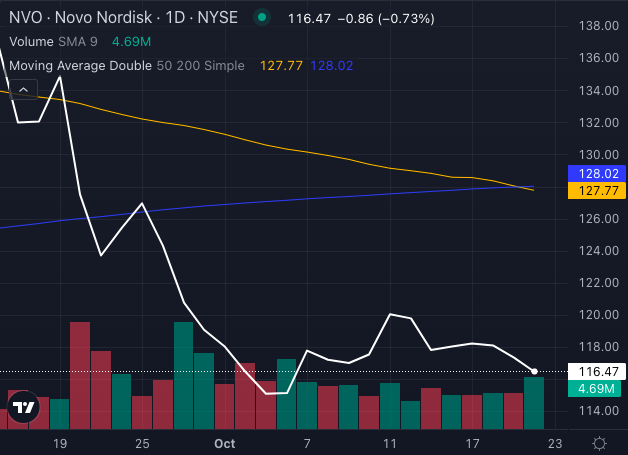

Novo Nordisk A/S NVO has recently triggered a technical warning known as a Death Cross.

Chart created using Benzinga Pro

This bearish pattern occurs when the 50-day moving average of a stock falls below its 200-day moving average, indicating a possible downturn in the stock’s performance.

Despite this ominous signal, the outlook for Novo Nordisk may not be as bleak as it seems. Let’s examine the latest data to determine if there are any bright spots for investors in this major pharmaceutical firm.

Mixed Signals: Stock Trends and Buying Pressure

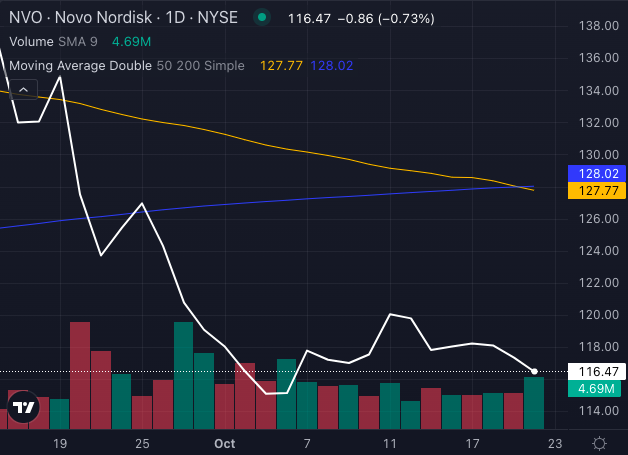

Novo Nordisk’s stock has experienced a shaky month, dropping 6.92%. However, it’s still up 12.76% year to date.

The current share price is below its five, 20, and 50-day exponential moving averages, illustrating a prevailing bearish trend.

Chart created using Benzinga Pro

The Moving Average Convergence/Divergence (MACD) is currently at negative 2.90, and the Relative Strength Index (RSI) stands at 34.00, nearing oversold conditions—suggesting sellers are dominating the market.

Interestingly, buying pressure is still noticeable even with these bearish indicators. This might suggest that some investors believe the stock could soon rebound.

Evaluating Novo Nordisk’s Strong Foundations

Despite the Death Cross signaling caution, Novo Nordisk shows strong fundamentals that could inspire confidence among investors.

Recently, the company introduced a once-daily diabetes pill that reportedly reduces the risk of heart attacks and strokes by 14%. Its pipeline includes potential blockbuster medications like Ozempic and Wegovy, expanding its reach into cardiovascular treatments and eyeing solutions for Alzheimer’s and alcohol addiction.

Read Also: Wegovy Maker Novo Nordisk’s Oral Diabetes Pill Cuts Heart Attacks, Stroke Events By 14%

As the company navigates this technical warning, traders should be attentive to the upcoming third quarter earnings report and the continued success of its diabetes innovations. Investors may need to tread cautiously, but should not lose sight of the upcoming opportunities.

Novo Nordisk’s stock sits at a crucial point. Observers will be keen to see if the promise of its pharmaceutical advancements can counterbalance the technical headwinds.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs