Jefferies Sees Potential in PG&E: Analyst Coverage Initiated with Buy Rating

Analyst’s Price Target Indicates Positive Outlook

On October 14, 2024, Jefferies began covering PG&E (LSE:0QR3) with a Buy recommendation. The average one-year price target for PG&E stands at 22.44 GBX/share as of September 25, 2024, suggesting a possible rise of 14.57% from its latest closing price of 19.59 GBX/share. The forecasted prices vary, with a low of 16.91 GBX and a high of 27.23 GBX.

Projected Revenue and Earnings Outlook

PG&E is expected to generate an annual revenue of 24,285MM, reflecting a slight decline of 1.98%. Furthermore, the estimated annual non-GAAP EPS is projected at 1.36.

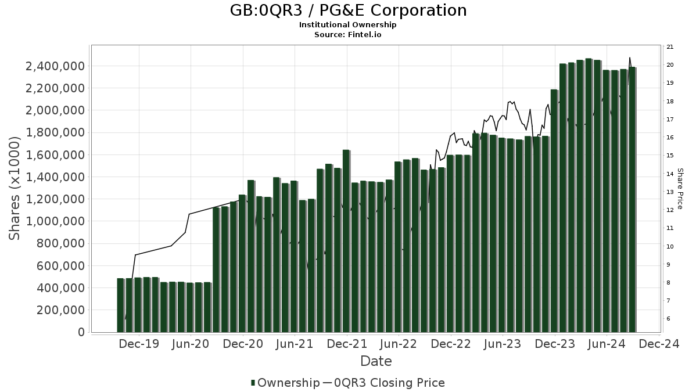

Institutional Ownership Trends

A total of 1,440 funds or institutions currently hold shares in PG&E, marking an increase of seven owners (0.49%) from the previous quarter. The average investment by these funds in PG&E stands at 0.48%, which is up by 5.37%. Over the last three months, institutional ownership rose by 1.91%, totaling 2,392,237K shares.

Key Shareholders Expanding Their Stakes

JP Morgan Chase now owns 129,795K shares, equating to 6.07% of the company. This represents a 2.83% increase from their previous holding of 126,127K shares. JP Morgan also expanded its portfolio allocation in PG&E by 4.11% this past quarter.

Capital International Investors holds 125,643K shares (5.88% ownership), up from 121,160K shares, reflecting a 3.57% increase. Their portfolio allocation for PG&E also rose by 9.85% over the last quarter.

Massachusetts Financial Services has increased its holdings to 101,910K shares (4.77% ownership), up by 14.72% from 86,912K shares. However, this firm cut its portfolio allocation in PG&E by 80.71% in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares hold 82,702K shares (3.87% ownership), slightly up from 82,224K shares (a 0.58% increase). They have also increased their allocation in PG&E by 1.89% recently.

Similarly, the Vanguard Mid-Cap Index Fund Investor Shares possess 56,014K shares, which is 2.62% of the company. This marks a minor decrease from 56,738K shares, yet their portfolio allocation increased by 6.17% over the past quarter.

Fintel stands as a leading platform for investment research, catering to individual investors, traders, financial advisors, and small hedge funds. Our extensive data suite includes fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, and more. Our stock picks benefit from advanced, backtested quantitative models for better profit potential.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.