Streaming Content Stocks: A Deep Dive into Netflix and Roku

Discover 30 key investment themes with Zacks Thematic Screens, focusing on the sectors that intrigue you, from breakthrough technology to healthcare advancements.

If you’re interested in exploring these themes further, please click here for Zacks Investment Research’s Thematic Screens.

Now, let’s examine the ‘Streaming Content’ theme and spotlight two prominent stocks.

Understanding Streaming Content

Streaming content refers to audio or video files available on the Internet that can be accessed without complete downloads, significantly shortening wait times. This accessible format supports a vibrant ecosystem encompassing film and TV studios, live media producers, game developers, and user-generated material.

The competition for exclusive content among subscription platforms has intensified, prompting significant investments in original material from streaming companies.

Netflix Earnings on the Horizon

Among the key players in streaming is Netflix (NFLX), currently holding a Zacks Rank #2 (Buy). The company is set to report earnings this week, marking one of the quarter’s most anticipated financial announcements.

Stay informed about upcoming quarterly reports: Check Zacks Earnings Calendar.

Subscriber metrics, crucial to Netflix’s performance, await scrutiny. Starting in 2025 Q1, the company will stop disclosing quarterly membership figures. For now, the Zacks Consensus Estimate anticipates 4.7 million new subscribers, a decline from the 8.7 million additions reported in the same quarter last year.

Netflix has a history of exceeding its subscriber addition estimates consistently, as illustrated below.

Image Source: Zacks Investment Research

The outlook for Netflix looks promising, with a projected 36% increase in EPS and a 14% rise in revenues. The introduction of ad-supported tiers and a crackdown on password sharing have contributed significantly to its growth, which seems likely to be reflected in the upcoming Q3 results.

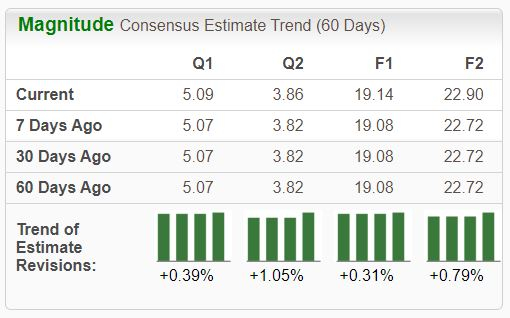

Positive revisions for the quarter have pushed the expected EPS to $5.09, rising recently.

Image Source: Zacks Investment Research

Notably, Netflix’s profit margins have improved since bottoming out in late 2022, suggesting a healthier financial profile.

Image Source: Zacks Investment Research

Entering the earnings release, shares appear reasonably priced. The current forward earnings multiple stands at 32.3X, significantly lower than the five-year peak of 98.4X and median of 34.1X. The current PEG ratio also shows promise at 1.2X, below its historical highs.

With positive momentum, a favorable earnings report could propel shares even higher given the current valuation.

Roku’s Continued Success

Roku (ROKU), also rated Zacks Rank #2 (Buy), leads the TV streaming platform market in the U.S. with over 60 million active accounts, driven by its standalone devices and partnerships with brands like TCL and JVC.

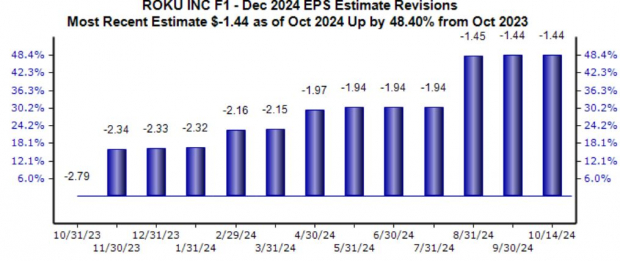

The outlook for Roku’s fiscal year is optimistic, as indicated in recent revisions.

Image Source: Zacks Investment Research

Roku’s recent quarterly results showcased solid growth, with Streaming Households increasing by 14% and Streaming Hours by 20% year-over-year. Furthermore, it ranks as the top-selling TV operating system in North America.

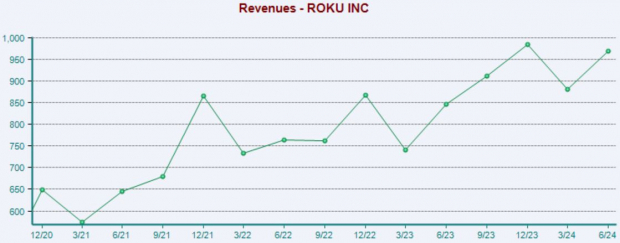

Expectations hint at a 14% revenue growth for Roku in the current fiscal year. The stock carries an ‘A’ for Growth in its Style Score.

Below is a chart reflecting Roku’s quarterly sales performance.

Image Source: Zacks Investment Research

Conclusion

Through Zacks Thematic Screens, investors can explore influential themes like streaming content. In this analysis, two promising stocks emerged: Netflix (NFLX) and Roku (ROKU).

Industry Insights: Top Semiconductor Stock

Introducing a compelling semiconductor stock, which is just 1/9,000th the size of NVIDIA, a company that has soared over 800% since our recommendation. While NVIDIA remains solid, this new contender has significant growth potential.

The semiconductor sector stands to benefit from the soaring demand for Artificial Intelligence, Machine Learning, and Internet of Things technology, with projections suggesting growth from $452 billion in 2021 to $803 billion by 2028.

To explore this stock further, see it for free here >>

For additional insights from Zacks Investment Research, download “5 Stocks Set to Double” for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

For the full article, visit Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.