Investing Insights: Analyzing Supermicro’s Stock Surge Amid Competition

Every quarter, investment firms managing over $100 million submit a 13F form to the Securities and Exchange Commission (SEC). This report is a valuable resource because it details the stocks being bought and sold by institutional investors, allowing us to spot trends among leading money managers.

One investor I closely watch is Jeff Yass, co-founder of Susquehanna International Group (SIG). In the second quarter, SIG acquired approximately 5 million shares of Super Micro Computer (NASDAQ: SMCI), boosting its stake by 148%.

In this article, I will explore Supermicro’s role in the AI sector and highlight key factors to consider when investing in the company.

1. Analyzing Supermicro’s Financial Health

Supermicro is often associated with semiconductor giants like Nvidia and Advanced Micro Devices, but it’s important to clarify its true business model. While many investors mistakenly categorize Supermicro as a chip stock, it is primarily an IT infrastructure company that designs storage architectures specifically for Nvidia’s and AMD’s graphics processing units (GPUs).

This means that while demand in the chip market impacts Supermicro, it does not operate as a direct competitor in that space. Despite benefiting from growing AI market trends, the reality of Supermicro’s financials is quite sobering.

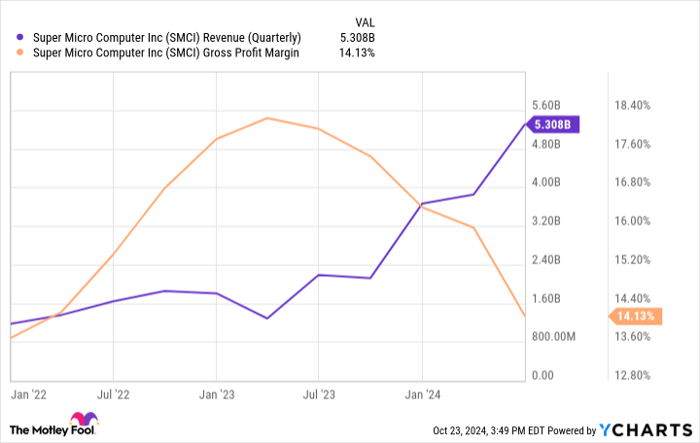

SMCI Revenue (Quarterly) data by YCharts

Supermicro’s gross profit margin has been declining, revealing concerning trends despite revenue growth. Management indicates that these challenges may be temporary, yet IT infrastructure tends to have lower profit margins, a reality that investors should consider.

2. Navigating a Competitive Market

While Supermicro has established partnerships with leading GPU manufacturers, its relationships are not exclusive, placing it in a competitive industry filled with notable rivals.

Supermicro faces stiff competition from larger companies like Dell Technologies, Hewlett Packard Enterprise, Lenovo, and Cisco. These competitors are well-established, making the market landscape challenging for Supermicro.

In a sector where numerous players offer similar solutions, price competition becomes inevitable. Although management projects increases in operating profits, questions remain regarding the sustainability of these profits in the face of fierce competition.

Image source: Getty Images.

3. The Impact of Short-Selling Concerns

Potential investors should pay attention to allegations raised against Supermicro by Hindenburg Research, a short-selling firm that benefits from declines in stock prices.

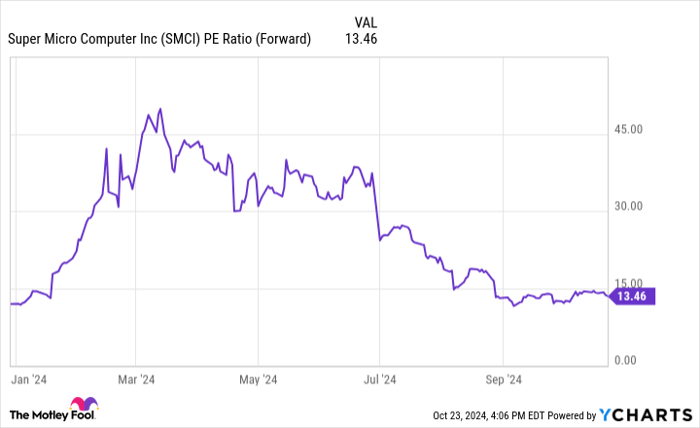

SMCI data by YCharts

Following Hindenburg’s report on August 27, Supermicro’s stock fell by 16%. The firm suggests that Supermicro’s financial controls may be flawed, resulting in mistrust among investors. Adding to the worries, a Wall Street Journal report indicates that the U.S. Department of Justice is reviewing Hindenburg’s claims.

However, it’s important to note that no substantial evidence has emerged from these allegations yet, suggesting that the sell-off may be driven more by fear than confirmed issues.

Concluding Thoughts

Currently, Supermicro trades at a forward price-to-earnings (P/E) ratio of about 13.5. As illustrated below, its valuation multiples have seen a decline as apprehensions regarding its future grow.

SMCI PE Ratio (Forward) data by YCharts

Though the current climate may prompt some investors to panic, Supermicro remains a vital player in IT infrastructure. With Nvidia’s upcoming Blackwell GPU architecture launch, coupled with the increasing investment in AI infrastructure, I believe Supermicro is positioned for long-term relevance.

While risks are present, the recent valuation decline may offer a unique chance to acquire shares of a potentially strong growth stock.

Seize the Opportunity for Strategic Investment

Have you ever wished you seized the moment to invest in top-performing stocks? If so, this is a critical time to consider your options.

Our expert analysts occasionally release a “Double Down” stock recommendation for companies they predict will see significant gains. If you think you’ve already missed your investing opportunity, now may be the optimal time to buy in before prices rise. The past performance of these recommendations speaks volumes:

- Amazon: A $1,000 investment in 2010 would have grown to $21,154!*

- Apple: A $1,000 investment in 2008 would be worth $43,777!*

- Netflix: A $1,000 investment in 2004 would have skyrocketed to $406,992!*

We are currently providing “Double Down” alerts for three outstanding companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Adam Spatacco owns shares in Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Cisco Systems, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.