Tesla Stock Upgrade Signals Growing Investor Confidence

On October 24, 2024, KGI Securities raised its outlook for Tesla (SNSE:TSLACL) from Neutral to Outperform.

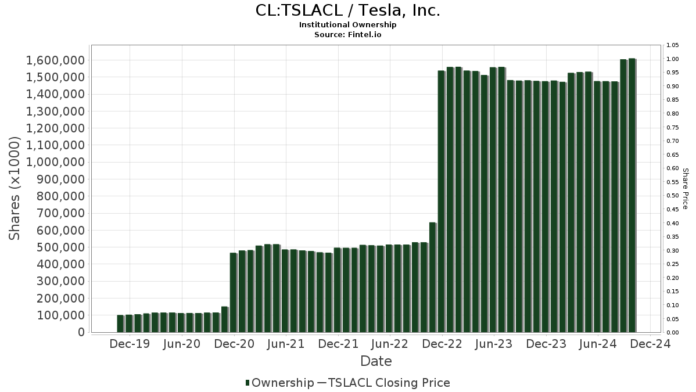

Increasing Fund Interest in Tesla

A total of 4,285 funds and institutions now hold positions in Tesla, marking an increase of 105 owners, or 2.51%, over the last quarter. The average portfolio weight for all funds investing in TSLACL has grown to 0.88%, reflecting a rise of 7.18%. Over the past three months, institutional ownership of Tesla has also expanded by 9.81%, bringing total shares owned to 1,621,591K.

Among the significant shareholders, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 85,652K shares, which represents 2.68% of Tesla. This is an increase from 85,113K shares in its previous filing, reflecting a growth of 0.63%. The firm also boosted its portfolio allocation in TSLACL by 10.16% last quarter.

Meanwhile, VFINX – Vanguard 500 Index Fund Investor Shares owns 71,212K shares, holding 2.23% ownership in the company. This is up from 69,825K shares previously, an increase of 1.95%. Their portfolio allocation in TSLACL rose by 8.68% over the last quarter.

Geode Capital Management’s holding increased as well; they now own 58,334K shares, which equates to 1.83% of Tesla. Previously, they reported owning 56,909K shares, showcasing a growth of 2.44%. An adjustment of 9.45% in their portfolio allocation in TSLACL was noted last quarter.

Additionally, Capital World Investors increased its holdings to 42,709K shares, or 1.34% ownership, from a previous 39,096K shares, indicating a rise of 8.46%. Their portfolio allocation in TSLACL was raised dramatically by 21.16% in the last quarter.

Lastly, Invesco QQQ Trust, Series 1 now holds 35,997K shares, representing 1.13% of Tesla. This is an increase from the prior 34,985K shares, marking a growth of 2.81%. Their portfolio allocation in TSLACL grew by 4.26% in the last quarter.

Fintel provides comprehensive investment research for individual investors, traders, financial advisors, and small hedge funds.

The platform’s data encompass global fundamentals, analyst reports, ownership insights, fund sentiment, and more. Advanced quantitative models enhance their exclusive stock picks for improved profitability.

For more information, click to learn more.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.