NVIDIA Triumphs with $3.5 Trillion Market Cap as Stocks Soar

NVIDIA Corporation (NVDA), led by CEO Jensen Huang, has just hit an impressive milestone, entering an exclusive group of major tech companies. With NVIDIA stock reaching unprecedented heights, investors may feel the urge to jump onboard. Fortunately, opportunities for investment still exist. Let’s explore the reasons why.

NVIDIA Hits $3.5 Trillion Market Value

On Monday, NVIDIA’s shares saw a remarkable increase of 4.1%, allowing the company to close with a market capitalization exceeding $3.5 trillion for the very first time. Earlier in June, NVIDIA had already surpassed a $3 trillion valuation, outpacing tech giant Apple Inc. (AAPL).

Though Apple was the first company to cross the $3.5 trillion threshold and is currently valued at $3.6 trillion, NVIDIA’s rapid growth might soon position it to catch up. Over the past year, NVIDIA’s shares surged by an astounding 243%, and in the last three years, they skyrocketed by 543%, largely driven by developments in artificial intelligence (AI).

Four Factors Supporting Continued Growth for NVIDIA

The overwhelming demand for NVIDIA’s cutting-edge Blackwell B200 chips—which surpass the current Hopper H100 chips in AI capacity—promises to drive up the company’s share price. NVIDIA is ramping up production to meet increasing interest from major players like Microsoft Corporation (MSFT) and Alphabet Inc. (GOOGL).

Additionally, NVIDIA’s expanding data center business is expected to bolster the stock’s value. The H100 chips play a crucial role in powering generative AI applications such as ChatGPT. As big technology firms continue to invest in AI data centers, the outlook for NVIDIA remains positive. Microsoft’s recent 10-K report highlighted a commitment to spend $108.4 billion on data centers over the next five years.

NVIDIA’s significant share of the graphics processing units (GPU) market also provides a sharp competitive advantage. Most developers favor NVIDIA’s CUDA software platform over rising rival Advanced Micro Devices, Inc. (AMD) and its ROCm platform. Currently, NVIDIA claims 80% of the GPU market, projected by Precedence Research to grow from $75.77 billion today to $1,414.39 billion by 2034.

Moreover, recent aggressive interest rate cuts by the Federal Reserve are acting as a favorable wind for NVIDIA’s shares. Lower interest rates reduce borrowing costs and enhance profitability, which are vital for growth initiatives in a capital-intensive industry (read more: NVIDIA & 2 Other AI Stocks to Gain From Lower Interest Rates).

NVIDIA Stock: A Strong Investment Choice

With a dovish Federal Reserve, leadership in the GPU sector, a booming data center business, and rising demand for AI chips, NVIDIA is poised for further growth, making it a solid investment opportunity.

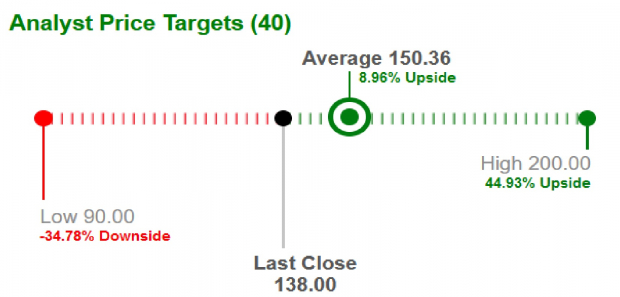

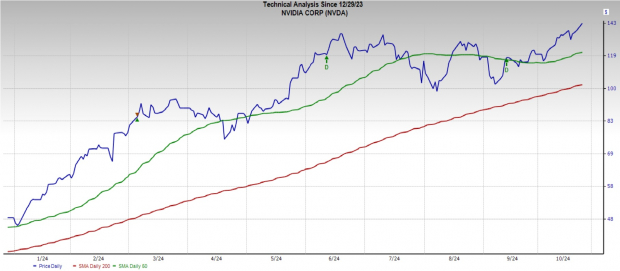

Analysts have raised their short-term price target for NVDA stock by nearly 9%, now set at $150.36, with the highest target reaching $200—a potential increase of 44.9% from the current price of $138.

Image Source: Zacks Investment Research

Vivek Arya, an analyst at Bank of America Corporation (BAC), also recently increased NVIDIA’s short-term price target from $165 to $190. Similarly, CFRA Research raised its target from $139 to $160 last week.

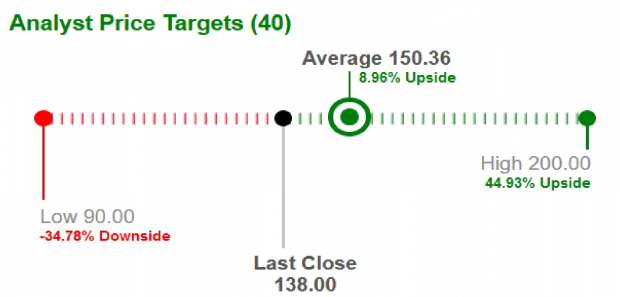

Currently, NVDA is trading above both its short-term 50-day moving average (DMA) and long-term 200-DMA, signaling a bullish trend and suggesting that this may be a good time to invest.

Image Source: Zacks Investment Research

In terms of price-to-earnings ratios, NVDA is currently trading at 51.0X forward earnings, which is lower than the Semiconductor – General industry’s forward P/E ratio of 55.8X. Thus, purchasing NVDA shares may be a more cost-effective option compared to its peers.

Image Source: Zacks Investment Research

NVIDIA boasts a Zacks Rank #2 (Buy). To explore other strong investment opportunities, see our full list of Zacks Rank #1 (Strong Buy) stocks.

Infrastructure Investment Boom on the Horizon

As the U.S. gears up to rebuild its aging infrastructure, a multi-trillion-dollar investment initiative is on the way. This effort is gaining bipartisan support and is seen as both urgent and essential.

The crucial question is, “Will you invest in the right stocks early to maximize your growth potential?”

Zacks has released a Special Report to guide investors in making informed decisions. Today, it’s available for free. Discover five key companies likely to profit from extensive spending on the construction and repair of roads, bridges, and buildings, as well as significant energy transformations.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the most recent stock recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Bank of America Corporation (BAC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.