Novavax Faces Challenges After FDA Holds Clinical Trials

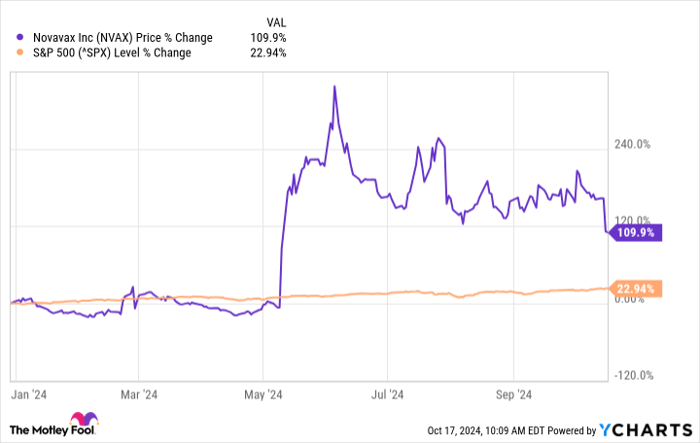

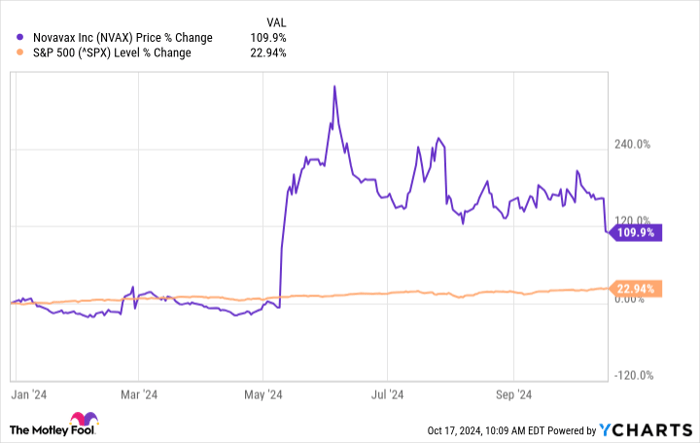

Vaccine manufacturer Novavax (NASDAQ: NVAX) has experienced significant ups and downs this year. In May, shares surged after a major agreement with biotech leader Sanofi. However, recent developments have led to a downturn, particularly following an announcement of a clinical setback.

Shares of Novavax plummeted by roughly 20% in a single day after the disappointing news. Although its stock is up more than 100% for the year, this drop may present an opportunity for long-term investors, contingent on the company’s ability to rebound. The question now is: can they?

Let’s investigate.

NVAX data by YCharts

Clinical Trials Put on Hold

Novavax has successfully developed its COVID-19 vaccine, the only product it currently offers. The company aimed to launch two additional candidates: an investigational influenza vaccine and a combination coronavirus/flu vaccine, with plans for phase 3 clinical trials to start in the fourth quarter.

Unfortunately, this timeline is now in jeopardy. The U.S. Food and Drug Administration (FDA) has placed a clinical hold on its Investigational New Drug (IND) application for these candidates due to safety concerns. This hold comes after a report of a severe adverse event in a patient experiencing nerve damage during one of Novavax’s phase 2 studies.

Assessing the Impact

While investigators have not concluded that Novavax’s vaccine caused this adverse event, it is worth noting that the report surfaced over a year after the trial’s completion. Caution is standard procedure for regulators when safety concerns arise, leading to clinical holds. The industry often reinforces the adage, “better safe than sorry.”

However, uncertainty in the market tends to spook investors. The longer the clinical hold continues, the more tension will build among shareholders. Should the situation linger, it could result in a further decline in stock prices, particularly as the clinical hold risks delaying the anticipated launch of these new candidates.

Novavax intended to carry out late-stage trials this fall, a crucial time for flu vaccines. The company hoped to share results by mid-2025, aiming for approval by mid-2026. If the hold persists, their timeline could be set back by a year or more, regardless of whether the vaccine was linked to the adverse event.

Investment Outlook

For prospective investors, it’s worth noting that Novavax was not particularly appealing even before this setback. While the partnership with Sanofi provided a crucial boost, Novavax’s COVID-19 vaccine lags behind its competitors in the U.S. market.

The combined coronavirus/flu candidate holds potential appeal, especially for patients preferring a two-for-one shot. However, Novavax faces fierce competition from larger firms, including Moderna and Pfizer, who are also developing similar combinations.

Despite the stiff competition, success is possible for Novavax. Still, investors should consider the considerable risks associated with clinical and regulatory hurdles. There is a real chance that if Novavax’s vaccines reach the market, their performance may not meet expectations.

This clinical hold underscores the inherent risks biotech companies face when dealing with unforeseen setbacks. Although it’s possible for Novavax to resolve this issue relatively soon, cautious long-term investors might choose to stay away from this stock.

Opportunity Knocks for Investors

Have you ever felt like you missed out on investing in successful stocks? If so, consider this news.

Occasionally, our team of analysts declares a “Double Down” stock recommendation for companies poised for growth. If you’re concerned that you’ve missed earlier opportunities, now could be your chance to invest before it’s too late. The statistics speak volumes:

- Amazon: A $1,000 investment when we doubled down in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment from our 2008 recommendation would be valued at $44,456!*

- Netflix: A $1,000 bet when we doubled down in 2004 has grown to $411,959!*

Currently, we’re providing “Double Down” alerts for three incredible companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.