Exploring the Surge of Intuitive Surgical: Is Now the Right Time to Invest?

Intuitive Surgical (NASDAQ: ISRG) has emerged as a significant player in healthcare, showing an impressive 800% increase in its share price over the last decade. Recently, the company’s stock soared again, buoyed by another strong earnings report related to its da Vinci robotic-assisted surgery system, resulting in a 45% rise in shares this year.

This raises an important question: Is it too late to buy shares, or does the stock still hold potential? To address this, we’ll take a closer look at Intuitive’s latest performance and the upcoming launch of its da Vinci 5 system in 2025.

Solid Earnings and Upcoming Innovations

In its recent third-quarter report, Intuitive Surgical showcased impressive growth, with revenue climbing 17% to $2.04 billion and adjusted earnings per share (EPS) up 26% to $1.84. These figures exceeded analysts’ expectations, which estimated EPS of $1.64 on revenues of $2.01 billion.

The earnings improvement was due to enhanced gross margins, which increased by 30 basis points to 69.1%, alongside effective cost management.

Sales of instruments and accessories surged by 18% to $1.26 billion, closely tied to the volume of procedures performed—an increase of 18% for the da Vinci Systems. Additionally, procedures utilizing the Ion system, designed for robotic bronchoscopy, soared by 73%.

During this quarter, the company shipped 379 da Vinci surgical systems, raising its total installed base to 9,539 systems, a 15% year-over-year growth. This included 110 new da Vinci 5 systems, still in a soft launch phase, out of 220 systems sent under leasing agreements.

Notably, the Ion system saw its installed base grow by 50% compared to the previous year, with placements made in international markets like China and Europe. Furthermore, adoption of its SP System also increased by 53% due to its growing acceptance in South Korea and early interest from Japan and Europe.

International procedure growth was robust, rising 24%, despite some regional challenges like a doctor strike in South Korea and budget constraints affecting capital spending in the U.K. and Germany. There was also rising domestic competition in China.

Intuitive Surgical generated approximately $600 million in free cash flow this quarter, boosting its total cash reserves to $8.3 billion, all while maintaining a debt-free status.

Looking forward, the company has updated its full-year procedure growth guidance to a range of 16% to 17%, up from its previous range of 15.5% to 17%, taking into account current trends in bariatric procedures.

Intuitive Surgical plans to fully launch its da Vinci 5 system by mid-2025, and early feedback suggests that the new system significantly improves surgical efficiency.

Image source: Getty Images.

Assessing the Stock’s Investment Potential

The da Vinci 5 system is expected to have a 30% higher average selling price than its predecessor, the Xi. However, with the inclusion of more standard features, the adjusted cost is closer to a 15% increase. Initially, gross margins may be lower, but they are anticipated to improve over time.

With 180 placements of the da Vinci 5 system in the first two quarters of its soft launch, demand appears strong. For context, the Xi system had 200 placements during its first year following its 2014 launch. The da Vinci 5 has already received approval in the U.S. and gained recent clearance in South Korea, while discussions with Japan’s regulatory bodies are ongoing. However, it will not be launched in Europe just yet.

This suggests that the da Vinci 5 is poised to drive future growth for Intuitive Surgical. While sales from the new system will be beneficial, the key lies in expanding the installed base and increasing the number of procedures performed. The da Vinci 5’s enhancements—such as a 3D display and force-sensing technology—are designed to save time, benefiting surgeons and potentially increasing the number of surgeries performed.

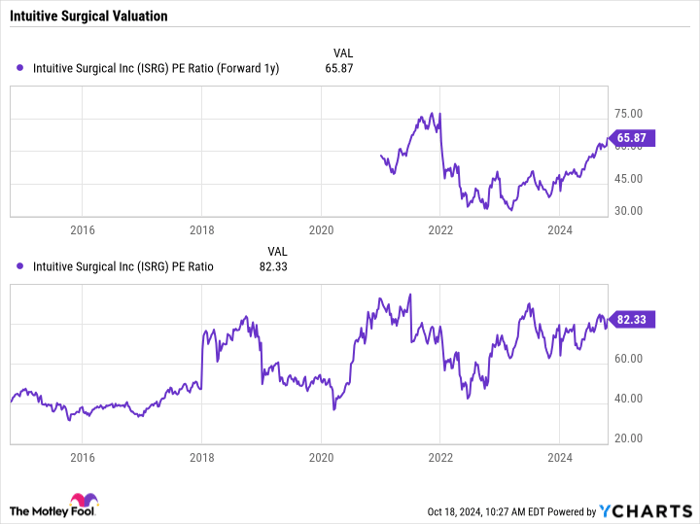

Nevertheless, investors should take note of the valuation aspect, as the stock currently trades at a forward price-to-earnings (P/E) ratio of 66 based on next year’s analyst projections, which is quite high compared to its own historical range.

ISRG PE Ratio (Forward 1y) data by YCharts.

In conclusion, Intuitive Surgical appears to be a promising long-term investment, thanks in part to its model where a significant portion of revenue comes from the sale of single-use instruments. This means as its installed base increases and more surgeries are conducted, revenue will likely rise. Still, caution is advisable; it may be wise to wait for a price pullback before making an investment.

A Potential Second Chance for Smart Investments

Have you ever felt like you missed out on investing in successful companies? If so, you’ll want to listen closely.

Our expert analysts occasionally issue a special recommendation called “Double Down” for companies poised for significant growth. If you’re worried about having missed your chance, this could be the perfect opportunity to invest before it slips away. The statistics speak volumes:

- Amazon: A $1,000 investment when we doubled down in 2010 would today equal $21,294!*

- Apple: A $1,000 investment from our 2008 recommendation would be worth $44,736!

- Netflix: Back in 2004, a $1,000 investment would now be worth an astonishing $416,371!

Right now, we are issuing “Double Down” alerts for three exceptional companies, and this may be one of the last chances for such opportunities.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool recommends Intuitive Surgical and has disclosed its investment positions.

The views expressed in this article reflect the author’s opinions and not necessarily those of Nasdaq, Inc.