Exxon Mobil’s Earnings Anticipation Amid Shifts in Oil Market

Analysts Predict a Dip in Q3 Profits as Exxon Mobil Prepares for Earnings Call

Exxon Mobil Corporation (XOM), headquartered in Spring, Texas, is engaged in the exploration and production of crude oil and natural gas. With a market capitalization of $487.4 billion, the company provides integrated solutions including fuels, lubricants, chemicals, and refined products for various industries, all while focusing on reducing greenhouse gas emissions. Investors are keenly awaiting the company’s fiscal third-quarter earnings announcement, scheduled for Friday, Nov. 1, before the market opens.

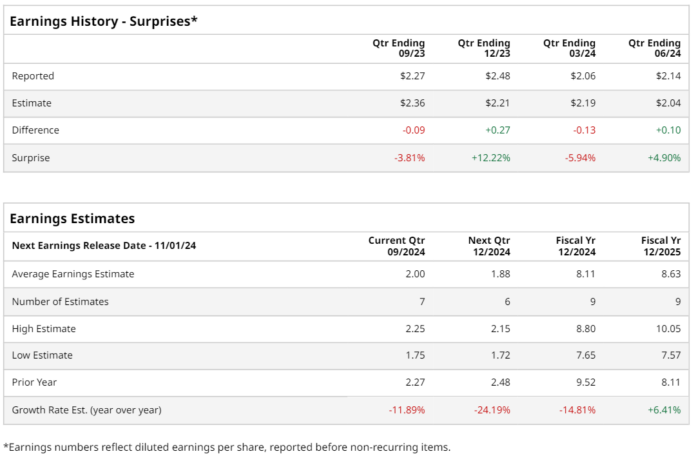

Analysts are projecting a profit of $2 per share on a diluted basis for XOM, a decrease of 11.9% from the previous year’s $2.27 per share. In the last four quarters, Exxon Mobil has managed to exceed consensus estimates twice and fell short on two occasions.

Looking ahead to the fiscal year, analysts expect XOM to report earnings per share (EPS) of $8.11, which is a decline of 14.8% from the $9.52 reported in 2023. However, there is a positive outlook for fiscal 2025, with expectations for EPS to climb to $8.63, marking a 6.4% year-over-year increase.

Year-to-date, Exxon Mobil’s stock has surged by 24.1%, outperforming the S&P 500’s gains of 22.9%. The company also surpassed the Energy Select Sector SPDR Fund’s (XLE) 10.7% rise within the same period.

Exxon’s robust performance can be attributed to significant achievements in rig productivity within the Permian Basin and its advantageous positioning near Gulf Coast refineries and export terminals. Since 2019, the company has doubled its production output and is committed to investing in efficient operations to enhance both production rates and profitability. Additionally, the company’s recent acquisition of Pioneer Natural Resources underscores its strategic intent to strengthen its foothold in vital areas. With a backlog of lucrative projects underway in the Permian Basin and offshore Guyana, Exxon Mobil is poised for continued growth in the coming years.

On Aug. 2, XOM disclosed its Q2 earnings, resulting in a slight decline in its stock price. The reported EPS was $2.14, surpassing Wall Street’s expectation of $2.01, while its revenue reached $93.1 billion, exceeding forecasts of $91 billion.

The consensus among analysts regarding XOM stock leans positively, reflecting a “Moderate Buy” rating overall. Out of 22 analysts reporting on the stock, 13 recommend a “Strong Buy,” eight suggest a “Hold,” and one advises a “Strong Sell.” The average target price set by analysts for XOM stands at $130.09, hinting at a potential upside of 4.8% from its current price level.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data are intended solely for informational purposes. For more information, please review the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.