Analysts Adjust Rating for Edison International Amid Mixed Fund Sentiment

On November 1, 2024, Ladenburg Thalmann revised their outlook for Edison International (LSE:0IFJ), changing it from Neutral to Sell.

Analyst Predictions Indicate Potential Price Growth

As of October 22, 2024, the average one-year price target for Edison International is set at 90.82 GBX/share. Forecasts vary with a low of 72.46 GBX and a high of 104.63 GBX. This average suggests a 20.65% increase from its latest closing price of 75.28 GBX/share.

Check out our leaderboard highlighting companies with the greatest price target upside.

Revenue and Earnings Projections

Projected annual revenue for Edison International stands at 17,822MM, reflecting a 2.89% increase. The expected annual non-GAAP EPS is 5.16.

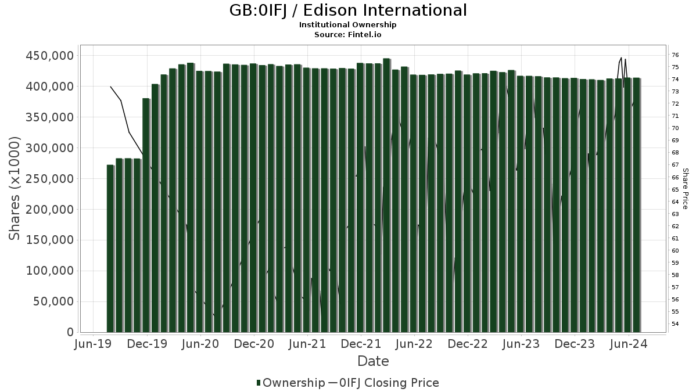

Understanding Institutional Sentiment

Currently, 1,632 funds or institutions report positions in Edison International, marking an increase of 44 owners, or 2.77%, over the last quarter. The average portfolio weight of all funds dedicated to 0IFJ is 0.31%, a rise of 3.74%. Total shares owned by institutions grew by 0.67%, reaching 409,371K shares in the last three months.

Institutional Investors’ Holding Changes

Capital Research Global Investors retains 19,366K shares, accounting for 5.00% ownership of the company. This is a decline from 20,345K shares, indicating a 5.05% decrease in holdings. Their portfolio allocation in 0IFJ decreased by 6.27% over the past quarter.

Pzena Investment Management has reduced their holdings as well, currently owning 12,875K shares, which is 3.33% of the company. Previous reports showed 13,605K shares, a drop of 5.67%. Their allocation decreased by 1.59% this quarter.

The Vanguard Total Stock Market Index Fund Investor Shares owns 12,092K shares, translating to 3.12% ownership. Their previous figure was 12,061K shares, indicating a slight 0.25% increase but a 1.02% reduction in portfolio allocation over the last quarter.

Meanwhile, Vanguard 500 Index Fund Investor Shares holds 9,876K shares or 2.55%. This is an increase from 9,666K shares, reflecting a rise of 2.12%, though the allocation in 0IFJ decreased by 1.81%.

Geode Capital Management currently owns 9,410K shares, which is 2.43% ownership. They previously reported 9,169K shares, showing a 2.56% increase, but their allocation in 0IFJ dropped significantly by 48.37% last quarter.

Fintel offers an extensive investing research platform suited for individual investors, traders, financial advisors, and small hedge funds.

The platform provides a comprehensive range of data, including fundamentals, analyst reports, ownership data, as well as fund and options sentiment. Additionally, it offers exclusive stock picks through advanced, backtested quantitative models designed to improve profit potential.

Click to Learn More

This article originally published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.