Understanding Plug Power’s Financial Landscape: A Deep Dive

Plug Power (NASDAQ: PLUG) has had a tumultuous history as a stock. Since its inception, shares of this hydrogen fuel cell systems developer have periodically skyrocketed, only to see investors face significant losses in other years. This company’s journey highlights the unpredictable nature of a boom-or-bust business model.

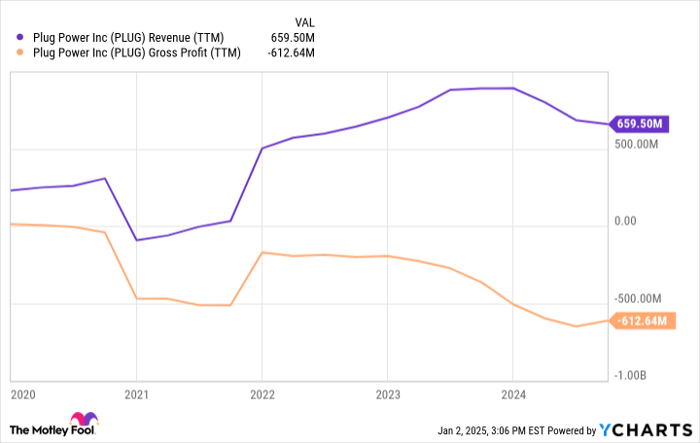

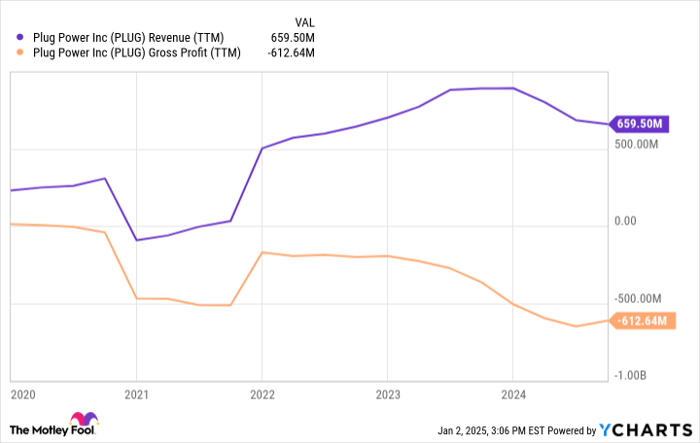

Notably, Plug Power’s revenue has surged by 186% since 2020. This remarkable growth has led to optimism among investors. However, there is another crucial number that should capture everyone’s attention.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Key Metrics for Plug Power’s Current Stock Performance

In recent years, Plug Power has demonstrated significant sales growth, with figures rising close to 200% since 2000. However, the company’s revenue over the last 12 months landed around $660 million, which remains substantial given its $2.1 billion valuation. The company operates within a potentially massive growth sector: hydrogen as a fuel source, which could dominate the energy landscape for decades.

Although the revenue figures appear promising, investors must also consider other vital financial aspects.

PLUG Revenue (TTM) data by YCharts

Despite the impressive revenue growth since 2020, Plug Power is experiencing its highest financial losses yet. In the past year alone, the company faced a gross loss of around $600 million, nearly equal to its total revenue. This raises the critical question: why hasn’t profitability accompanied revenue growth? Understanding Plug Power’s business model offers some clarity.

Plug Power designs and produces equipment facilitating hydrogen fuel usage, a clean energy source that could eventually replace more polluting alternatives in difficult-to-transition sectors like transportation, aviation, and cement production.

The challenge lies in the high costs associated with developing necessary infrastructure. Currently, hydrogen technology struggles to compete financially in many areas. As a result, Plug Power relies heavily on small pilot projects and significant government subsidies to stay afloat. For long-term success, the company must prioritize achieving profitability, making gross profit margins a more important metric to track than revenue alone.

Is Plug Power a Smart Investment Choice Today?

Before considering an investment in Plug Power, keep the following in mind:

The Motley Fool Stock Advisor analysts recently highlighted other companies they consider the 10 best stocks to invest in currently, and Plug Power was notably absent from that list. The selected stocks are projected to yield substantial returns in upcoming years.

For instance, when Nvidia was included in this list on April 15, 2005, a $1,000 investment at that time would have grown to $885,388!*

Stock Advisor provides investors with a straightforward roadmap for success, offering portfolio-building advice, regular updates from their analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has delivered more than four times the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.