Netflix Soars on Strong Q3 Earnings: What Investors Need to Know

Netflix (NASDAQ: NFLX) has once again impressed investors. The video-streaming leader announced robust Q3 earnings, propelling its stock over 10% to reach all-time highs. As the company attracts more subscribers, it is broadening its offerings by diving into gaming, advertising, and live events.

Impressive Revenue Growth and Profit Margins

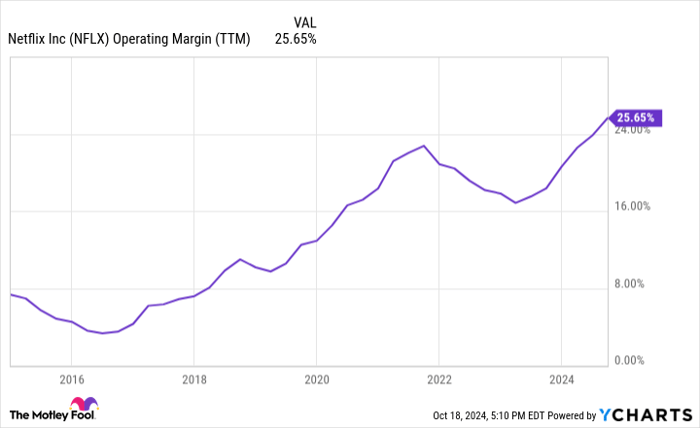

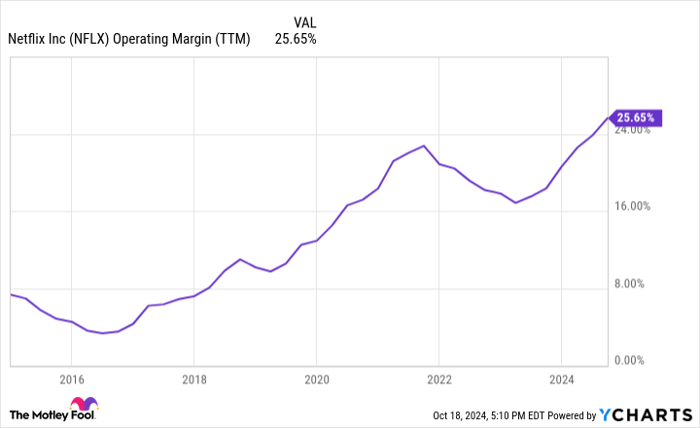

Let’s break down Netflix’s Q3 performance. The company achieved a 15% increase in revenue compared to last year, totaling $9.8 billion, along with an operating margin expansion from 22.4% to 30%. This reflects Netflix’s ability to grow revenue without significantly increasing content expenses. Additionally, free cash flow was a healthy over $2 billion during this period.

Other important figures are equally encouraging. Netflix added more than 5 million subscribers, making gains in all regions except Latin America, where subscriber growth remained flat due to recent price hikes. Notably, the average revenue per subscriber rose by 5% in North America, demonstrating Netflix’s strong pricing power.

Shifting Focus: From Subscribers to Viewing Time

A significant shift is coming for Netflix: starting in 2025, the company will stop disclosing its subscriber count. This decision means that investors will no longer receive specific subscriber data by region. Traditionally, this metric has significantly influenced stock market responses to earnings reports.

As Netflix matures, management believes that metrics like revenue, operating margin, and viewer engagement—measured by hours watched—are more relevant. Their goal is to prioritize increasing viewing time rather than simply boosting subscriber numbers.

NFLX Operating Margin (TTM) data by YCharts

Future Prospects for Netflix

This upcoming change might concern some investors, but it’s not necessarily a cause for alarm. The focus should remain on Netflix’s strategies to keep revenue climbing in the next five to ten years. The company has several innovative plans in place.

For one, Netflix is working on attracting more advertising-supported subscribers and enhancing its advertising revenue. Management reports that this revenue stream is doubling year over year and is expected to become a significant contributor to overall growth within two to three years.

Moreover, Netflix is entering the realm of live events, featuring items like boxing matches, NFL games on Christmas Day, and WWE events. The company is also investing in mobile gaming and other game formats to boost engagement on its platform.

With these efforts, the potential for increased viewer engagement translates into more revenue and profits for Netflix. This trajectory suggests continued growth, even as the company curtails detailed subscriber reporting each quarter.

Is Investing $1,000 in Netflix Worth It Now?

Before committing to Netflix stock, it’s wise to consider the following:

The Motley Fool Stock Advisor analysts recently pinpointed what they believe are the 10 best stocks for investment right now—and Netflix did not make the list. They believe these selected stocks could yield high returns in the years to come.

Consider this: when Nvidia was recommended on April 15, 2005, an investment of $1,000 would now be worth $845,679!*

Stock Advisor provides an easy-to-follow strategy for investors, including portfolio development guidance, regular updates from their analysts, and two new stock picks each month. Since 2002, Stock Advisor has significantly outperformed the S&P 500, returning more than four times its returns.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.