Netflix Stock: Riding the Streaming Wave(NASDAQ: NFLX) has been a standout investment, surging over 1,100% in the last decade. Its impressive run continues this year, with shares increasing by more than 50%, largely due to strong quarterly results.

The streaming giant shows no signs of slowing down, adding a significant number of paid members in Q3, while also providing an encouraging outlook for the upcoming year.

Let’s analyze Netflix’s Q3 performance and consider if it’s still a smart time to invest in the stock going forward.

Membership Growth Surging

The company’s membership rolls are expanding at a robust pace, as paid memberships increased 14.4% year over year, reaching 282.72 million members. Notably, the ad-supported plan saw a remarkable 35% sequential growth, contributing to the consistent double-digit growth in memberships over the past year.

| Metric | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|---|

| Membership growth | 10.8% | 12.8% | 16% | 16.5% | 14.4% |

| Paid members |

247.15 million |

260.28 million |

269.6 million |

277.65 million |

282.72 million |

Data source: Netflix earnings reports.

This surge in membership contributed to a 15% rise in revenue, totaling $9.8 billion, surpassing the forecast of $9.7 billion.

In the U.S. and Canada, revenue grew by 16%, propelled by a 10% increase in paid members and a 5% rise in average revenue per member (ARM). Asia stood out with a 19% revenue increase, while European and Latin American revenues rose by 16% and 9%, respectively.

Earnings per share (EPS) rose by 45%, from $3.73 a year ago to $5.40, comfortably exceeding the forecast of $5.10 provided three months earlier.

Approximately half of new memberships came from the ad-supported tier, illustrating its growing influence. The company is approaching a subscriber count that would attract significant advertising investment, although it currently struggles to monetize its ad inventory adequately.

Netflix has also raised subscription prices in various markets, recently increasing fees in several EMEA countries, Japan, and planning a hike in Spain and Italy. It has discontinued the basic plan in the U.S. and France, with Brazil next on the list for Q4. While analysts anticipated a price increase in the U.S., the company did not specify a timeline for this change.

Looking ahead, Netflix projects Q4 revenue to rise nearly 14% year over year to $9.7 billion, with EPS expected around $5.10. Additionally, they have provided guidance for 2025.

The company forecasts an 11% to 13% revenue increase for 2025, estimating their total revenue will reach $43 billion to $44 billion, with operating margins slightly improving to around 28% from 27% in 2024.

Image source: Getty Images.

Should You Buy Netflix Stock Now?

Despite challenges in content production due to the 2023 Hollywood strikes, Netflix managed to grow its paid memberships this year. As those effects wane in 2025, fans can expect new seasons of popular shows like Wednesday, Squid Games, and Stranger Things to fuel further growth.

The company is also expanding into live events, with upcoming NFL broadcasts and the highly anticipated Mike Tyson-Jake Paul fight. In 2025, Netflix will begin airing WWE’s Monday Night Raw weekly. These live events could significantly enhance their advertising strategy, encouraging growth through more engagement.

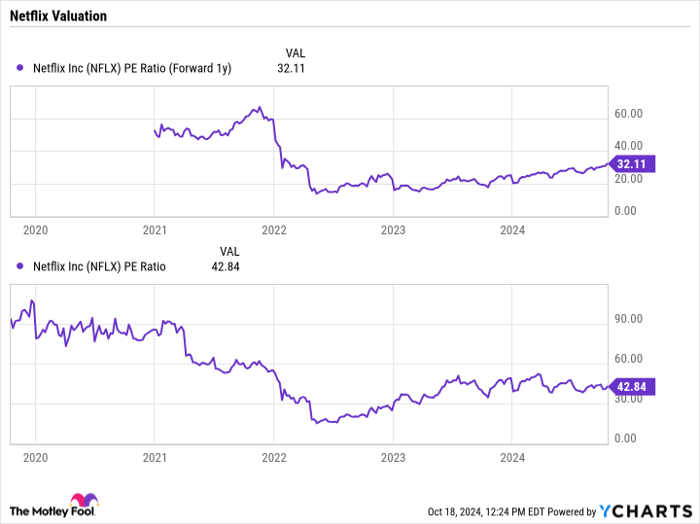

Currently, Netflix has a forward price-to-earnings (P/E) ratio of 32 based on 2025 analyst estimates. Historically, the stock has traded at P/E ratios above 40, indicating that, while the stock is more expensive than it was, it remains less expensive than in previous years.

NFLX PE Ratio (Forward 1y) data by YCharts

Looking at the bigger picture, Netflix maintains ample opportunity for growth, fueled by increasing memberships and a return to normal content production. With pricing power and advertising poised to become a major revenue driver in the future, Netflix still presents a compelling investment case.

Therefore, I assert it is not too late to invest in Netflix as its prospects continue to shine.

Exclusive Opportunity for Astute Investors

Do you ever feel like you missed out on investing in top-performing companies? If so, it’s time to pay attention.

Our team of experts occasionally issues a “Double Down” stock recommendation for companies poised to succeed. If you’re worried you missed the investment wave, this is a prime moment to act before the opportunity slips away. The following results illustrate the potential:

- Amazon: Investing $1,000 when we doubled down in 2010 would have grown to $21,285!*

- Apple: A $1,000 investment at the time of our 2008 recommendation would now be $44,456!*

- Netflix: Investing $1,000 back in 2004 would have amounted to $411,959!*

Currently, we’re signaling “Double Down” alerts for three promising companies, and such opportunities may be rare.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.