Nokia Navigates Challenges While Targeting Future Growth

Nokia Oyj is a leading global provider of telecom equipment and network infrastructure solutions. Competing alongside Telefonaktiebolaget LM Ericsson ERIC, Nokia plays a crucial role in the deployment of 5G and 4G networks.

Diverse Network Solutions at Nokia

Once a leading mobile phone manufacturer, Nokia has transitioned to delivering comprehensive network infrastructure solutions. The company now supports a variety of networks, such as:

- Mobile Networks: Nokia supplies hardware and software to enable and manage 5G and earlier networks for telecom providers like T-Mobile US Inc. TMUS. It has been instrumental in advancing 5G rollouts and is eyeing a critical role in 6G, anticipated to enhance the metaverse and extended reality (XR) by its expected launch in 2030.

- Cloud Networks: Providing cloud infrastructure services, Nokia includes software-defined networking (SDN) and network security solutions, along with tools for network management and optimization.

- Optical Networks: Nokia delivers high-capacity optical transport solutions designed for long-distance data transmission, complemented by internet protocol (IP) routers and switches.

Business Stability Amid Economic Pressure

Telecom operators are experiencing macroeconomic pressures, leading to reduced spending that has impacted Nokia’s performance, especially in year-over-year comparisons.

In the second quarter of 2024, Nokia reported earnings per share (EPS) of 7 cents, exceeding consensus estimates by a single penny. However, revenues plunged 21.8% year-over-year to $4.87 billion, missing expectations of $5.13 billion due to challenging comparisons with an exceptional quarter a year prior.

Segment Revenue Contraction

Revenue declines affected all of Nokia’s segments. Sales in the Network Infrastructure segment dropped by 11% year-over-year. Consequently, management revised sales forecasts from an anticipated increase of 2% to 8% to a decline between 2% and 3%. Operating margins are projected to range from 11.5% to 14.5%.

The Cloud and Network Services sector experienced a 16% decrease in sales, which included a 3% hit from the divestiture of its device management services. Future sales guidance has been revised to a range of flat to a 5% decline, down from a previous estimate of 2% to 3% decline. Operating margin projections remain stable at around 6% to 9%.

In the Mobile Networks segment, the revenue decrease was most pronounced at 24% year-over-year, attributed to economic pressures and normalization in India, which saw a spike in 5G deployment the previous year. Management adjusted projections for this segment downward from a 19% decline to a 14% drop, with operating margins anticipated between 4% and 7%.

Despite the bleak segment performances, it’s notable that 2023 marked a peak in India’s 5G infrastructure spending, which resulted in an revenue spike for Nokia. Following fast growth, normalizing often takes time, illustrated by the comparative revenue drop now. Nevertheless, positivity in revenue from North America and other key regions fueled a rally in Nokia’s stock price, rising from $3.60 after Q2 2024 earnings.

Strategic Acquisition of Infinera

On June 27, 2024, Nokia announced its acquisition of Infinera Co. INFN for $6.65 per share. This acquisition is set to enhance its Optical Networks segment, adding over $1.5 billion in annual sales. The deal is expected to finalize in the first half of 2025.

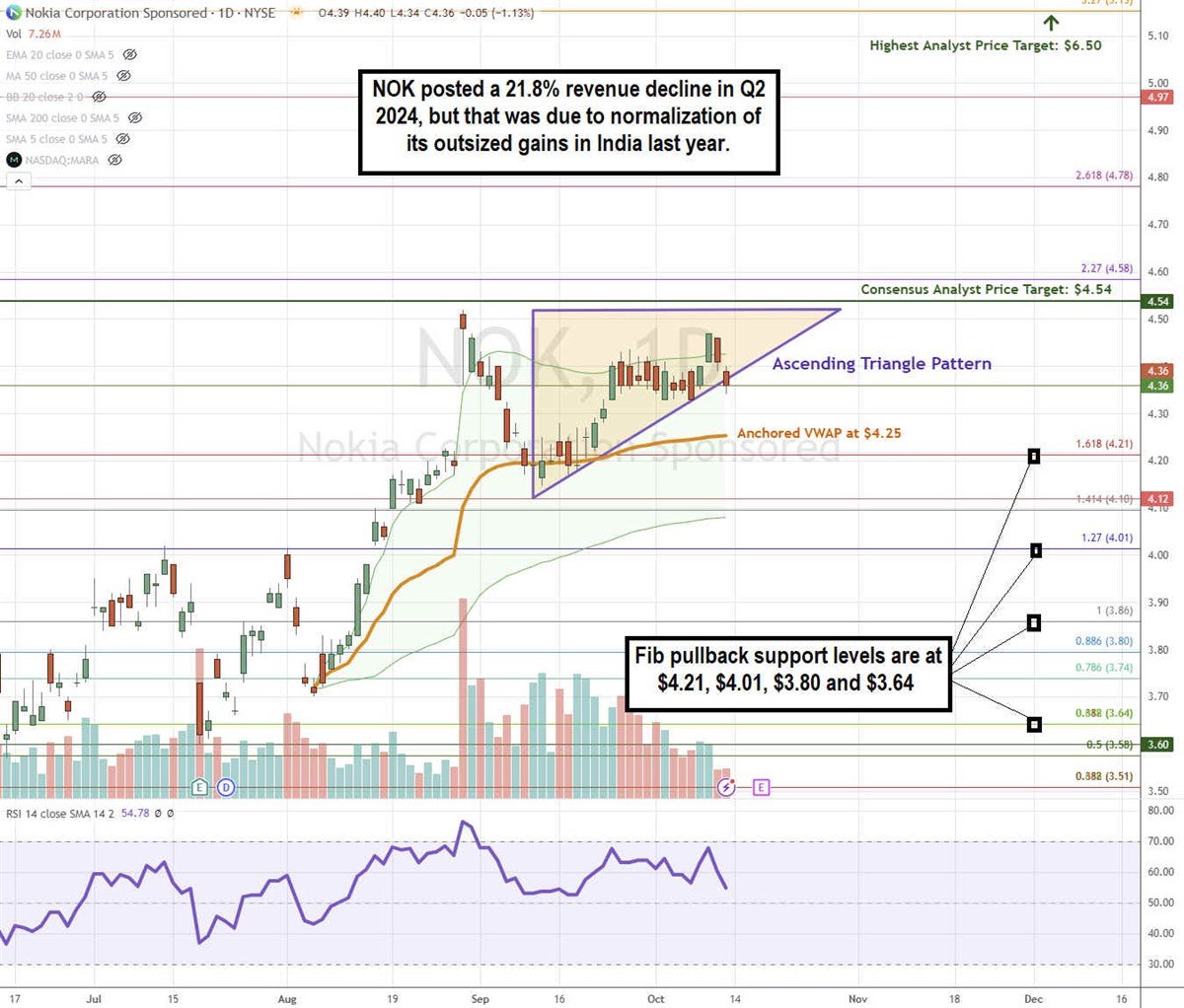

NOK Stock Shows Promise with Technical Patterns

The stock is forming an ascending triangle pattern, characterized by a rising upper trendline representing resistance and a rising lower trendline indicating support. A breakout occurs if the stock surpasses the upper trendline, while a breakdown happens if it falls below the lower trendline.

NOK stock has experienced upward movement since its Q2 2024 earnings report. The daily candlestick chart highlights the ascending triangle pattern, with the flat-top resistance near $4.54, coinciding with the consensus analyst target. As the stock approaches the apex of the triangle, it faces pivotal moments of either breakout or breakdown. The daily RSI has adjusted to the 54-band, with Fibonacci pullback support levels at $4.21, $4.01, $3.80, and $3.64.

Nokia holds a consensus price target of $4.54, with the highest analyst target reaching $6.50. Currently, it enjoys two Buy ratings, four Hold ratings, and two Sell ratings among analysts. The stock trades at 12.11 times the forward earnings estimate.

Investment Opportunities: Investors feeling bullish might consider cash-secured puts at Fibonacci pullback support levels for entering positions and writing covered calls to execute a wheel strategy, alongside enjoying a 1.83% annual dividend yield.

The original article, “Don’t Sleep on Nokia: Quietly Accelerating Into Infinera Merger,” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs