Evaluating Lucid Group: Should You Buy, Sell, or Hold?

Lucid Group (NASDAQ: LCID) may not be the first name that comes to mind when discussing electric vehicles (EVs), with Tesla (NASDAQ: TSLA) usually taking that spot. Tesla’s influence pushed many major automakers to start producing EVs, leaving Lucid facing significant challenges, including its late entry into the market and serious financial hurdles. Investors remain uncertain about its stock potential as they weigh their options: buy, sell, or hold.

Reasons to Consider Selling Lucid Stock

Lucid has a market capitalization of $7.5 billion, which seems impressive but is dwarfed by Tesla’s staggering $707 billion. Although comparisons may not seem entirely fair given their different stages of development, Lucid must vie for customers against Tesla and numerous other automakers, as well as emerging competitors like Rivian (NASDAQ: RIVN). In 2024, Lucid aims to produce only about 9,000 vehicles, a figure that is negligible compared to Rivian’s production or Tesla’s impressive 410,000 vehicles made just in the third quarter alone.

Image source: Getty Images.

Financially, Lucid’s situation is troubling. In the second quarter, it reported a loss of $0.34 per share but noted it had $4.2 billion in liquidity. To bolster its finances, the company brought in an additional $1.5 billion in funding after the quarter ended. While this might seem reassuring, Lucid itself cautioned that this funding is only expected to last until at least the fourth quarter of 2025.

Investors must recognize that if Lucid fails to garner more funding, it could face cash flow issues in the near future. Given these factors, many financial advisors would recommend selling or avoiding this stock altogether unless one is a particularly risk-tolerant investor.

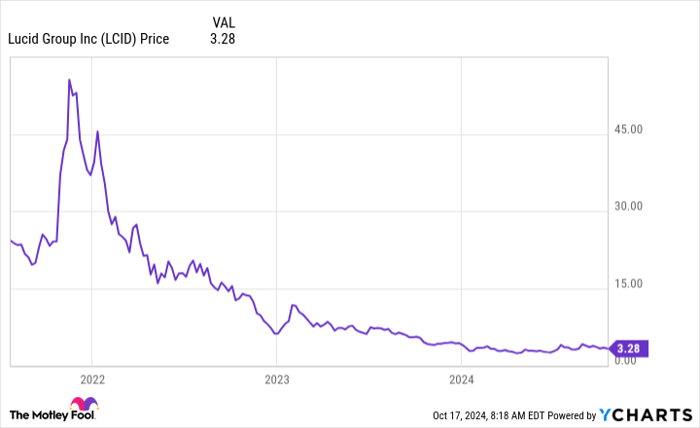

LCID data by YCharts

Considerations for Holding Lucid Stock

The chart illustrates a significant rise in Lucid’s stock price after its merger with a special purpose acquisition company (SPAC) in mid-2021. Back then, the EV market was thriving, but as interest shifted elsewhere, Lucid saw its value tumble nearly 90%. Those who bought at the peak now face substantial losses, making it challenging to decide whether to hold onto their shares.

If selling seems uncomfortable, especially after significant losses, staying in the game might appear easier. Yet, management’s warnings about liquidity concerns mean that investors should genuinely believe in Lucid’s long-term survival before holding on. Otherwise, they risk losing everything, as stock prices can, unfortunately, drop to zero.

Reasons to Consider Buying Lucid Stock

On the flip side, some investors might see opportunity after the considerable drop in Lucid’s stock price. They could argue that the risks of failure are already reflected in the current stock value. If Lucid succeeds in establishing its EV business, it could become a major player in the industry, potentially rivaling Tesla in the future.

Lucid has received several industry awards, reinforcing its position as a producer of highly regarded vehicles. The company boasts superior battery efficiency compared to its competitors, especially when considering costs. If it can convert its technological advancements into sales or collaborations with established automakers, a notable upside exists.

However, investing in Lucid is not for everyone. It calls for a positive outlook on the company’s future and a willingness to back that belief with sound reasoning and research into its technology and market position.

Lucid Presents a Challenging Investment

For most investors, Lucid is not an ideal stock. The company is currently losing money, lacks a solid cash runway, and faces competition from larger, established firms. While it has the potential to thrive, it could equally fail, following the fates of other small EV companies. A successful investment in Lucid requires a significant degree of optimism about its uncertain future.

Explore Potential Investment Opportunities

Do you feel like you’ve missed your chance to invest in top-performing stocks? There’s hope. Occasionally, expert analysts issue a “Double Down” stock recommendation for companies poised to appreciate significantly. If you think you’ve missed your moment to invest, now is a prudent time to consider before opportunity slips away. Historical performance shows:

- Amazon: A $1,000 investment in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment in 2008 would have grown to $44,456!*

- Netflix: An investment of $1,000 in 2004 would now be worth $411,959!*

Currently, we’re issuing “Double Down” alerts for three promising companies. Opportunities like this may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.