Berkshire Hathaway’s Bold Bet on Sirius XM Sparks Investor Interest

Berkshire Hathaway has taken significant steps with Sirius XM (NASDAQ: SIRI) this month. The investment company led by Warren Buffett has increased its stake in the audio and entertainment platform to 32%, valuing it at approximately $3 billion. This acquisition coincided with Sirius XM merging all of its tracking stocks into a single entity.

Challenges in Subscriber Growth Amidst Industry Changes

Sirius XM gained popularity through its satellite radio subscription service, largely by partnering with automakers to bundle its service with new car purchases. This strategy made premium radio a small addition to a significant purchase. Currently, Sirius XM boasts 33 million total subscribers.

However, this represents a decline from 33.5 million subscribers in 2018. Over the past 15 years, the audio industry has shifted from traditional radio to paid and advertising-supported streaming services like Spotify. Users can now effortlessly connect their smartphones to cars using Bluetooth, auxiliary cords, or integrated systems such as those in a Tesla. Spotify currently leads with 246 million paying subscribers, which has multiplied almost tenfold over the last decade.

While Sirius XM owns the streaming service Pandora, it has faced significant challenges in comparison to Spotify and YouTube. Last quarter, Pandora reported only 6 million total users. It raises concerns that Pandora may be unprofitable for Sirius XM and might face closure in the years ahead.

Financial Struggles with Declining Margins and Heavy Debt

Management highlights Sirius XM’s subscriber retention, evidenced by a churn rate of just 1.5% last quarter, consistent with the same period in 2023. While low churn is positive, concerns remain about the high costs of retaining subscribers.

The company is known for its expensive content deals, such as the one with Howard Stern, and is increasing investments in podcasts, including a $100 million deal for Call Her Daddy. This pivot illustrates Sirius XM’s attempt to adapt to evolving listener preferences.

Despite these efforts, revenue has been on a downward trend, impacting profit margins. The operating margin was 23.3% over the past year, a decline from 30% in 2018. This figure does not account for Sirius XM’s substantial debt, which is around $9 billion. The company incurred $416 million in interest over the last 12 months, a significant portion of its $2 billion in operating earnings. If revenues continue to decline, profits will likely follow suit, while interest payments remain constant.

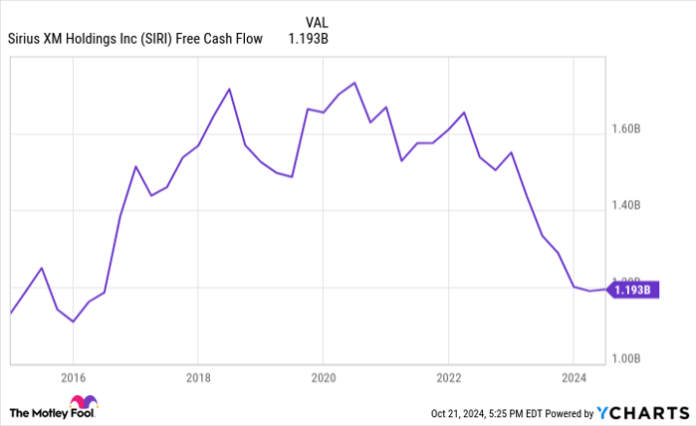

SIRI Free Cash Flow data by YCharts

Evaluating the Investment Potential of Sirius XM Stock

In straightforward terms, Sirius XM stock is not a buy at this time.

The stock’s market capitalization is $9 billion. When its $9 billion debt is factored in, the enterprise value jumps to $18 billion. This year, management forecasts $1.2 billion in free cash flow, which translates to a multiple of 15 times its enterprise value. For investors, it’s vital to rely on enterprise value due to Sirius XM’s large debt burden. While a 15x free cash flow multiple may appear attractive, Sirius XM’s financial trajectory is troubling.

Free cash flow reached its peak several years ago and shows no signs of revival. Given the subscriber declines and increasing content costs, the outlook for Sirius XM suggests a likely deterioration in the coming years. Caution is advised against following Buffett into this potential pitfall.

Is Now the Right Time to Invest $1,000 in Sirius XM?

Before committing to Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to invest in right now…and Sirius XM did not make the list. These selected stocks are positioned to deliver impressive returns in the foreseeable future.

For instance, when Nvidia was featured on this list on April 15, 2005, a $1,000 investment would now be worth approximately $867,372!*

Stock Advisor offers investors a simple plan for success, including guidance for building a portfolio, ongoing analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Brett Schafer has positions in Spotify Technology. The Motley Fool has positions in and recommends Berkshire Hathaway, Spotify Technology, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.