Netflix Shifts Strategy After Studio Closure as It Embraces Mobile Gaming

Streaming leader Netflix (NFLX) has faced challenges in its gaming plans, leading to the shutdown of its Team Blue studio located in Southern California. Established in 2022, this studio was working on a much-anticipated triple-A PC game. However, lack of progress resulted in its closure.

The studio’s closure led to approximately 30 layoffs, impacting skilled game developers previously involved in big-name franchises such as Microsoft’s (MSFT) Halo and Sony’s (SONY) God of War.

In light of this change, NFLX is redirecting its attention towards creating and acquiring casual games primarily for mobile platforms. This strategic pivot aims to enhance user engagement and attract new subscribers beyond its traditional streaming offerings.

Netflix Focuses on Third-Party Partnerships

Even as it reduces internal game development, Netflix is open to partnerships with external developers. In 2024, it welcomed three titles from Take-Two Interactive’s (TTWO) Grand Theft Auto series onto its platform, signaling a desire to work with established gaming names.

The company is also investing in studio acquisitions to bolster its gaming portfolio, with recent additions including Night School, Boss Fight, Next Games, and Spry Fox.

Netflix is making strides to improve its gaming offerings, as evidenced by its upcoming launch of the Netflix Game Controller app. This innovative tool will allow smartphones to serve as controllers for games played on TVs or computers, enhancing the overall gaming experience for users.

Is NFLX a Smart Investment?

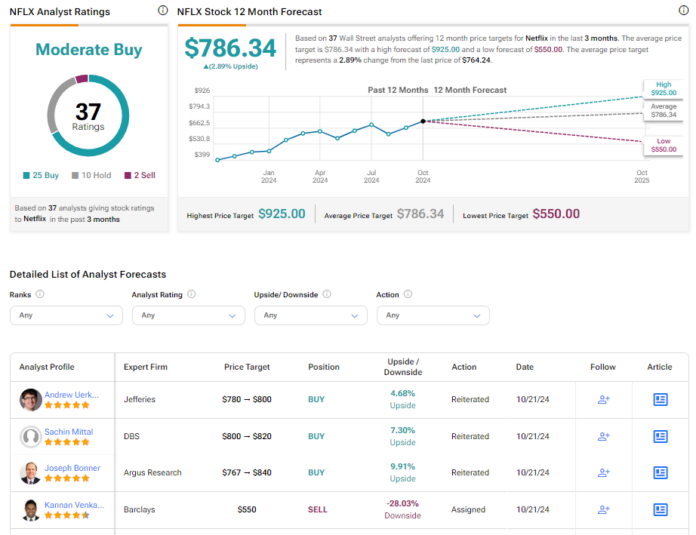

On the investment front, NFLX holds a Moderate Buy consensus rating according to recent Wall Street assessments, which comprise 25 Buys, 10 Holds, and two Sells over the last three months. With an average price target of $786.34, analysts see potential for a 2.89% increase in share value. Year-to-date, Netflix shares have appreciated by approximately 57%.

See more NFLX analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.