Nordson Corporation‘s NDSN division, Nordson Electronics Solutions, has recently unveiled a game-changer in the world of electronic manufacturing – the Synchro 3. This cutting-edge selective soldering system is specifically designed for high-volume printed circuit board assembly applications.

The SELECT Synchro series introduces a new level of efficiency with its innovative synchronous motion technology, promising to revamp the traditional approach to soldering. The flagship Synchro 3 Soldering System is equipped to host up to three soldering stations, catering to a variety of alloys and nozzle configurations, while accommodating board sizes of up to 2500 x 460 millimeters (mm).

Building upon the success of its predecessors, the Synchro 5 and Synchro 5 XL models, the latest addition underscores Nordson’s commitment to harnessing advanced technologies to meet the evolving needs of the electronics manufacturing industry.

One of the standout features of the SELECT Synchro system is its patent-pending synchronous motion technology. This groundbreaking innovation not only reduces conveyance time significantly but also enhances throughput by an impressive 20-40% for most applications. Furthermore, it boasts of a remarkable 60% reduction in carbon footprint, positioning itself as a sustainable choice for electronics manufacturers.

Zacks Rank and Price Performance

Nordson currently holds a Zacks Rank #3 (Hold), reflecting a balanced outlook among analysts.

The company’s diversified business structure has been a key strength, with robust demand observed across its industrial coatings, polymer processing, and non-wovens product lines, particularly driving growth in the Industrial Precision Solutions segment.

However, challenges persist within the Advanced Technology Solutions segment, primarily stemming from a decline in demand for electronics dispensing product lines, which largely serve the cyclical semiconductor end market.

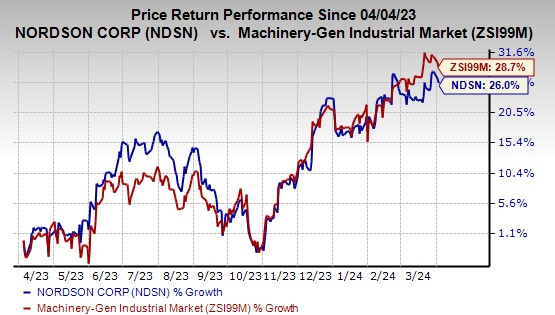

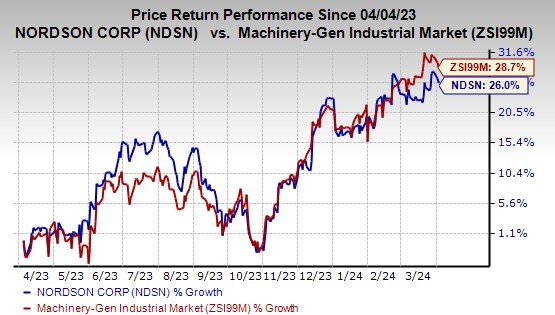

Over the past year, Nordson’s stock has exhibited a commendable performance, registering a 26% increase in value compared to the industry’s 28.7% growth trajectory.

Image Source: Zacks Investment Research

Stocks to Consider

Exploring potential investment opportunities within the Industrial Products sector, here are some companies worth considering:

Belden Inc. (BDC) currently holds a Zacks Rank #2 (Buy), with an impressive trailing four-quarter earnings surprise of 12.3%, on average. The company’s consistent performance and steady earnings estimates have garnered investor interest, reflecting a 5.6% rise in its stock value over the past year.

A. O. Smith Corporation (AOS) is another notable player with a Zacks Rank of 2. The company boasts a trailing four-quarter average earnings surprise of 12%, with optimistic outlook towards 2023 earnings. A. O. Smith’s stock has soared by 34.5% in the last year, indicating strong investor confidence.

Applied Industrial Technologies, Inc. (AIT), currently holding a Zacks Rank of 2, is poised for growth with a trailing four-quarter average earnings surprise of 10.4%. The company’s positive earnings outlook for fiscal 2024 has captured the attention of investors, driving the stock up by 41.9% over the past year.

Embrace the Future in Semiconductor Investments

As the semiconductor industry continues to flourish, investors are presented with a remarkable opportunity to capitalize on the sector’s exponential growth. With one semiconductor stock emerging as a standout performer, navigating this dynamic landscape could lead to lucrative returns.

Are you ready to uncover the next big chip stock poised for success? Take advantage of the market insights and potential growth opportunities in the semiconductor market. Get ahead of the curve as global semiconductor manufacturing is projected to surge to $803 billion by 2028.

Discover This Stock Now for Free >>

Read the full article on Zacks.com here.

Free Stock Analysis Report: A. O. Smith Corporation (AOS)

Free Stock Analysis Report: Applied Industrial Technologies, Inc. (AIT)

Free Stock Analysis Report: Belden Inc (BDC)

Free Stock Analysis Report: Nordson Corporation (NDSN)

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.