Wall Street Analysts Weigh In on Netflix: Is It Time to Buy?

Investors often lean on Wall Street analysts for guidance when making decisions about their stocks. Changes in recommendations by these experts can lead to immediate fluctuations in stock prices. But how impactful are these recommendations for investors?

To assess their value, let’s first look at what analysts are saying about Netflix (NFLX).

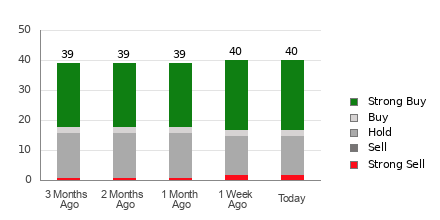

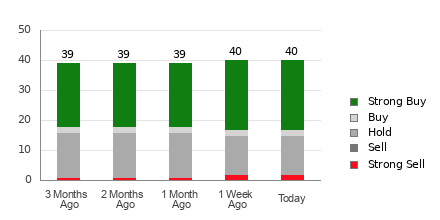

Netflix holds an average brokerage recommendation (ABR) of 1.89 on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This figure is based on recommendations from 40 different brokerage firms. An ABR of 1.89 suggests a position between Strong Buy and Buy.

Breaking down those recommendations, there are 23 Strong Buy ratings and 2 Buy ratings, which make up 57.5% and 5% of the total recommendations respectively.

Current Trends in Analyst Recommendations for NFLX

To examine price targets and stock forecasts for Netflix, click here>>>

While an ABR recommending a buy might tempt you, it’s not advisable to base your investment solely on these ratings. Research indicates that brokerage recommendations have limited success in helping investors select stocks with the most promising price potential.

The reason for this? Brokerage analysts often display a strong positive bias in their ratings due to their companies’ interests in covered stocks. Research shows that brokerage firms typically issue five “Strong Buy” recommendations for every “Strong Sell.”

This discrepancy can mislead retail investors, making it difficult to predict whether a stock’s price will rise or fall. Thus, using these ratings to supplement your own research or a reliable tool may yield better results.

Our Zacks Rank system offers a strong track record, categorizing stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool serves as a dependable indicator of a stock’s near-term performance. Combining the Zacks Rank insights with ABR could lead to more informed investment choices.

Understanding the Difference: Zacks Rank vs. ABR

Although both Zacks Rank and ABR use a 1-5 scale, they measure different aspects.

The ABR is based solely on current broker recommendations and is often quoted in decimal form (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model focusing on earnings estimate revisions and is presented as whole numbers—from 1 to 5.

Brokerage analysts frequently exhibit an overly optimistic bias in their recommendations, often failing to align their ratings with more objective research due to their interests. This leads to misguidance for investors more than it aids them.

In contrast, the Zacks Rank is driven by earnings estimate revisions, and numerous studies have shown a significant correlation between these revisions and short-term stock price movements.

The Zacks Rank categorically distributes grades for all stocks that have brokerage analysts providing earnings estimates, ensuring fairness across all stocks within its ranking system.

Another significant difference is the timing of updates. ABR can become outdated quickly, while the Zacks Rank reflects changes in earnings estimates promptly, maintaining its relevance in forecasting future stock performance.

Should You Invest in NFLX?

Looking at Netflix’s earnings estimates, the Zacks Consensus Estimate for this year has risen by 3.6% in the last month, now standing at $19.78.

The increasing optimism surrounding the company’s earnings potential—reflected in analysts’ agreement to raise EPS estimates—could signify a positive trend for the stock moving forward.

This significant change in consensus, along with three additional factors linked to earnings estimates, has earned Netflix a Zacks Rank #2 (Buy). To explore the full list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

Thus, the Buy-equivalent ABR for Netflix may still be a useful reference for investors.

Access Zacks’ Stock Picks for Just $1

It’s true.

A few years back, we surprised our members by offering a 30-day trial to all our stock recommendations for just $1—no strings attached.

While many took advantage of this offer, others hesitated, suspecting a catch. However, our goal was to introduce you to our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which achieved 228 positions with significant gains in 2023 alone.

Interested in the latest recommendations from Zacks Investment Research? Today, you can download a report on 5 Stocks Set to Double for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.