Jefferies Gives Brookdale Senior Living Inc. a Boost with New Buy Rating

Analysts Predict Significant Growth Potential

Fintel reports that on October 16, 2024, Jefferies initiated coverage of Brookdale Senior Living Inc. – Preferred Security (NYSE:BKDT) with a Buy recommendation.

Analyst Price Forecast Points to Large Upside

As of September 25, 2024, analysts project an average one-year price target of $105.12 per share for Brookdale Senior Living Inc. – Preferred Security. Forecasts vary from a low of $81.24 to a high of $126.69, indicating a potential increase of ∞% from its most recent closing price of $0.00 per share.

Revenue Growth and Earnings Expectations

The anticipated annual revenue for Brookdale Senior Living Inc. – Preferred Security is $3,226 million, representing a growth rate of 10.42%. However, the projected annual non-GAAP EPS stands at -0.91.

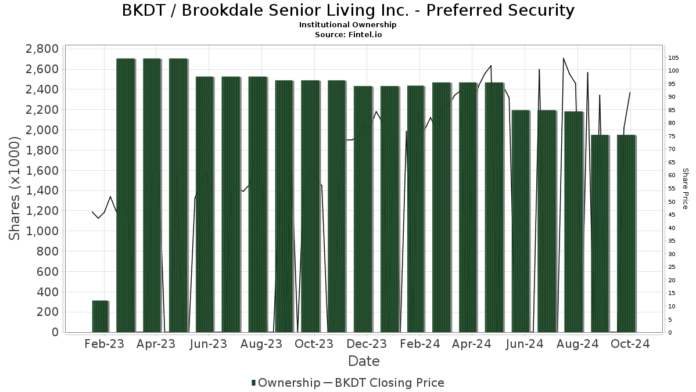

Institutional Ownership Trends

What is Fund Sentiment?

Currently, 14 funds and institutions hold positions in Brookdale Senior Living Inc. – Preferred Security, reflecting a decrease of one owner (or 6.67%) in the past quarter. The average portfolio weight of all funds invested in BKDT is 0.43%, which has risen by 34.65%. However, institutional ownership has decreased by 11.09% over the last three months, totaling 1,952,000 shares.

Flat Footed holds 336K shares, showing no change from the last quarter.

Two Sigma Investments has maintained 254K shares, with no change noted.

Camber Capital Management reports owning 250K shares, unchanged in the last quarter.

D. E. Shaw has increased its holdings from 205K shares to 205K shares, marking a slight increase of 0.15% and a boosted portfolio allocation in BKDT by 11.86% over the previous quarter.

BLACKROCK LARGE CAP SERIES FUNDS, INC. – BlackRock Event Driven Equity Fund Investor A has retained 167K shares, without any changes in the last quarter.

Fintel is a comprehensive research platform for individual investors, traders, financial advisors, and small hedge funds, offering insights across global markets.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.