Energy Sector Struggles as Healthcare Stocks Exhibit Mixed Results

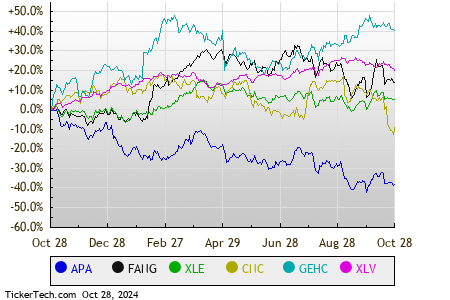

As midday trading unfolds on Monday, the Energy sector is facing challenges, showing a 0.9% decline. Major players in this sector, such as APA Corp (Symbol: APA) and Diamondback Energy, Inc. (Symbol: FANG), are lagging with losses of 3.4% and 2.9%, respectively. The Energy Select Sector SPDR ETF (Symbol: XLE), which tracks this sector, is down 0.7% today, though it has gained 8.92% year-to-date. In contrast, APA Corp has dropped 30.39% this year, whereas Diamondback Energy, Inc. has experienced a 20.26% year-to-date increase. Collectively, these two companies constitute about 3.1% of XLE’s holdings.

Healthcare Sector Shows Slight Gains Amid Declines in Key Stocks

The Healthcare sector follows closely with a marginal rise of 0.1%. However, significant stocks such as Centene Corp (Symbol: CNC) and GE HealthCare Technologies Inc (Symbol: GEHC) are struggling, reporting losses of 4.0% and 3.6%, respectively. The Health Care Select Sector SPDR ETF (XLV), which tracks this sector, is performing better, up 0.2% for the day and 10.36% year-to-date. Year-to-date, Centene Corp is down 16.91%, while GE HealthCare Technologies Inc is up 10.41%. Together, these two stocks represent about 1.3% of XLV’s underlying holdings.

For a clearer view, here is a comparative chart showcasing the stock price performance of these companies and ETFs over the last twelve months:

This afternoon, the overall performance of the S&P 500 sectors tells a notable story: while eight sectors are trending upward, the Energy sector remains the only one in the red.

| Sector | % Change |

|---|---|

| Financial | +1.0% |

| Materials | +1.0% |

| Services | +0.8% |

| Utilities | +0.8% |

| Consumer Products | +0.7% |

| Industrial | +0.6% |

| Technology & Communications | +0.3% |

| Healthcare | +0.1% |

| Energy | -0.9% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Mondelez International RSI

• LMCA Historical Stock Prices

• Top Ten Hedge Funds Holding AHPI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.