Jefferies Upgrades Ecolab’s Outlook: A Buy Recommendation

Fintel reports that on October 18, 2024, Jefferies changed their rating for Ecolab (LSE:0IFA) from Hold to Buy.

Analyst Price Forecast Indicates Modest Growth

On September 25, 2024, the average one-year price target for Ecolab stood at 262.14 GBX/share. Projections range from a low of 201.98 GBX up to a high of 321.27 GBX. This average target signifies a potential increase of 1.76% from the most recent closing price of 257.60 GBX/share.

For further insights, check out our leaderboard of companies projected for the highest price target upside.

Projected Revenue and Earnings Growth

Ecolab’s expected annual revenue is projected at 16,077MM, reflecting an increase of 2.83%. The anticipated annual non-GAAP EPS is 5.85.

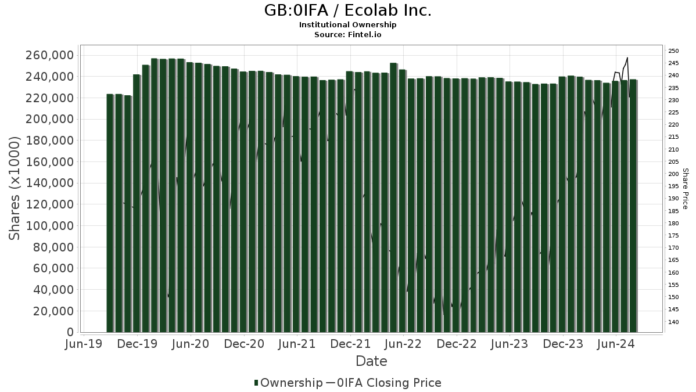

Fund Sentiment Shifts

Currently, 2,301 funds or institutions are reporting positions in Ecolab, marking an increase of 75 owners, or 3.37%, in the last quarter. The average portfolio weight for all funds invested in 0IFA is now 0.39%, up by 2.25%. Over the past three months, total shares held by institutions grew by 3.34% to 238,060K shares.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, which holds 8,123K shares (2.85% of ownership), reported an increase from 8,074K shares, or a growth of 0.61%. The fund raised its allocation to 0IFA by 0.85% lastly.

VFINX – Vanguard 500 Index Fund Investor Shares owns 6,523K shares (2.29% ownership) and increased from 6,395K shares, showing a rise of 1.96%. However, the firm decreased its 0IFA allocation by 0.48% in the last quarter.

Wellington Management Group Llp decreased its holdings to 5,455K shares from 6,675K shares, reflecting a drop of 22.35%, with a corresponding decline in allocation by 15.12% in 0IFA.

The Bill & Melinda Gates Foundation Trust maintains its position with 5,218K shares (1.83% ownership), unchanged in the last quarter.

Geode Capital Management increased its shares to 5,114K, up from 4,979K, representing a 2.64% growth, and raised its 0IFA allocation by 0.45% recently.

Fintel stands as one of the most comprehensive investing research platforms tailored for individual investors, traders, financial advisors, and small hedge funds.

Our platform features global data, including fundamental insights, analyst reports, ownership trends, fund sentiment, and more. Unique stock picks are derived from advanced, backtested quantitative models to maximize profit potential.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.