Pro-Dex, Inc. Experiences Remarkable Growth, Surpassing Industry Peers

Pro-Dex, Inc. (PDEX) has experienced impressive growth this past year, with its valuation reaching an all-time high. This surge indicates strong confidence from investors and the market.

Founded in 1978 and based in Irvine, CA, Pro-Dex also operates facilities in Santa Ana, Beaverton, OR, and Carson City, NV. The company focuses on developing and manufacturing technology-based solutions, including embedded motion control devices, miniature rotary drive systems, and fractional horsepower DC motors. These innovations serve several sectors, including medical, dental, semiconductor, scientific research, and aerospace.

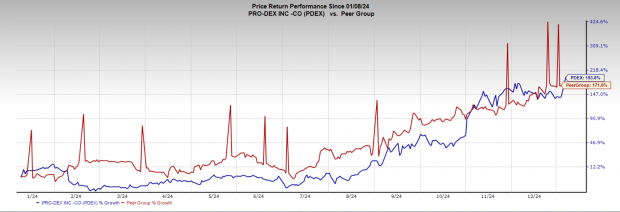

Pro-Dex holds a Zacks Rank of #1 (Strong Buy) and is categorized within the Zacks Medical – Dental Supplies industry. Notably, it shares this ranking with McKesson Corporation (MCK), while CONMED Corporation (CNMD) has a rank of #2 (Buy). Over the past 12 months, Pro-Dex’s stock has surged by 193.8%, outperforming its Zacks Peer Group’s rally of 171.8%.

Image Source: Zacks Investment Research

The company’s growth trajectory has been notable over the last five years, with a 239.7% increase in share price during this time. Notably, Pro-Dex achieved a compound earnings growth rate of 11% annually, indicating positive investor sentiment. On January 6, shares notably jumped 23% to reach $57.78, illustrating strong market confidence.

At the close of October, Pro-Dex announced first-quarter fiscal 2025 earnings of 75 cents per share, significantly surpassing the Zacks Consensus Estimate of 29 cents. Analysts anticipate earnings of 38 cents per share for the upcoming release on February 13, 2025, reflecting a year-over-year growth of 171.43%.

Considering the positive outlook, Pro-Dex appears reasonably valued at around $55. The medical and dental supplies sector ranks in the top 10% among all industries tracked by Zacks, bolstering its appeal in investment considerations.

Five Stocks Poised for Significant Gains

Expert analysts at Zacks have identified five stocks predicted to potentially double in value in 2024. While not every selection might succeed, some previous picks have reported gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks remain under the radar, presenting a unique chance for early investment.

Discover Today’s 5 Potential Home Runs >>

Analyze CONMED Corporation (CNMD) for Free.

Explore McKesson Corporation (MCK) for Free.

View Pro-Dex, Inc. (PDEX) Analysis for Free.

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.