Nvidia Soars in Value: TSMC Emerges as a Strong AI Investment Alternative

Understanding Nvidia’s Ten-Year Climb

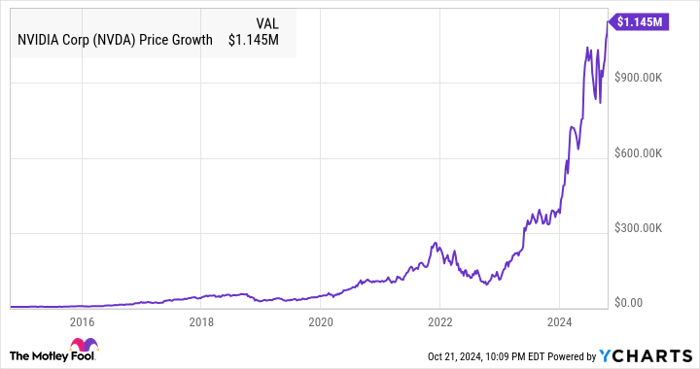

Nvidia has proven to be an exceptional investment over the last decade. Shares have skyrocketed by an impressive 32,600%, far surpassing the S&P 500 index’s gain of 207%. A $3,500 investment in Nvidia shares made ten years ago would now be valued at over a million dollars.

NVDA data by YCharts.

Nvidia has truly become a millionaire-maker stock for those who invested early and held onto their shares. However, as the chart indicates, most of these gains have occurred recently amidst a global boom in artificial intelligence (AI).

As a leading player in the AI revolution, Nvidia’s graphics processing units (GPUs) have been vital for training AI models and enabling AI inference. The company seems poised for continued expansion in the promising AI chip market where it currently dominates.

Nonetheless, potential investors should be mindful that Nvidia’s current valuation stands at 65 times earnings and 36 times sales. Although the company’s remarkable growth can justify these numbers, those seeking relatively cheaper alternatives may want to examine Taiwan Semiconductor Manufacturing (NYSE: TSM), commonly referred to as TSMC.

The Strength of TSMC in the AI Market

TSMC is recognized as the world’s largest semiconductor foundry, providing fabrication services to major chip manufacturers such as Nvidia, AMD, Broadcom, and Qualcomm. Consumer electronics giant Apple is TSMC’s largest client, with other companies like Sony also relying on its chip production capabilities.

By the end of 2023, TSMC had an impressive roster of 528 customers, manufacturing nearly 12,000 products across various markets, including smartphones, the Internet of Things (IoT), high-performance computing, consumer electronics, and automotive. The AI sector is driving growth in these areas, helping TSMC expand rapidly.

On October 17, TSMC announced its third-quarter 2024 results, revealing a 36% year-over-year increase in revenue to $23.5 billion, surpassing the company’s guidance of $23.2 billion. Net profit surged by 54% year-over-year to $10.1 billion, indicating solid earnings growth partly due to a 4.2 percentage point improvement in net profit margins.

The demand for advanced chip nodes, specifically those smaller than 7 nanometers (nm), is driving TSMC’s remarkable growth. Advanced process nodes produced 69% of total revenue compared to 59% a year ago, with the 3nm node alone contributing 20% in the most recent quarter, up from 6% in the same period last year.

This boom can largely be attributed to the release of Apple’s latest iPhones that feature a TSMC-manufactured 3nm processor. Moreover, the upcoming generation of AI chips from Nvidia, AMD, and Intel is expected to utilize TSMC’s 3nm process node.

Looking ahead, TSMC is even developing its 2nm technology, set for production next year. This adds another advanced node for customers and promises to be a significant growth driver as well.

TSMC’s Long-term Viability as an Investment

Chips created using smaller-process nodes are known to contain more transistors per square area, enhancing computing power and thermal efficiency. As a result, TSMC’s advanced-process nodes are increasingly being used for chips that deliver impressive performance while maintaining low power consumption.

With nearly 62% market share in the global semiconductor foundry space—far ahead of Samsung’s 11%—TSMC is well-positioned to benefit from the continuous growth in the semiconductor market long term. TSMC projected Q4 revenue at $26.5 billion, along with an operating margin of 47.5%. This estimate implies a potential revenue increase of 35%, alongside growth in bottom-line performance compared to a 41.6% operating margin from the same quarter last year.

As investors aim to build a million-dollar portfolio, the focus should also be on TSMC’s long-term growth potential.

Assessing TSMC for Your Investment Portfolio

The global semiconductor market is anticipated to reach $1.47 trillion in revenue by 2030, up from $729 billion in 2022. The semiconductor foundry market is expected to expand significantly, from $122 billion last year to $276 billion in 2033. TSMC remains a dominant player in this field, with a broadening addressable market thanks to its new Foundry 2.0 business model.

This revamped model has allowed TSMC to diversify into “packaging, testing, mass making, and other areas,” raising its addressable market estimate from $115 billion to $250 billion. This suggests a strong likelihood of sustained growth for TSMC in the years ahead.

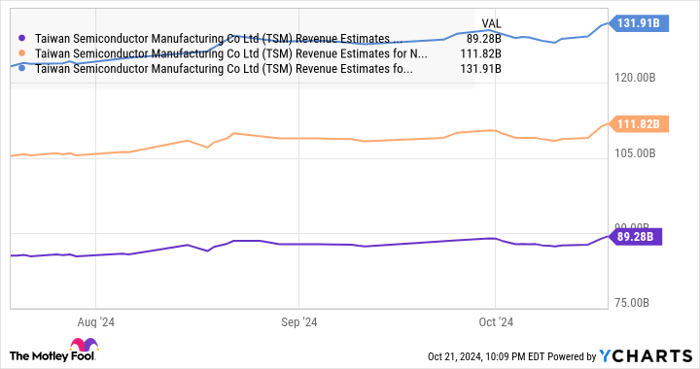

Analyst predictions indicate TSMC’s revenue for 2024 could reach $89.3 billion, marking a 28% increase from last year. The chart below reflects analysts’ upward revisions in revenue estimates for TSMC, a sign of confidence that may persist due to the company’s expanded addressable market and the favorable growth of the foundry sector in the coming decade.

TSM Revenue Estimates for Current Fiscal Year data by YCharts.

Notably, TSMC stock has appreciated over ninefold in the past decade and could repeat such performance in the future due to the compelling factors discussed. Hence, investors looking to create a million-dollar portfolio might consider adding TSMC before its stock climbs further.

Making the Decision to Invest in TSMC

Before investing in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks to buy now, and Taiwan Semiconductor Manufacturing was not included. Those stocks may have the potential for substantial returns in the coming years.

For context, when Nvidia made this list on April 15, 2005… an investment of $1,000 at that time would now be worth $867,372!*

Stock Advisor offers an accessible strategy for investors, providing advice on portfolio construction, regular updates from analysts, and two new stock recommendations each month. Since 2002, the Stock Advisor program has more than quadrupled the return of the S&P 500.

Explore the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Harsh Chauhan does not have a position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. Please review the Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.