Super Micro Computer Faces Headwinds Despite Surging Demand for AI Solutions

Super Micro Computer (NASDAQ: SMCI) has experienced a tumultuous 2024. Initially, it started off as a top performer, seeing its share price triple in less than three months. However, after some investors cashed in their gains and Supermicro (the company’s common name) released a disappointing earnings report, the stock began to falter. Compounding the situation, allegations of accounting fraud emerged from Hindenburg Research, a well-known short-selling firm, prompting a probe by the Department of Justice (DOJ).

Investors in Supermicro have had a bumpy ride, as the stock is significantly below its all-time high. Nonetheless, could this be an opportunity for potentially lucrative investing? Looking closer, one can see that Supermicro’s business is thriving.

Unprecedented Demand Boosts Supermicro’s Growth

Super Micro Computer’s growth is largely driven by the burgeoning need for artificial intelligence (AI) computing capabilities. The company designs components for servers and also offers complete server solutions. Its products stand out due to their exceptional cooling technology; the most efficient servers are liquid-cooled, reducing the need for expansive, costly air-conditioned environments.

Supermicro claims that its technology results in up to 40% energy savings and 80% space efficiency. By utilizing this advanced cooling method, customers can fit more servers into compact spaces—an attractive selling point.

This surge in demand has resulted in remarkable growth for Supermicro. In the fourth quarter of FY 2024 (ending June 30), Supermicro reported revenue growth of 143% year-over-year, reaching $5.3 billion. Additionally, management forecasts revenue for FY 2025 between $26 billion and $30 billion, translating to a growth rate of approximately 74% to 101%.

Management has ambitions beyond that figure, projecting $50 billion in annual revenue down the line. Although this may seem ambitious, it’s noteworthy that this forecast has already surpassed last year’s Q4 projection of $20 billion, further fueling investor interest.

Nevertheless, investors have more to consider beyond favorable revenue growth.

Challenges Ahead for Supermicro

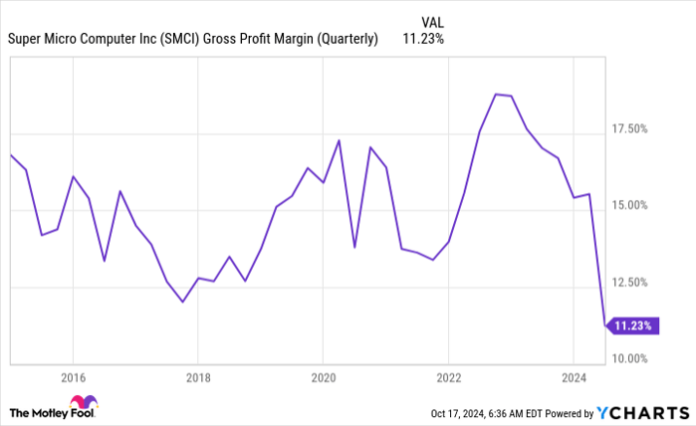

One major concern is Supermicro’s declining gross margin, which has now reached its lowest point in a decade, even as revenues rise. Such a trend is typically a troubling sign.

SMCI Gross Profit Margin (Quarterly) data by YCharts

Management believes that gross margins will improve in FY 2025 due to a more profitable product mix, better manufacturing efficiencies in its liquid-cooled line (as production ramps up at factories in Malaysia and Taiwan), and the introduction of new products. This improvement is something investors need to monitor closely, as it could significantly affect Supermicro’s profitability.

However, the shadow of past accounting issues looms large. Hindenburg Research has highlighted that Supermicro previously faced a $17.5 million fine for accounting mistakes in 2018. Adding to the uncertainty, the company delayed its end-of-year 10-K filing as it evaluated the “design and operating effectiveness of its internal controls over financial reporting.”

Given these factors, the ongoing DOJ investigation might lead some investors to exercise caution. While the risks are evident, so are the potential rewards if management’s optimistic projections materialize and the DOJ investigation yields no wrongdoing.

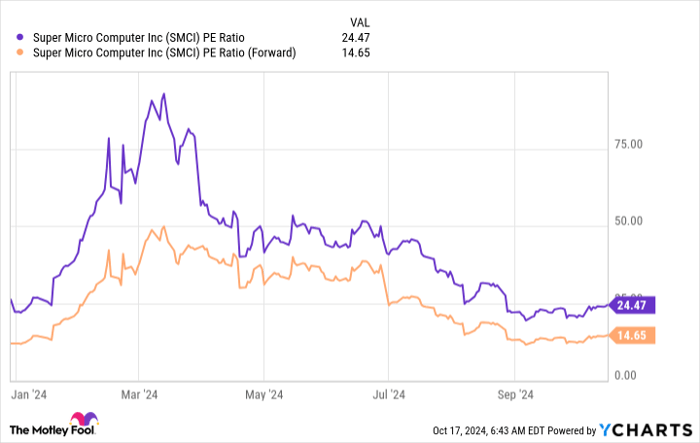

Supermicro could be one of the more affordable stocks aligned with the AI investment trend, currently trading at just 15 times projected earnings.

SMCI PE Ratio data by YCharts

If the company can emerge from these challenges intact, it could see its valuation rise to match that of the S&P 500 (SNPINDEX: ^GSPC), which averages a forward earnings multiple of 23.8.

The path is fraught with risk for Supermicro, yet the upside potential is significant. While it’s unlikely to make anyone a millionaire overnight, a potential doubling or tripling of stock price in the coming years could benefit those who invest with caution. For instance, a minority investment that constitutes about 1% of a portfolio could enhance long-term returns.

A New Opportunity on the Horizon

Have you ever felt like you missed your chance to invest in some of the biggest success stories? A new opportunity may be right at your fingertips.

From time to time, our team of expert analysts issues a “Double Down” stock recommendation for companies they believe are poised for growth. If you think you’ve missed out on investing, now could be the ideal time to consider before it’s too late. The results speak for themselves:

- Amazon: An investment of $1,000 when we doubled down in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $44,456!*

- Netflix: If you invested $1,000 when we doubled down in 2004, it would be worth $411,959!*

Currently, we’re sharing “Double Down” alerts for three remarkable companies, and this may be an opportunity that won’t come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.