Tesla’s Stock Outlook Upgraded to Outperform by KGI Securities

Analysts Predict Possible Price Drop Despite Positive Upgrade

Fintel reports that on October 24, 2024, KGI Securities upgraded their outlook for Tesla (NasdaqGS:TSLA) from Neutral to Outperform.

Analyst Price Forecast Suggests 17.66% Downside

As of October 22, 2024, the average one-year price target for Tesla is $214.48/share. The forecasts range from a low of $25.11 to a high of $325.50. This average price target represents a decrease of 17.66% from its latest reported closing price of $260.48/share.

Institutional Investors Show Increased Interest

The projected annual revenue for Tesla is $152,227MM, reflecting a significant increase of 56.69%. Additionally, the projected annual non-GAAP EPS is 7.07.

What is the Fund Sentiment?

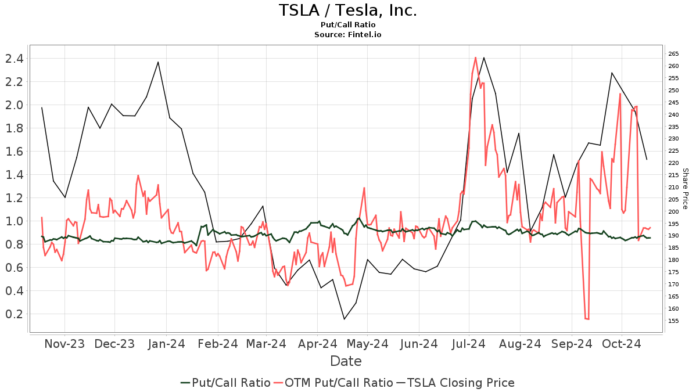

Currently, there are 4,286 funds or institutions reporting positions in Tesla. This number has increased by 79 (or 1.88%) in the last quarter. The average portfolio weight of all funds dedicated to TSLA is 0.88%, representing an increase of 8.07%. Moreover, total shares owned by institutions rose by 6.82% in the last three months, amounting to 1,621,591K shares.  The put/call ratio for TSLA stands at 0.88, indicating a bullish sentiment among traders.

The put/call ratio for TSLA stands at 0.88, indicating a bullish sentiment among traders.

Institutional Movements and Portfolio Adjustments

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 85,652K shares, representing 2.68% ownership of the company. Previously, the fund reported owning 85,113K shares, marking an increase of 0.63%. Over the last quarter, this fund boosted its portfolio allocation in TSLA by 10.16%.

The VFINX – Vanguard 500 Index Fund Investor Shares owns 71,212K shares, accounting for 2.23% of the company. Its prior filing showed ownership of 69,825K shares, indicating a 1.95% increase. The firm also increased its TSLA holdings by 8.68% in the last quarter.

Geode Capital Management holds 58,334K shares for 1.83% ownership, enhancing its position from 56,909K shares with a 2.44% rise. This firm increased its TSLA portfolio allocation by 9.45% last quarter.

Capital World Investors possesses 42,709K shares, or 1.34% ownership, rising from 39,096K shares, which reflects an 8.46% increase. Their portfolio allocation in TSLA grew by 21.16% last quarter.

Invesco QQQ Trust, Series 1, holds 35,997K shares, representing 1.13% ownership, which is an increase from 34,985K shares, reflecting a 2.81% rise. This firm increased its TSLA allocation by 4.26% recently.

The Story Behind Tesla

Tesla Background Information

(Description provided by the company.)

Tesla’s mission is to accelerate the world’s transition to sustainable energy. Founded in 2003, Tesla has set industry standards by developing high-performance electric vehicles with zero tailpipe emissions. The company’s flagship model, the Model S, along with the Model X and the more accessible Model 3, positions Tesla as a leader in the electric vehicle market. Furthermore, with the establishment of Gigafactories and the acquisition of SolarCity, Tesla now offers a range of energy products, including solar, storage, and grid services. By integrating these technologies, Tesla is leading the charge toward sustainable energy solutions on a larger scale.

Fintel provides comprehensive investment research resources for individual investors, traders, financial advisors, and small hedge funds.

They offer a wide array of data, including fundamentals, analyst reports, ownership statistics, and options sentiment.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.