“`html

Election Anxiety: Why Gold is Your Best Bet for Stability

Hello, Reader.

As Election Day approaches, many Americans feel a cloud of uncertainty hanging over the country and their investments.

If you’re feeling uneasy, you’re not alone. A recent survey from LifeStance Health indicates that 79% of Americans are dealing with election-related anxiety.

The stock market is also reacting. On Wednesday, all three major indexes fell due to factors including political uncertainty.

As investors look for safety in these unpredictable times, one asset stands out as a potential anchor for your portfolio.

Gold.

In this edition of Smart Money, I’ll explain why keeping gold in your investment strategy could be crucial in the turbulent times leading up to and following November 5.

Gold isn’t the only recovery option in a chaotic market. We will explore a reliable strategy for fortifying your investments in the weeks and months to come.

Let’s get started…

Understanding Historical Trends

Though elections do not directly dictate market movements, the unique circumstances of election years can lead to increased market volatility. This year, we are contending with both political division and rising global tensions.

The situation mirrors the contentious 2000 election between George W. Bush and Al Gore, where polls showed no clear front-runner.

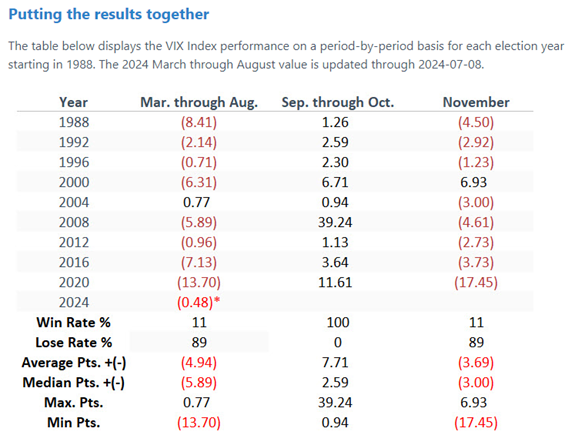

The CBOE Volatility Index (VIX) demonstrates that during presidential election years since 1985, market volatility generally rises in September and October, then declines in November.

However, two years stood out as exceptions: November 2000 and 2008.

It is important to note that the contexts for those years were significantly different. The financial crisis dominated 2008, deviating from typical election-year volatility.

This year’s election could result in an even tighter race than in 2000, possibly leaving results in dispute for an extended period.

This is where gold’s role becomes significant.

While gold may seem like a non-productive asset—a “shiny rock” that does not create products or earnings—its value often rises in chaotic times like these.

Even investor icon Warren Buffett acknowledges that gold has limitations, having stated, “Gold has two significant shortcomings, being neither of much use nor procreative.”

Despite that, gold can provide investors with a safety net, especially during times of economic turmoil. This “lifeless” asset has historically offered worthy trading opportunities, particularly when traditional markets falter.

Looking back at 2000 and 2008, gold performed remarkably well. Following the 2000 election, for instance, while the S&P 500 dropped 21%, gold increased by 6%. In the two years that followed, the S&P fell by 35%, but gold climbed 21%.

During the aftermath of the 2008 elections, as the S&P 500 gained just 7%, gold skyrocketed by more than 43%. Over the next two years, the S&P saw a 27% increase, but gold appreciated a staggering 82%.

Historically, gold moves upward when stocks decline, creating a zigzagging relationship that serves as a hedge during poor stock performance—as evidenced during the “lost decade” following the dot-com crash.

From August 2000 to August 2011, the S&P 500 reported a loss of 8%. In contrast, gold prices surged nearly 600% during that span.

This year, gold has already risen over 30% due to global tensions and economic instability. Additionally, some gold-related…

“`

Gold Prices Surge Amid Political Uncertainty: A Strategy for Investors

Investors are paying keen attention as gold prices rise during a period of political unrest. Recent analyses predict that this trend may continue, especially with a significant election approaching.

Gold Mining Stocks Shine

One notable example is a gold mining company I recommended to my Fry’s Investment Report subscribers back in January. Since then, the stock has soared over 60%, illustrating gold’s potential as a protective asset during turbulent times.

History reveals a strong link between political turmoil and rising gold prices. As we approach another contentious election, many investors might find value in this time-tested hedge against uncertainty.

It’s essential to approach gold cautiously; investing all your resources in one asset is unwise. Opportunities will still arise in the market, and flexibility will be key.

With upcoming election-driven volatility, having a well-thought-out trading strategy is critical. The true impact on markets will come after the election, making it necessary to prepare accordingly.

My colleague, InvestorPlace Senior Analyst Louis Navellier, has developed a robust trading strategy. During his “Day-After Summit” presentation, scheduled for Tuesday, October 29, at 7 p.m. Eastern, he will unveil a system designed to navigate post-election fluctuations and capitalize on them.

A Proven Track Record

According to Louis, back-tests reveal that this system has outperformed the S&P 500 by a ratio of 6-to-1 since 1990. Among the 19 current trades identified by the system, 18 have been successful.

He emphasizes that this approach offers a unique opportunity to potentially triple your investment in a matter of weeks while safeguarding against major losses linked to expected market reactions.

Louis plans to demonstrate how to transform upcoming volatility into profit during his “Day-After Summit”. Attendees will also receive a complimentary post-election trade, designed to succeed regardless of which candidate emerges victorious.

Don’t forget to register for the summit using this link.

Looking forward to reconnecting next week.

Regards,

Eric Fry