Nvidia Resolves Chip Design Flaw Amid Ongoing Demand for AI Technology

Nvidia (NVDA) CEO Jensen Huang announced on Wednesday that the company has addressed a design flaw in its Blackwell AI chips, thanks to collaboration with longtime partner Taiwan Semiconductor Manufacturing (TSM). Despite this positive development, shares of Nvidia are experiencing a decline as of the latest reports.

Initially, Nvidia planned to deliver its Blackwell chips to major clients such as Meta (META), Google (GOOGL), and Microsoft (MSFT) in the second quarter of this year. However, production delays caused by the design issue have pushed back those timelines. Huang acknowledged that the design flaw was entirely Nvidia’s responsibility and dismissed speculation about any tension with TSMC related to the delay, calling such rumors “fake news.”

Huang previously described the demand for Blackwell chips as “insane,” highlighting their innovative design, which incorporates two silicon components aimed at significantly enhancing performance for AI applications, including chatbot interactions.

Introduction of New Supercomputer

While in Denmark, Huang unveiled a new supercomputer called Gefion. This collaboration involved the Novo Nordisk Foundation (NVO), Denmark’s Export and Investment Fund, and Nvidia. The Gefion supercomputer features 1,528 GPUs, showcasing Nvidia’s ambition to lead in AI computing technology.

Moreover, Nvidia is strategically working to expand its influence by offering a range of AI software platforms. This initiative aims to create a recurring revenue stream while fostering long-term relationships with its customer base.

Should You Invest in NVDA Stock?

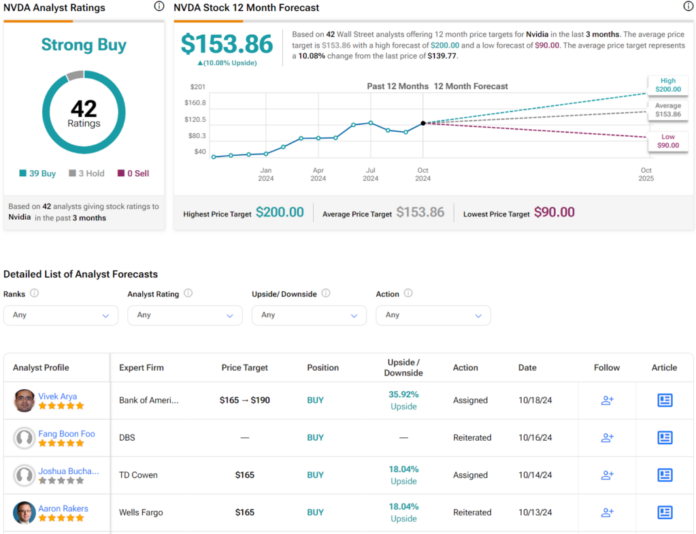

Wall Street analysts hold a Strong Buy consensus rating for NVDA stock, which is based on 39 Buys, three Holds, and zero Sells recorded in the past three months. Following a remarkable 220% rise in share price over the past year, the average target price of $153.86 per share suggests over 10% potential growth.

See more NVDA analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.