AI Growth Sparks Waves of Investment: Microsoft’s Strategy Amid Challenges

The artificial intelligence (AI) sector is experiencing a massive growth spurt, with projections suggesting it could exceed $1.8 trillion by the decade’s end, according to estimates from Grand View Research. This growth forecasts a compound annual growth rate of 36.6%. Such promising figures motivate tech companies to invest significantly in AI, despite the competitive landscape.

However, the challenges are evident. OpenAI, the creator behind ChatGPT, anticipates around $5 billion in losses this year, even while generating $3.7 billion in revenue. This stark reality highlights the difficulty of achieving profitability in the AI space, particularly in the short term.

Microsoft Steps Up with Significant AI Investments

Microsoft (NASDAQ: MSFT) is placing substantial bets on AI. The company has not only invested in OpenAI but is also focusing on integrating AI into its existing products and services. The impact these investments will have on Microsoft’s financial performance remains a topic of debate.

Microsoft’s Rising Capital Expenditures Highlight Growth Aspirations

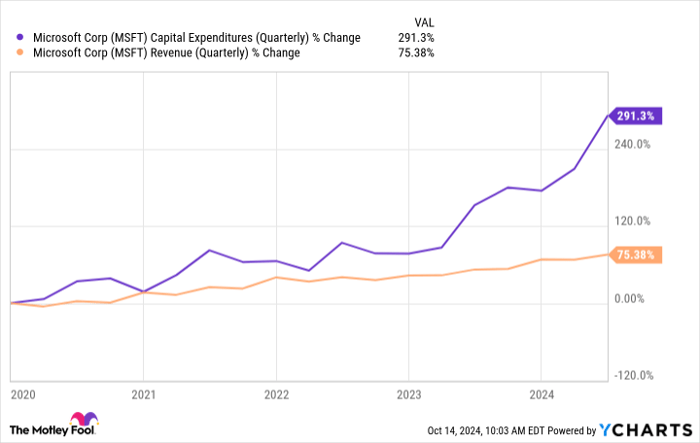

Capital expenditures, or capex, represent a company’s investment in acquiring or upgrading assets to foster future growth. Recently, Microsoft’s capital spending has surged faster than its revenue growth over the past five years.

MSFT Capital Expenditures (Quarterly) data by YCharts

This spending increase is not a cause for alarm; the aim is to capitalize on future revenue opportunities. The real test will be whether this spending translates into a significant growth uptick for Microsoft.

Investing in AI: Will It Pay Off?

While Microsoft possesses the financial strength to invest in AI, simply pouring money into this sector does not guarantee successful outcomes. The landscape is filled with AI products and services, and Microsoft must demonstrate that it offers superior solutions to ensure substantial revenue growth.

Salesforce CEO Marc Benioff has drawn an amusing parallel, likening Microsoft’s new Copilot AI to the unpopular Clippy from the past. Although Microsoft recently launched an updated Copilot, it needs to impress business users and justify its $30/month per user price tag for Microsoft 365 to make its AI investments worthwhile.

Is Microsoft Stock a Smart Buy?

This year, Microsoft’s stock has climbed a modest 12%, while the S&P 500 has surged 23%. Concerns about the stock’s valuation and the potential of AI to drive growth may be causing investor hesitation. Currently trading at 36 times earnings, Microsoft’s valuation is on the high end, with a market cap of $3.1 trillion making it one of the world’s most valuable companies.

Long-term investors willing to hold might still find Microsoft attractive. The company’s stronghold in office software, the popularity of its Windows operating system, and its ventures into gaming suggest continued resilience. Still, without robust growth, investors might be reluctant to pay a premium. Underperforming AI initiatives could amplify these concerns.

Ultimately, I believe Microsoft will navigate the learning curve surrounding its AI ventures. The company has the resources to experiment, and while initial setbacks may occur, its long-term prospects remain promising.

Seize a Second Chance at Investing Opportunities

Have you ever wished you could invest in top-performing stocks before they skyrocketed? Now might be your chance.

Our team of expert analysts has identified a select group of companies they believe are poised to experience significant growth. If you think you missed out before, this could be the perfect time to get involved, and the numbers are compelling:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

We are currently issuing “Double Down” alerts for three outstanding companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool is long on Microsoft and Salesforce. The Motley Fool recommends options such as long January 2026 $395 calls on Microsoft while shorting January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.