Are Dividend Giants the Future? Kinder Morgan Leads the Charge in 2024

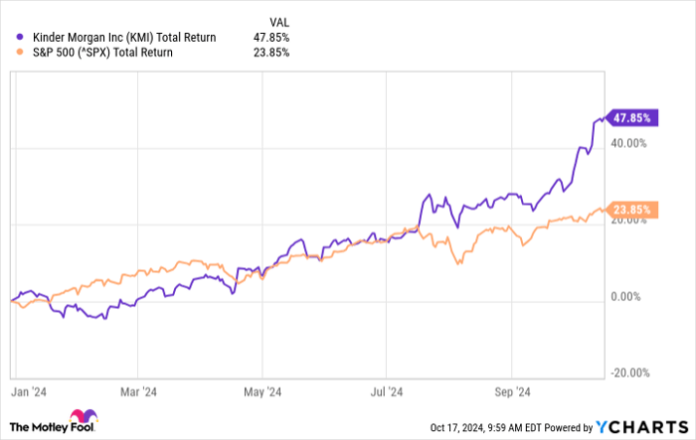

Investors eyeing the technology and AI boom in 2024 may find themselves neglecting the value of diversification. Many think this means sacrificing potential growth for the safety of dividend stocks. However, one energy infrastructure company, Kinder Morgan (NYSE: KMI), is proving this notion wrong. With its hefty dividends, Kinder Morgan is significantly outperforming the S&P 500 index this year. In fact, the total return from Kinder Morgan has doubled that of the index through mid-October. For those who have yet to invest, there are solid reasons to consider Kinder Morgan now.

KMI Total Return Level data by YCharts

Solid Cash Flow Powers Growth

Kinder Morgan’s stock rise can be linked to its strong operational success. The company is generating substantial cash flow, which has allowed it to fund various promising projects. A key example is its $1.8 billion acquisition of STX Midstream from NextEra Energy Partners that was finalized late last year. This acquisition includes pipelines connecting Texas’ Eagle Ford basin to the Gulf Coast and Mexican markets, as well as important recent expansions to its midstream pipeline.

Kinder Morgan’s capital investments are projected to yield long-term benefits, with many of its operations secured by contracts averaging over eight years. Recently, it approved nearly $500 million to enhance its Gulf Coast Express pipeline, facilitating increased natural gas deliveries from the Permian Basin to South Texas. Capital spending on midstream natural gas is nearing its peak this decade, hinting at rising returns for shareholders in future years.

Image source: Statista.

Over the past six months, Kinder Morgan generated nearly $3 billion in operational cash flow, with $1.7 billion in free cash flow. The company has used this excess to boost its dividend while maintaining a debt level well below its target of 4.5 times net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). This metric has decreased by 26% since 2016 and is expected to fall to 3.9 by the end of the year, allowing Kinder Morgan to return about 41% of its recent market cap to shareholders during this time.

Riding the Energy Wave

Beyond financial figures, the broader energy landscape continues to favor Kinder Morgan. Chairman Richard Kinder noted in the company’s third-quarter report that “substantial projected increases in natural gas demand both domestically and globally” present many future opportunities.

Demand for natural gas in the U.S. has climbed steadily over the years. This trend is reinforced by increasing energy requirements driven by the expansion of AI data centers and the growing adoption of electric vehicles.

Image source: Statista.

Investing in the Leader

Kinder Morgan plays a crucial role in the U.S. natural gas market, transporting about 40% of the nation’s production. Its extensive pipeline infrastructure is hard to replicate. Investors have the opportunity to acquire shares in a leading company that continues to aggressively invest in its future while offering a growing dividend.

Though Kinder Morgan significantly cut its dividend in 2016 to focus on reducing debt and improving cash flow, it has consistently raised the payout as its financial situation has strengthened. Despite substantial gains in its stock price this year, the current dividend yield remains attractive at 4.6%.

Those considering an investment in Kinder Morgan shouldn’t feel rushed; it’s still a good moment to buy. Even if the stock doesn’t repeat its past performance in the near future, the dividend provides a reliable yield, and the company is well-positioned to benefit from ongoing trends, offering the potential for capital gains as well.

Is an Investment in Kinder Morgan a Smart Move?

If you are thinking about buying Kinder Morgan shares, take note:

The Motley Fool Stock Advisor analyst team has recently highlighted what they view as the 10 best stocks to buy now… and Kinder Morgan isn’t included. The stocks selected have substantial growth potential over the coming years. Remember how Nvidia was recommended on April 15, 2005? A $1,000 investment then would now be worth $845,679!*

Stock Advisor offers a straightforward guide for investors, with regular updates from analysts and two new stock recommendations each month. This service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Howard Smith has positions in Kinder Morgan. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.