seize new growth opportunities.

As the third-quarter earnings announcement approaches, investors will closely scrutinize Tesla’s revenue growth, profit margins, and cash flow performance to assess the company’s financial stability.

Following the recent Robotaxi event on October 10, Tesla’s stock saw a significant sell-off, creating some caution among investors. However, Cathie Wood’s Ark Invest took advantage of this dip, acquiring nearly $3 million in Tesla shares. Ark Invest has a track record of buying when stocks experience pullbacks, viewing this decline as a possible opportunity for long-term investment, regardless of the forthcoming earnings results.

Zacks Identifies Top Semiconductor Stock

Highlighted as a strong contender, this stock is only 1/9,000th the size of NVIDIA, which has soared over +800% since our recommendation. While NVIDIA continues to perform well, our new semiconductor pick has ample room for growth.

This company is poised to meet high demand resulting from advancements in Artificial Intelligence, Machine Learning, and the Internet of Things. Predictions estimate that global semiconductor manufacturing will surge from $452 billion in 2021 to $803 billion by 2028. Explore this stock now for free >>

Want the latest recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double today. Click for your free report.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Stellantis N.V. (STLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.