In our latest analysis at ETF Channel, we’ve evaluated the iShares Core S&P U.S. Growth ETF (Symbol: IUSG). By comparing each holding’s trading price with the average 12-month target price set by analysts, we’ve calculated the ETF’s implied target price to be $147.77 per unit.

IUSG is currently trading at approximately $132.69 per unit. This indicates that analysts predict a potential upside of 11.36% based on their target prices for IUSG’s underlying holdings. Notably, several holdings are expected to see significant price increases. These include Abercrombie & Fitch Co (Symbol: ANF), Brinks Co (Symbol: BCO), and Hilton Grand Vacations Inc (Symbol: HGV).

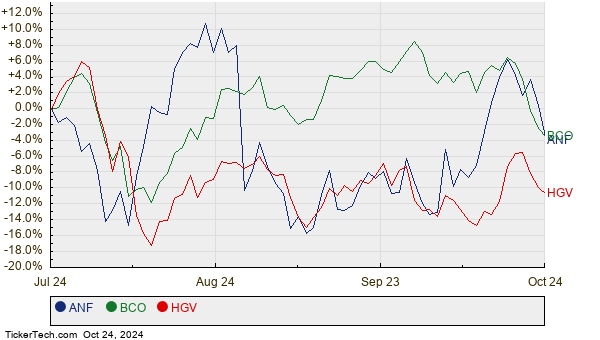

Although ANF recently traded at $147.82 per share, analysts have set an average target of $184.50, suggesting a promising upside of 24.81%. Meanwhile, BCO, priced at $102.74, is estimated to rise to an average target of $123.50, representing a potential increase of 20.21%. HGV shares are currently at $36.64, with an anticipated target of $43.78, presenting a possible upside of 19.48%. The historical performance of these stocks is depicted in the chart below:

Below is a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P U.S. Growth ETF | IUSG | $132.69 | $147.77 | 11.36% |

| Abercrombie & Fitch Co | ANF | $147.82 | $184.50 | 24.81% |

| Brinks Co | BCO | $102.74 | $123.50 | 20.21% |

| Hilton Grand Vacations Inc | HGV | $36.64 | $43.78 | 19.48% |

As these expectations unfold, it raises questions about whether analysts are justified in their targets. Are they too optimistic given recent market trends? An elevated target price relative to a stock’s trading price may indicate positive outlook, but could also lead to potential downgrades if analysts fail to keep up with current developments. Investors should consider these aspects as they conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• BDCO Insider Buying

• Institutional Holders of CDAK

• DRIV Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.