Keybanc Lowers Apple Stock Rating Amid Growing Fund Activity

Fintel reports that on October 25, 2024, Keybanc downgraded their outlook for Apple (SNSE:AAPLCL) from Sector Weight to Underweight.

Fund Sentiment: A Snapshot

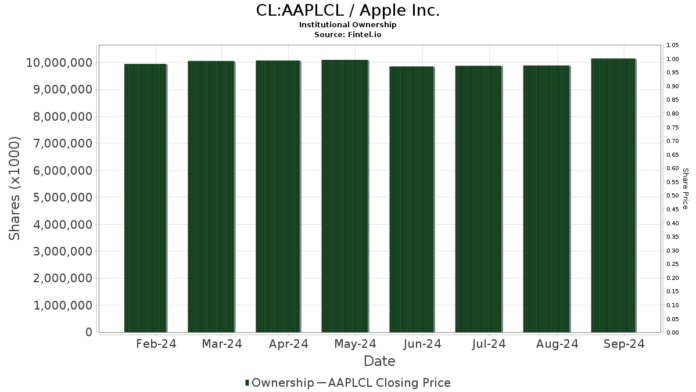

Currently, 7,110 funds or institutions hold positions in Apple, marking an increase of 201 owners (2.91%) from last quarter. The average portfolio weight dedicated to AAPLCL across all funds is 3.62%, which is up by 13.96%. Institutional ownership rose by 6.45% over the past three months, totaling 10,272,177K shares.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 460,208K shares, translating to 3.03% ownership of Apple. This represents a slight decrease of 0.20% from the previous filing, even though they increased their portfolio allocation in AAPLCL by 19.20% last quarter.

Berkshire Hathaway’s position shrank significantly, holding 400,000K shares (2.63% ownership), down from 789,368K shares for a staggering decrease of 97.34%. Their portfolio allocation in AAPLCL was reduced by 26.26% last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) increased its holdings from 365,796K shares to 369,946K shares, amounting to 2.43% ownership. This demonstrates an increase of 1.12%, coupled with a portfolio allocation rise of 17.59% from the last filing.

Geode Capital Management also saw its holdings rise, increasing from 307,721K shares to 313,374K shares, indicating 2.06% ownership and a gain of 1.80%. Their portfolio allocation in AAPLCL increased by 18.67% over the last quarter.

Price T Rowe Associates holds 228,489K shares, representing 1.50% ownership. They reported an increase from 206,972K shares, equating to a 9.42% rise, with their portfolio allocation in AAPLCL jumping by 32.38% during the same period.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, including fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, unusual options trades, and more. Furthermore, our exclusive stock picks are derived from advanced, backtested quantitative models aimed at improving investment returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.