Before diving into the reliability of brokerage recommendations, let’s take a look at what Wall Street analysts have to say about Super Micro Computer (SMCI).

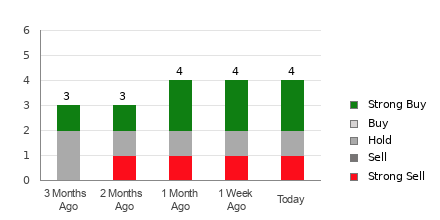

The Brokerage Verdict

Super Micro currently boasts an average brokerage recommendation (ABR) of 1.57, indicating a consensus between Strong Buy and Buy, based on assessments from seven brokerage firms. Out of these seven recommendations, an overwhelming 71.4% vouch for a Strong Buy rating.

Understanding Brokerage Recommendations

While the ABR leans towards a favorable view of Super Micro, it is essential to exercise caution when solely relying on this metric for investment decisions. Numerous studies have questioned the reliability of brokerage recommendations in identifying stocks with substantial potential for price appreciation. This skepticism arises from the evident positive bias seen in brokerage ratings, with a disproportionate number of “Strong Buy” recommendations as compared to “Strong Sell” recommendations.

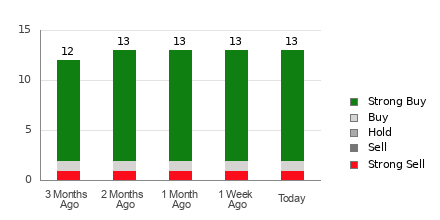

Zacks Rank: A More Reliable Indicator?

Counterbalancing the broker-centric view, the Zacks Rank offers a different perspective by leveraging earnings estimate revisions to evaluate a stock’s short-term price performance. Unlike the ABR, the Zacks Rank remains impartial and timely, making it a valuable tool for validating investment choices.

Analyzing Super Micro’s Prospects

Despite the favorable ABR, the Zacks Consensus Estimate for Super Micro’s current-year earnings has witnessed a 0.9% decline over the past month. This downtrend, coupled with other factors, has culminated in a Zacks Rank #4 (Sell) for Super Micro, signaling potential challenges in the near term.

Final Considerations

While the brokerage ABR paints a rosy picture for Super Micro, investors are advised to approach it with a degree of skepticism, especially given the contrasting insights provided by the Zacks Rank. It’s crucial to conduct thorough research and consider multiple factors before making any investment decisions.

Just Released: Zacks Top 10 Stocks for 2024

If you remain on the fence about Super Micro, exploration of alternative investment opportunities may prove beneficial. Zacks’ latest stock recommendations, driven by robust research methodologies, could offer a fresh perspective for your investment portfolio.

For more in-depth insights and personalized investment recommendations, consider exploring Zacks Investment Research or Zacks’ Top 10 Stocks for 2024.