Leidos Holdings Set to Report Q3 Earnings, Analysts Predict Mixed Results

What to Expect from Leidos’ Upcoming Financial Report

Reston, Virginia-based Leidos Holdings, Inc. (LDOS) provides a variety of services in markets such as defense, intelligence, engineering, civil, and health. With a market capitalization of $22.8 billion, the company specializes in scientific, engineering, systems integration, and technical services. Investors are keenly awaiting the announcement of its fiscal third-quarter earnings for 2024, set to occur after the market closes on Tuesday, Oct. 29.

Analysts Forecast Earnings Decline

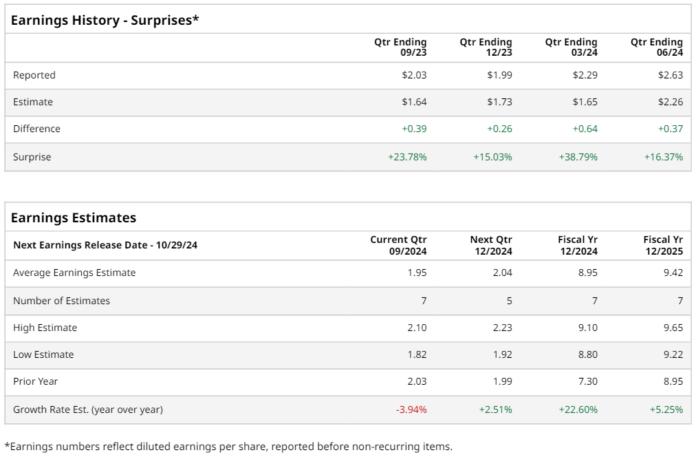

Analysts anticipate that LDOS will report earnings per share (EPS) of $1.95, which represents a decrease of 3.9% compared to the $2.03 per share reported in the same quarter last year. Notably, the company has a history of exceeding Wall Street’s EPS expectations in its recent quarterly results.

Full-Year and Future EPS Predictions

For the entire fiscal year, forecasts suggest an EPS of $8.95 for LDOS, reflecting an increase of 22.6% from the $7.30 reported in fiscal 2023. Looking ahead, the EPS is expected to grow by 5.3% to reach $9.42 in fiscal 2025.

Stock Performance: An Impressive Surge

Over the past 52 weeks, LDOS stock has significantly outperformed the S&P 500, which gained 34.4%. LDOS shares increased by an impressive 76.7% during the same period and also surpassed the Technology Select Sector SPDR Fund’s (XLK) gains of 35.6%.

Factors Behind Strong Performance

The company’s success can be attributed to its leading role as a defense contractor in the U.S. It benefits from a continuous stream of contracts for its defense products and enjoys a strong financial position. A diverse array of cost-effective defense solutions—ranging from technology-enabled services to advanced defense systems—ensures a healthy order backlog. Additionally, increased global defense spending enhances demand for its offerings, allowing for ongoing investment in research and development.

Recent Quarterly Results and Analyst Sentiment

On July 30, LDOS shares dropped more than 4% following the release of its Q2 results. The adjusted EPS of $2.63 surpassed Wall Street’s expectations of $2.26, while revenue reached $4.1 billion—better than the forecasted $4 billion. The company projected full-year adjusted EPS between $8.60 and $9, with revenue estimates ranging from $16.1 billion to $16.4 billion.

Analysts Recommend LDOS Stock

The consensus among analysts is a “Strong Buy” rating for LDOS stock. Of the 13 analysts covering it, 11 recommend a “Strong Buy,” while two suggest a “Hold.” The average price target for LDOS is set at $176.18, indicating a potential upside of 5.1% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.