Planning for Retirement: Understanding Social Security and Personal Savings

Experts predict that the Social Security program in the United States is facing challenges, with potential reductions of around 20% in benefits projected for the mid-2030s. Even with these uncertainties, many individuals are optimistic about their future benefits and continue to budget for them.

This leads to an essential question: How will my spending look in retirement? Will my Social Security benefits cover all my expenses?

Examining Average Spending for Retirees

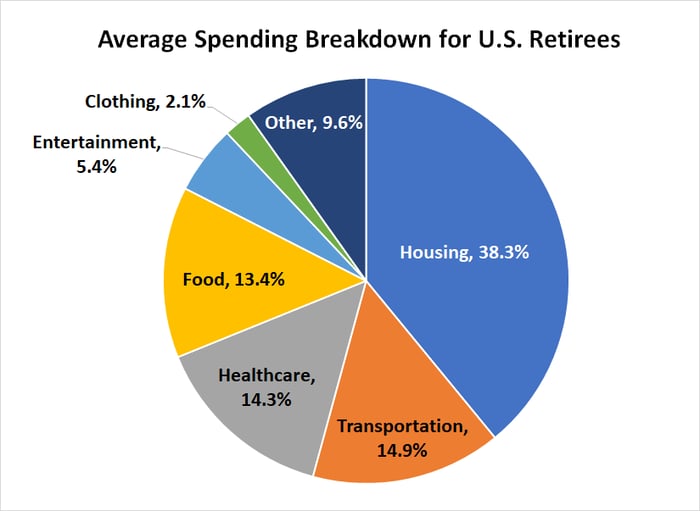

It’s important to note that Social Security benefits alone will not constitute the majority of my retirement income. I plan to rely on a combination of Social Security and my personal retirement savings. Understanding the average budget, I expect my spending will align with common trends reflected in the graphic below.

Data sources: Bureau of Labor Statistics, Boldin, Canvas Annuity, Alliance for Lifetime Income, Western & Southern Financial Group. Chart by author.

According to the U.S. Census Bureau, the average annual income for U.S. retirees is approximately $75,000, with the median income just beneath $48,000. These figures include both Social Security and personal retirement savings. The Social Security Administration reports that average payments this year amount to just under $23,000. Keep in mind, these figures are calculated per person, meaning households typically have higher combined incomes.

Individual spending can vary significantly. For example, while clothing expenses might remain consistent, housing costs could differ greatly depending on whether one rents or owns a home. Renters will continue to allocate funds toward housing, while homeowners may have their mortgage paid off, reducing their costs in retirement.

Interestingly, the budget breakdown suggests that retirees are spending very little on entertainment. Many have worked hard for this stage in life, yet they are not investing much into leisure activities.

Taking Control of Your Retirement Savings

It’s crucial not to feel overwhelmed by the possibility of Social Security cuts. Taking personal initiative in saving for retirement, even through small contributions, can lead to significant growth over time. What may seem like a minor effort today can result in a substantial nest egg in the future.

For instance, saving an additional $300 per month in the stock market, assuming a 10% average annual return, could grow to around $62,000 over time. Increasing that contribution to $500 could elevate the total to over $100,000. Commit to saving $500 monthly for 20 years, and it could accumulate to around $380,000. If extended to 30 years, the investment might exceed $1.1 million, yielding an annual income of more than $40,000 at a 4% return, complementing any Social Security benefits.

While tax implications and investment strategies may shift as retirement nears, the essential advice remains: consistent savings can significantly impact financial security.

Start Small, Just Start

No matter what adjustments you make to your spending and savings, remember this: I rely on expecting some Social Security income, yet I understand it won’t be enough. Continuing to save independently is essential for a secure retirement.

Additionally, maximizing your savings typically involves investing wisely in the stock market to optimize returns.

The $22,924 Social Security Bonus Often Missed

If you’re behind in retirement savings, consider exploring little-known strategies that could enhance your retirement income. One such approach could potentially add up to $22,924 to your annual income by maximizing your Social Security benefits. Click here to learn more about these strategies and gain the confidence needed for a secure retirement.

Learn more about “Social Security secrets” »

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.