Zuora’s Stock Rating Adjusted as Institutional Interest Shifts

Fintel reports that on October 18, 2024, Lake Street downgraded their outlook for Zuora (LSE:0XL5) from Buy to Hold.

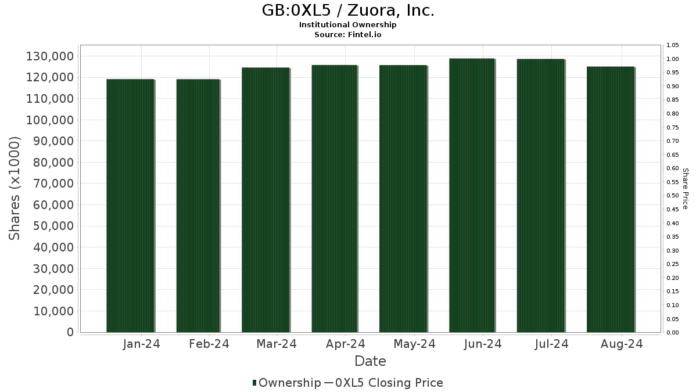

Fund Sentiment on the Rise

Currently, 403 funds and institutions have reported holdings in Zuora, an increase of 21 owners, or 5.50%, over the last quarter. The average portfolio weight allocated to 0XL5 is now 0.58%, showing a significant increase of 15.04%. Additionally, the total number of shares owned by these institutions rose by 4.40% in the past three months, totaling 133,369K shares.

Bank of New York Mellon reported holding 6,555K shares, which accounts for 4.58% of Zuora. This represents a decrease from 7,140K shares previously, reflecting an 8.92% drop and a 1.33% decrease in portfolio allocation for 0XL5 during the last quarter.

On the other hand, Scalar Gauge Management has increased its position, now holding 5,091K shares, or 3.56% ownership. This is up from 3,759K shares, noting a 26.17% increase and an 11.43% rise in their portfolio allocation for 0XL5 over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares holds 4,343K shares, representing 3.04% of the company. This is an increase from 3,995K shares, reflecting an 8.03% rise and a 15.12% increase in their portfolio allocation for 0XL5.

Solel Partners also increased its holdings, now owning 4,058K shares, or 2.84%. This is an increase from 3,575K shares, showing an 11.91% growth and a 21.53% rise in portfolio allocation for 0XL5 over the last quarter.

The Manufacturers Life Insurance Company holds 3,463K shares, representing 2.42% ownership, down from 3,511K previously, which constitutes a 1.38% decrease. However, their portfolio allocation for 0XL5 still increased by 8.24% during the same period.

Fintel is recognized as a leading investment research platform for individual investors, traders, financial advisors, and smaller hedge funds. Our robust data encompasses global market fundamentals, analyst reports, ownership data, fund sentiment, and much more, supported by advanced quantitative models for improved investment results.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.