L3Harris Introduces Diamondback: A New Era for Autonomous Vehicles

L3Harris Technologies, Inc. LHX has launched a new autonomous reconnaissance and security vehicle named Diamondback at the Association of the United States Army’s annual convention. This introduction is set to enhance LHX’s position in the rapidly growing unmanned ground vehicle (UGV) market.

Overview of Diamondback

Diamondback is designed to adapt to various missions, offering a technological edge in the face of potential threats. Its flexible development approach promises to accelerate production, reduce costs, and improve maintainability, allowing for quick adjustments in technology for mission requirements.

This vehicle boasts impressive mobility, autonomous capabilities, and mission-specific modular payloads, enabling it to conduct initial contact without risking human lives. It aims to complement existing robotic vehicles while addressing the roles and expenses tied to manned operations.

Created to operate autonomously, Diamondback minimizes the need for direct control, enhancing overall mission effectiveness.

Growth Potential for LHX

The demand for autonomous systems in both defense and commercial sectors is soaring, which is driving the need for UGVs. Significant technological advancements have broadened the operational scope for UGVs, including their use in disaster rescue missions. This trend has led Mordor Intelligence to project a compound annual growth rate (CAGR) of 9.8% for the global UGV market from 2024 to 2029.

L3Harris stands to benefit from this growing market. In addition to Diamondback, the company’s T4 unmanned ground vehicle is notable for its exceptional mobility and all-terrain performance, positioning it as a reliable option for various tasks.

Market Opportunities for Competitors

The expanding UGV sector presents opportunities for other defense giants, including Northrop Grumman NOC, BAE Systems BAESY, and Teledyne Technologies, Inc. TDY, all of whom have made significant strides in this area.

Northrop Grumman’s Andros FX is a nimble UGV specifically engineered to tackle a range of threats, from explosive devices to various operational challenges. It features advanced system electronics, improved mobility for better speed and maneuverability, and a modern touchscreen interface with 3D graphics for easier control.

Northrop Grumman has an expected long-term earnings growth rate of 8.7%. The Zacks Consensus Estimate projects a 5.4% increase in NOC’s 2024 sales compared to the previous year.

BAE Systems has introduced Ironclad, a UGV that operates on high-endurance batteries for near-silent operation over a distance of 50 kilometers. It features a modular connection system that allows two vehicles to share the load, including specialized equipment. Its design fortifies it against explosions and bullets, enhancing its survivability in missions.

BAE Systems is looking at a long-term earnings growth rate of 12.4%, with sales in 2024 expected to improve by 37.4% from last year, according to the Zacks Consensus Estimate.

Teledyne’s SUGV 325 delivers superior mobility in portable robotics, designed to meet today’s challenges. Its lightest version weighs just 9.1 kilograms, making it easy for a single operator to transport over difficult terrain.

Teledyne’s long-term earnings growth rate stands at 7.3%, having achieved an average earnings surprise of 3.47% across the last four quarters.

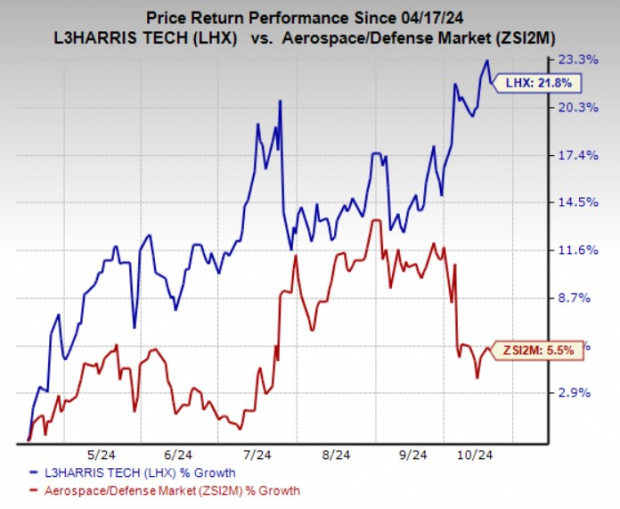

Stock Performance of LHX

Over the past six months, shares of L3Harris have appreciated by 21.8%, significantly outperforming the industry average growth of 5.5%.

Image Source: Zacks Investment Research

LHX’s Current Standing

L3Harris holds a Zacks Rank of #3 (Hold). For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks Identifies Top Semiconductor Stock

This company’s stock is only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, this new leading chip stock has significant growth potential.

With robust earnings growth and a growing customer base, this company is well-positioned to meet the rising demands in Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

To explore this stock further for free, click here >>

For the latest insights from Zacks Investment Research, you can download “5 Stocks Set to Double” for free.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

BAE Systems PLC (BAESY): Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

L3Harris Technologies Inc (LHX): Free Stock Analysis Report

To view the original article on Zacks.com, click here.

Zacks Investment Research

The views expressed here are those of the author and do not reflect the views of Nasdaq, Inc.