Nasdaq Composite Reaches New Heights Amid Tech Stock Surge

On October 25, 2024, the Nasdaq Composite achieved an all-time high, propelled by significant gains in large-cap technology stocks. The index increased by 0.56%, closing at 18,518.61. In contrast, the S&P 500 dipped slightly by 0.03%, ending at 5,808.12, while the Dow Jones Industrial Average fell by 259.96 points, or 0.61%, closing at 42,114.40.

Excitement surrounding tech earnings fueled investor interest in the Nasdaq Composite ahead of forthcoming quarterly reports. Additionally, the Nasdaq-100 exchange-traded fund (ETF), Invesco QQQ Trust (QQQ), rose by 0.6% on the same day.

For the week, the Nasdaq Composite inched up 0.2%, marking its seventh consecutive week of gains. A recent rally in Tesla stock has played a significant role. Conversely, both the S&P 500 and the Dow Jones ended their six-week streaks of growth, declining nearly 1% and 2.7%, respectively.

Prospects for Nasdaq ETFs Ahead of Q3 Earnings

It’s noteworthy that the Nasdaq dropped over 30% in 2022 but bounced back with a remarkable 43% increase in 2023. Historical trends suggest a positive outlook for 2024 as well; since 1972, the year following a rebound, the Nasdaq has averaged a 19% gain, hinting that the current upward trend may continue.

Since 1990, during bull markets, the Nasdaq has returned an average of 215% with average durations of approximately 40 months. If today’s bull market aligns with historical patterns, the Nasdaq could potentially rise by another 139% from its current lows over the next 22 months.

Let’s explore the elements that could support the Nasdaq’s potential upward momentum.

Key Drivers of Nasdaq’s Possible Rally

Artificial Intelligence Optimism

The Nasdaq’s rise is largely linked to excitement over artificial intelligence (AI). The “Magnificent 7” — comprising Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla — have spearheaded the Nasdaq’s rebound after the challenging conditions of 2022, characterized by rising interest rates and recession concerns. Notably, Microsoft has positioned itself as a leader in the AI domain, with Alphabet, Meta, and Amazon also taking significant strides. Chipmaker Nvidia is seen as a significant benefactor of the AI surge.

Positive Earnings Reports from Big Tech

Tesla set a positive tone for the Q3 earnings season for the Magnificent 7, reporting substantial margin gains that raised hopes of alleviating competitive pressures. Tesla’s unique challenges do not provide direct insights for its peers, but the upcoming earnings from this group are keenly anticipated.

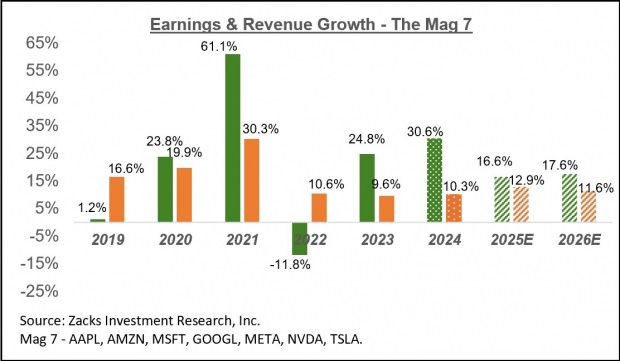

Alphabet (GOOGL) is expected to report on Tuesday, October 29, followed by Meta (META), Microsoft (MSFT) on Wednesday, October 30, and Amazon (AMZN) and Apple (AAPL) on Thursday, October 31. The Magnificent 7 is projected to see a 16.9% increase in earnings for Q3 compared to the previous year, alongside a 13.3% increase in revenues.

If Tesla’s margin improvements are sustainable, the overall net margin for the “Magnificent 7” could rise to 23.2% in Q3, up from 22.6% in the same quarter last year. Expectations for Q3 of 2025 predict margins reaching 24%. This group appears to have returned to a more stable growth pattern, which is likely to persist moving forward.

Image Source: Zacks Investment Research

Potential Fed Rate Cuts Ahead

The U.S. Federal Reserve implemented its first rate cut in four years this past September. Predictions for November suggest a 95.1% chance of a 25 basis point cut, per the CME FedWatch Tool. This speculation around rate cuts has been a significant factor in the Nasdaq’s upward movement.

Biotech Sector Recovery?

The Nasdaq shows substantial exposure to the biotechnology sector, which has recently rebounded. The iShares Biotechnology ETF (IBB) has gained 12% over the past six months, largely fueled by mergers and acquisitions, new drug launches, and favorable conditions arising from lower interest rates and easy access to funding.

Consumer Resilience

The Nasdaq-100 index has invested 13.24% in consumer discretionary and 6% in consumer staples. A strong consumer base benefits the index. Consumer sentiment in the U.S. rose in October to a six-month high as households became more optimistic about buying conditions, aided by lower interest rates. The University of Michigan’s final October sentiment index climbed to 70.5 from 70.1 in September, driven by a preliminary reading of 68.9.

Highlighted Nasdaq ETFs

In light of these factors, here are some notable Nasdaq ETFs to consider: Invesco QQQ (QQQ), Invesco NASDAQ 100 ETF (QQQM), First Trust NASDAQ-100 Equal Weighted Index Fund (QQEW), Invesco NASDAQ Next Gen 100 ETF (QQQJ), and Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE).

Your Source for ETF Insights

To stay informed, subscribe to Zacks’ free Fund Newsletter for updates on crucial news and analysis, including insights on top-performing ETFs delivered weekly.

For the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

iShares Biotechnology ETF (IBB): ETF Research Reports

Invesco QQQ (QQQ): ETF Research Reports

Alphabet Inc. (GOOGL): Free Stock Analysis Report

First Trust NASDAQ-100 Equal Weighted ETF (QQEW): ETF Research Reports

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE): ETF Research Reports

Invesco NASDAQ Next Gen 100 ETF (QQQJ): ETF Research Reports

Invesco NASDAQ 100 ETF (QQQM): ETF Research Reports

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.